GERMAN DATA: Factory Orders Strong in March

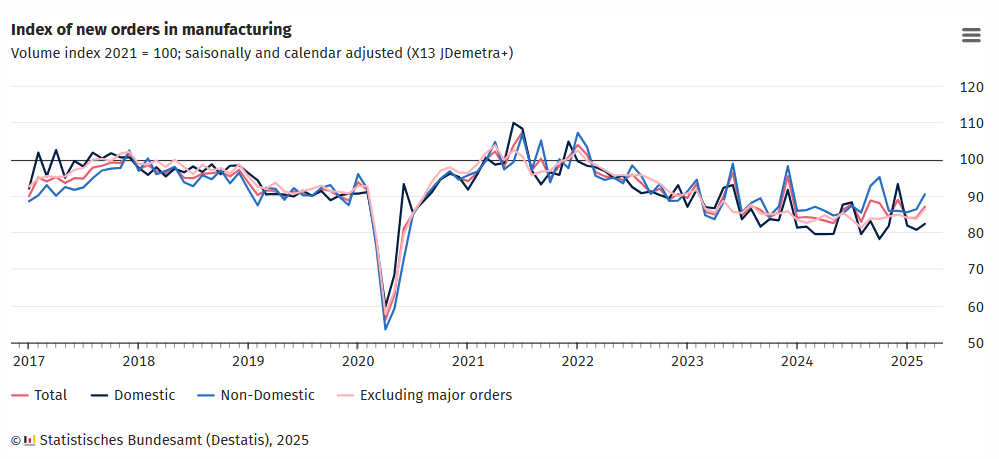

German factory orders were comparably strong in March, at 3.6% M/M (vs 1.3% cons, 0.0% prior). Overall, the data appears to indicate that the industrial sector in Germany was off cycle lows towards the end of Q1 - sentiment has also increased recently and the higher infrastructure / military government spending will provide some relief in due time, the broad-based decline until mid-24 seems to have halted for a while now. Despite this, we remain cautious if this represents a major turning point and the release does not suggest factory orders will soon print at cycle highs again.

- One-offs were not behind the strong performance this time, as also 'core' orders increased 3.2%, and the increase this month appears broad-based from a split across sectors as well as regions (foreign orders +4.7%, domestic +2.0%).

- The factory orders data provides no specific country split - this leaves open to what extent last-minute tariff frontrunning from US importers might have helped the March print.

- Analyst consensus had a wide range (0.4%-7.5% M/M), so not everyone was surprised by the figures. One clue for the analysts who have been looking for a comparably strong print might have come from the Q1 flash GDP release - which specifically noted a positive contribution from capital formation, even though January and February factory orders figures were not far off cycle lows. Of course, orders do not flow into GDP directly - but at least for subsectors with low production time, some feedthrough seems plausible.

- "Many economic sectors contributed to the increase in new orders in manufacturing in March 2025, in particular the manufacture of electrical equipment (seasonally and calendar adjusted: +14.5% on the previous month), the manufacture of machinery and equipment (+5.3%), the manufacture of other transport equipment (aircraft, ships, trains, military vehicles; +13.0%), the automotive industry (+2.5%) and the pharmaceutical industry (+17.3%)."

- Commerzbank view the data positively: "The strong rise in the index excluding large orders in particular gives us hope that things could soon improve for industry in Germany."

- Real turnover in manufacturing, which can provide some signal for the March industrial production release (due tomorrow), was 2.2% M/M and -0.4% Y/Y. Current consensus for March IP stands at 1.0% M/M (-1.3% prior) and -2.7% Y/Y (-4.0% prior) - so there may be some upside risks to tomorrow’s print.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EUROSTOXX50 TECHS: (M5) Impulsive Sell-Off Extends

- RES 4: 5254.79 20-day EMA

- RES 3: 5047.00 High Apr 4

- RES 2: 4931.00 Low Jan 13 (cont)

- RES 1: 4809.00 Low Dec 20 ‘24 (cont)

- PRICE: 4500.00 @ 08:17 BST Apr 7

- SUP 1: 4444 - intraday low Round number support

- SUP 2: 4372.46 76.4% retracement of the Oct ‘23 - Mar ‘25 bull cycle

- SUP 3: 4336.00 Low Nov 28 ‘23 (cont)

- SUP 4: 4302.00 Low Nov 15 ‘23 (cont)

Eurostoxx 50 futures remain in a bear cycle following the latest impulsive sell-off. Last week’s move down resulted in a break of 5229.00, the Mar 11 low. Today’s sell-off has resulted in a breach of a key support at 4699.00, the Nov 19 ‘24 low (cont). This exposes 4372.46, the 76.4% retracement of the Oct ‘23 - Mar ‘25 bull cycle. The contract is oversold, a recovery would allow this condition to unwind. Initial resistance is 4809.00, the Dec 20 ‘24 low (cont).

GILTS: Off Highs, Curves Meaningfully Steeper

Gilts off highs, alongside a similar move in Bunds, while equities edge away from early lows. Tariff/trade war worries continue to dominate, as detailed elsewhere.

- Futures peaked at 94.50, last ~94.20.

- A break above session highs would expose the 76.4% retracement of the Dec 3-Jan 13 bear leg drawn on a continuation chart (94.75).

- Initial support of note at the Mar 20 high (93.01)

- Yields 2-12bp lower, meaningful bull steepening on the curve.

- Gilt bulls managed to force a break below the Feb 2 lows in 10s (4.375%), but the move hasn’t stuck, last 4.390% vs. lows of 4.363%.

- 2s10s through the May ’22 closing highs, next upside level of note at the Oct ’21 closing high (62.85bp).

- 5s30s on for the highest close since October ’17. Next level of upside interest at the October ’17 closing high (118.36bp).

GILT TECHS: (M5) Trading At Its Highs

- RES 4: 95.57 High Dec 11 ‘24 (cont)

- RES 3: 95.00 Round number resistance

- RES 2: 94.75 76.4% retracement of the Dec 3 - Jan 13 bear leg (cont)

- RES 1: 94.80 Intraday high

- PRICE: 94.30 @ 08:10 BST Apr 7

- SUP 1: 93.01 High Mar 20

- SUP 2: 92.13 20-day EMA

- SUP 3: 91.59 Low Mar 31

- SUP 4: 91.03 Low Mar 28

Gilt futures maintain a firmer tone and the contract is trading at its recent highs. A key resistance at 93.79, the Mar 4 high, has been cleared and this has been followed by a move through the 94.00 handle. The breach signals scope for a climb towards 94.75, 76.4% of the Dec 3 - Jan 13 bear leg (cont). On the downside, initial support lies at 93.01, the Mar 20 high. A firmer support is seen at 92.13, the 20-day EMA.