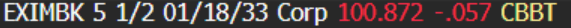

EM ASIA CREDIT: EXIMBK: Indian Reserve Bank Governor talking up the economy.

Export-Import Bank India (EXIMBK, Baa3/BBB-/BBB-)

"*MALHOTRA: POSSIBLE FOR INDIA TO ACHIEVE 7% PLUS GDP GROWTH" - BBG

- RBI Governor Malhotra talking up the Indian economy. As a reference point, Bloomberg forecasts GDP of +6.3% and +6.5% for the coming 2 years. Neutral for spreads.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EUROZONE ISSUANCE: EGB Supply

Italy is due to hold a syndication while Spain and France are both still due to hold auctions this week. We also pencil in syndications from Ireland and Portugal (which would be dependant upon mandate announcements today) and see a good probability of an EFSF RFP being sent today. Belgium and Slovakia already held syndications this week, whilst Austria and Germany already held auctions. We estimate gross issuance for the week at E60.8bln.

- Italy has announced a mandate to hold a dual-tranche syndication to launch a new 10-year BTP maturing 1 August 2035 and E5bln (WNG) of a new BTP Green maturing 30 April 2046. We pencil in a transaction on today with E10bln for the 10-year tranche. We had noted that we thought there would be an Italian syndication this week and that we would see a new 10-year BTP launched in January (but we had thought the 10-year launch would be via auction and that we would have seen a 15-year via syndication this week). The 20-year area was one we had highlighted as the potential for a new Green BTP in our Deep Dive.

- On Wednesday, Germany will return to sell E5bln of the new 2.50% Feb-35 Bund (ISIN: DE000BU2Z049).

For more details on issuance this week and next week see the full document here: EZ250108.pdf

EUROSTOXX50 TECHS: (H5) Rally Extends

- RES 4: 5097.00 High Oct 14

- RES 3: 5080.00 High Oct 15

- RES 2: 5068.13 0.764 proj of the Nov 21 - Dec 9 - 20 price swing

- RES 1: 5050.00 High Jul 7

- PRICE: 5019.00 @ 06:34 GMT Jan 8

- SUP 1: 4925.88 50-day EMA

- SUP 2: 4829.00 Low Dec 20 and key short-term support

- SUP 3: 4800.87 76.4% retracement of the Nov 21 - Dec 9 bull cycle

- SUP 4: 4775.00 Low Nov 29

A bull cycle in the Eurostoxx 50 futures contract remains intact. This week’s strong rally highlights a reversal of the recent corrective pullback. Resistance at 5040.00, the Dec 9 high, has been pierced. A clear break of this level would confirm a resumption of the bull cycle that started on Nov 21 last year and open 5068.13, a Fibonacci projection. On the downside, initial firm support lies at 4925.88, the 50-day EMA.

EURGBP TECHS: Resistance Still Intact

- RES 4: 0.8448 High Oct 31 and reversal trigger

- RES 3: 0.8376 High Nov 19 and a bull trigger

- RES 2: 0.8356 High Nov 27

- RES 1: 0.8311/29 50-day EMA / High Dec 27

- PRICE: 0.8289 @ 06:46 GMT Jan 8

- SUP 1: 0.8263/23 Low Dec 31 / 19

- SUP 2: 0.8203 Low Mar 7 2022 and a major support

- SUP 3: 0.8200 Round number support

- SUP 4: 0.8188 1.00 proj of the Oct 31 - Nov 11 - 19 price swing

EURGBP is unchanged and remains in consolidation mode. Resistance at 0.8311, the 50-day EMA, has recently been pierced. A clear breach of the average would undermine the dominant bear theme and highlight a stronger reversal. A resumption of the primary downtrend would pave the way for a move towards major support at 0.8203, the Mar 7 ‘22 low and the lowest point of a multi-year range.