JET FUEL: Europe’s Air Traffic Up 2.0% on Week: Eurocontrol

Mar-12 14:13

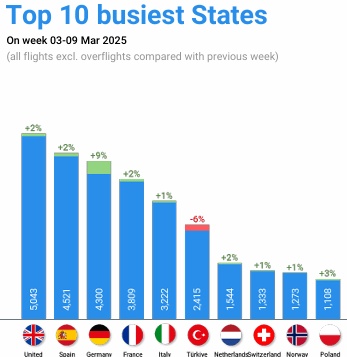

European air traffic recorded 26,476 average daily flights in the seven days to March 9, up around 2.0% on the week across the top ten countries, according to Eurocontrol

- Last week’s levels were up around 6% versus 2024. Year to date traffic is around 96% of 2019 levels and up 5% on the year, Eurocontrol added.

- Germany recorded the greatest weekly increase in flights, up 9%, principally due to a recovery from a ground staff strike at German airports, Eurocontrol said.

- The top 10 largest operators recorded 2.9% more flights than the previous week, with a rise in traffic from 6 of the 10 (falls from Turkish Airlines, KLM, Wizz Air, and Vueling).

- Lufthansa, saw the greatest percentage increase, up 15% to 1,076 average daily flights.

- All top 10 operators apart from Turkish Airlines have more daily flights compared to the same period in 2024. 5 of the 10 are higher than 2019 levels, with Ryanair’s daily flights up 40% and Wizz Air’s up 67%.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

STIR: Effective Fed Funds Rate

Feb-10 14:04

- FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $107B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $286B

- Earlier Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.35% (-0.01), volume: $2.336T

- Broad General Collateral Rate (BGCR): 4.34% (+0.00), volume: $929B

- Tri-Party General Collateral Rate (TCR): 4.34% (+0.00), volume: $901B

- (rate, volume levels reflect prior session)

BONDS: Broader buying interest going through in Futures

Feb-10 14:03

- Overall Volumes are below averages in Government Bonds on both sides of the Atlantic, but there has been some pick up in demand in the past 10 minutes or so.

- TYA is bought in 10k cumulative volumes, FVA 5k, USA 2k and in Europe, Schatz and Bund in 5k respectively.

- We already noted on the Bund open that the German contract was already trading at pre NFP level, and that the initial resistance is still unchanged at 133.86.

- For the US Tnotes (TYH5), the contract would need a test to 109.18 to trade at pre NFP levels now trading at 109.09.

SLOVAKIA: On offer next week

Feb-10 14:01

Slovakia has announced it will be looking to sell the following at its auction next Monday, February 17:

- the 3.00% Feb-28 SlovGB (ISIN: SK4000024683)

- the 3.75% Mar-34 SlovGB (ISIN: SK4000024865)

- the 3.75% Feb-35 SlovGB (ISIN: SK4000022539)

- the 2.00% Oct-47 SlovGB (ISIN: SK4120013400)

Related bullets

Related by topic

Jet Fuel

Gasoil

Marine Oil

Oil Positioning (del)

OPEC

Freight

Gasoline

Fuel Oil

Diesel

Oil Options

Energy Data

European Union

UK

Turkey