STIR: Fed Rate Path At Middle Of Week’s Range Ahead Of PCE Report

Mar-28 10:40

- Fed Funds implied rates are little changed overnight as they hold within yesterday’s range.

- Today sees focus on the monthly PCE report plus any notable revisions to the final U.Mich survey. Unrounded analyst estimates put core PCE inflation at a 'high' rounded 0.3% and recent consumption trends will be watched closely amidst declining consumer sentiment.

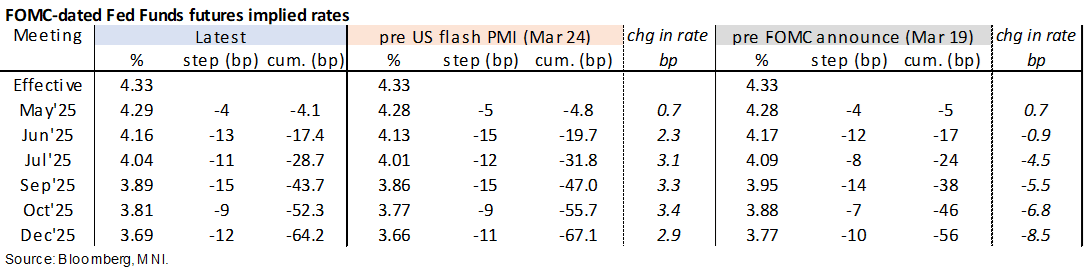

- Cumulative cuts from 4.33% effective: 4bp May, 17.5bp Jun, 29bp Jul and 64bp Dec. There have been between 70bp and 59bp of cuts priced for 2025 over the course of this week.

- Yesterday say Collins (’25 voter, dovish leaning) reiterate her patient stance on potential future rate cuts amid uncertainty, noting that her view of tariffs impacts saw her conclude that holding rates steady for "a longer time is likely to be appropriate". Barkin (non-voter, hawkish leaning) remains cautious on the rate path ahead and appeared to be one of the 8 FOMC members who at the March meeting pencilled in either one or no cuts by the end of 2025.

- Barr (permanent voter) and Bostic (non-voter) both speak today although we’ve already heard from them since last week’s FOMC decision, albeit in a more limited mon pol capacity for Barr.

- 1215ET – Barr gives speaks on banking policy (Q&A only). He’s no longer VC for supervision but will talk on banking policy. He said Mar 24 that lending standards become tight in the pandemic and remain so, noting that interest rates overall are still high for businesses.

- 1545ET – Bostic moderates panel on housing finance (Q&A only). He told BBG on Mar 24 that he reduced his 2025 rate cut expectations to 1 in March's SEP versus 2 previously, "because I think we will see inflation be very bumpy", and delayed inflation progress warranted pushing back the path to neutral rates. This puts him among the 8 most hawkish FOMC members for 2025 (of 19 participants, 4 saw 1 cut, 4 saw none).

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GILTS: Off Highs After Futures Pierce Initial Resistance

Feb-26 10:38

Gilts are off highs after rallying alongside wider core global FI markets during the European morning.

- The uptick gained momentum as gilt and Bund futures broke through their respective Tuesday highs, although there was no clear headline catalyst driving the rally.

- M5 futures pierced initial resistance at the Feb 13 high (93.39), with the contract topping out at 93.51 before fading back to 93.35.

- Fresh extension higher would target the Feb 6 high & bull trigger (93.83). A break there would reignite bullish momentum.

- Yields 1.5-3.0bp lower, curve flatter.

- The 10-Year UK/German yield spread is close to its ’25 closing low (203.8bp), with a post-election increase in odds of near-term German fiscal support driving spread tightening week-to-date.

- GBP STIR pricing little changed on the day, with 57bp of cuts showing through year-end.

- ~20bp of cuts priced through May, with the next full 25bp move discounted through the end of the June MPC.

- Little of note on the UK data calendar today,

- BoE dove Dhingra will speak on “Trade fragmentation and monetary policy” from 16:30 GMT, don’t expect a change in tone after she reaffirmed her dovish stance earlier in the week (pushing back against the idea of gradual cuts given her view on consumption).

BoE Meeting | SONIA BoE-Dated OIS (%) | Difference vs. Current Effective SONIA Rate (bp) |

Mar-25 | 4.447 | -0.8 |

May-25 | 4.254 | -20.0 |

Jun-25 | 4.187 | -26.8 |

Aug-25 | 4.046 | -40.9 |

Sep-25 | 3.993 | -46.1 |

Nov-25 | 3.910 | -54.5 |

Dec-25 | 3.882 | -57.3 |

EGBS: Bund Futures Strengthen Alongside European Equities; Spreads Tighten

Feb-26 10:38

Major EGB futures have strengthened this morning with no obvious catalyst. A renewed fall in natural gas futures (-4% today) will have helped limit retracements over the last 90 minutes, even in the presence of modest 15-year Bund supply.

- Bund futures are +24 ticks at 132.72, through the Feb 21 high of 132.60. Recent gains still appear corrective for now, but clearance of key near-term resistance at 132.97 (Feb 13 high) would signal a reversal. Support is seen at the Feb 19 low (131.96).

- The German curve has bull flattened, with 30-year yields down 2.5bps.

- Today ‘s 15-year Bund auction passed smoothly.

- European equity futures are also higher, facilitating a tightening of 10-year EGB spreads to Bunds. The BTP/Bund spread is 1bp narrower at 111.5bps, after mechanically widening on the back of a BBG benchmark BTP roll earlier this week.

- Regional focus remains on tomorrow’s data calendar. Which includes Spanish flash February inflation.

GERMAN AUCTION RESULTS: 15-Year Bunds

Feb-26 10:34

| 0% May-36 Bund | 1.00% May-38 Bund | |

| ISIN | DE0001102549 | DE0001102598 |

| Total sold | E500mln | E1.5bln |

| Allotted | E401mln | E1.253bln |

| Previous | E0.408bln | E0.438bln |

| Avg yield | 2.51% | 2.60% |

| Previous | 2.34% | 2.42% |

| Bid-to-offer | 2.15x | 2.36x |

| Previous | 3.98x | 4.81x |

| Bid-to-cover | 2.68x | 2.83x |

| Previous | 4.87x | 5.49x |

| Avg price | 75.75 | 82.29 |

| Low price | 75.73 | 82.27 |

| Pre-auction mid | 75.702 | 82.235 |

| Prev avg price | 76.46 | 83.57 |

| Prev low price | 76.46 | 83.57 |

| Prev mid-price | 76.386 | 83.529 |

| Previous date | 09-Oct-24 | 04-Sep-24 |