EUROZONE DATA: Feb Flash PMI: Services Inflation Pressures Remain Prevalent

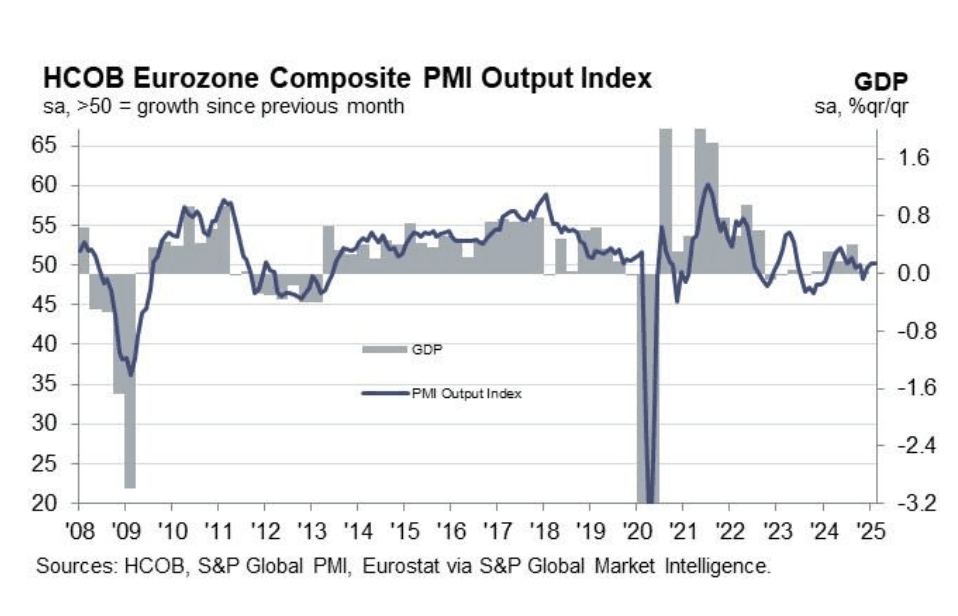

Following the French and German February flash PMI releases, the Eurozone reading unsurprisingly saw services weaker-than-expected (50.7 vs 51.5 cons, 51.3 prior) and manufacturing slightly stronger (47.3 vs 47.0 cons, 46.6 prior). The composite reading was 50.2 (vs 50.5 cons, 50.2 prior).

Details of the report suggest the Eurozone ex-Germany and France continue to outperform, with more political certainty likely a contributing factor here. Overall though, growth prospects in the region continue to appear stagnant, while a renewed uptick in output charges (to a ten-month high, driven by the services sector) will keep inflation concerns at the forefront of hawkish ECB policymaker's minds.

Key notes from the release ex- France and Germany:

- “The Eurozone’s largest economy – Germany – recorded a second consecutive monthly rise in output, with the pace of expansion quickening to a nine-month high. In contrast, France posted a marked and accelerated reduction in business activity, one that was the most pronounced for almost a year-and-a-half. Meanwhile, the rest of the euro area posted a solid expansion in output”

- “Staffing levels dropped in both Germany and France, with the pace of job cuts sharper in the latter. Meanwhile, the rest of the Eurozone saw employment increase at the fastest pace in five months”.

- “Output prices were up markedly in Germany, while France posted renewed inflation following a fall in January. The rest of the euro area also saw selling prices rise”.

- “Sentiment dropped across both manufacturing and services alike. Strong confidence was again seen in the rest of the Eurozone. Positive expectations in Germany dipped and were below-average, while optimists in France only just outweighed the pessimists”.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GILTS: Cross-Market Cues Dominate, Bearish Trend Intact

Gilts continue to take cross-market cues, initially rallying alongside EGBs and European equities, before fading back from highs.

- Futures breached yesterday’s high, peaking at 92.52, but failed to challenge Fibonacci resistance at 92.75. Contract fades back to 92.30 last.

- The overarching technical setup remains bearish, but the recent recovery poses a risk to that trend.

- Bears need to force a move through the Jan 16 low (90.68) to assert fresh pressure.

- Yields little changed to 1bp lower across the curve.

BONDS: French OAT and Italian BTP are leading Bonds higher

- The push higher in Govies continues to be OAT and BTP led, OAT has been bought in close to 10k in a 5 minutes window, and 5k for the BTP.

- There's hasn't been any obvious trigger, and the moves looks to more order flow related, but Some selling interest is emerging now at the top of the range in OAT and BTP, Bund also starts to fade of its intraday high.

ECB: Lagarde: Energy Prices "Might Have A Real Impact"

Lagarde plays down the need for forward guidance, in line with GC colleagues over the last few weeks (e,g Nagel and de Guindos): “We have a method, we will apply the method, and we will take all the data that comes in. And data is going to be fascinating, as I said, the price of energy is going to be something that might have a real impact”.

- Earlier, when speaking about why the ECB has not cut by 50bps yet, Lagarde pointed the earlier start to the cutting cycle (e.g. compared to the Fed).