EUROPEAN INFLATION: EZ Services Inflation Revised Marginally Higher In March

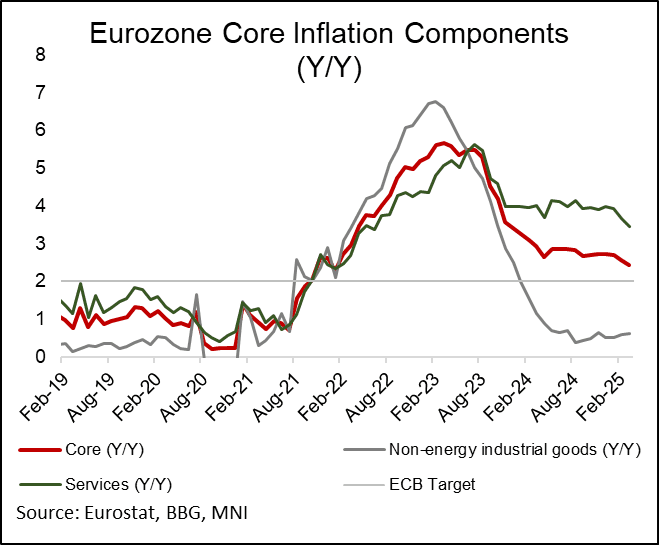

Eurozone HICP inflation was unrevised at a rounded 2.2% Y/Y in the final March release along with core inflation at 2.4% Y/Y. The lack of revisions masked marginally less favourable undercurrents, mainly with services from the ECB's perspective although this upward revision was exaggerated by rounding. The release shouldn't have a material impact on tomorrow's ECB decision.

- Within the details, headline was unrevised to 2.d.p at 2.18% Y/Y after 2.32% in Feb.

- Core (ex energy, food, alcohol and tobacco) was revised up slightly 2.41% to 2.43% Y/Y after 2.57% in Feb.

- Services inflation was revised up from 3.42% to 3.45% Y/Y, rounding up to 3.5%. That’s still a moderation from the 3.68% Y/Y in February but it no longer sees a rounded 3.4% that had last been lower in Apr 2022 and just about leaves a 3.5% reading that was in line with original analyst estimates.

- Recall that seasonally adjusted momentum accelerated in flash March data to 3.2% annualized (having bottomed at 2.5% in Jan) as it somewhat looks to repeat last year’s pattern amidst residual seasonality concerns. We’ll update latest trends here when the ECB updates its seasonal data later today.

- Some volatile items saw larger revisions but they were partly offsetting:

- Unprocessed food inflation was revised up from 4.11% to 4.19% Y/Y, still its strongest since Jan 2024.

- Energy inflation was revised down from -0.74% to -0.98% Y/Y. This doesn’t materially alter its trend though, still the lowest since November after three positive Y/Y readings through Dec-Feb.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EGB OPTIONS: Latest Bund Options

- RXK5 130c, bought for 49.5 in ~5.6k.

- RXK5 126.50/125.50ps, bought for 33 in 7.75k.

EQUITIES: Trend Condition in Stocks Remains Bearish

The trend condition in S&P E-Minis remains bearish and fresh cycle lows last week reinforced current conditions. Moving average studies are in a bear-mode set-up highlighting a dominant downtrend. The medium-term trend direction in the Eurostoxx 50 futures contract remains up and the recent pullback is considered corrective - for now. However, note that support at the 50-day EMA, at 5314.94, has been pierced.

- Japan's NIKKEI closed higher by 343.42 pts or +0.93% at 37396.52 and the TOPIX ended 32.27 pts higher or +1.19% at 2748.12.

- Elsewhere, in China the SHANGHAI closed higher by 6.566 pts or +0.19% at 3426.128 and the HANG SENG ended 185.59 pts higher or +0.77% at 24145.57.

- Across Europe, Germany's DAX trades higher by 61.14 pts or +0.27% at 23046.41, FTSE 100 higher by 13.92 pts or +0.16% at 8645.73, CAC 40 up 26.1 pts or +0.33% at 8053.5 and Euro Stoxx 50 up 13.3 pts or +0.25% at 5416.74.

- Dow Jones mini down 208 pts or -0.5% at 41304, S&P 500 mini down 27.25 pts or -0.48% at 5616, NASDAQ mini down 99 pts or -0.5% at 19620.5.

BUNDS: Breaking through the initial resistance

- A pick up in Volumes in Bund, as it extends above the 127.65, bought in over 10k cumulative volume, so suggestion that some short have bailed out, at that level and above.

- Around 30k has gone through in just the past 5 minutes.

- Next resistance of interest is now at 128.33.