US OUTLOOK/OPINION: Fed's SLOOS Survey Signals Continued Bank Lending Recovery

Feb-04 21:11

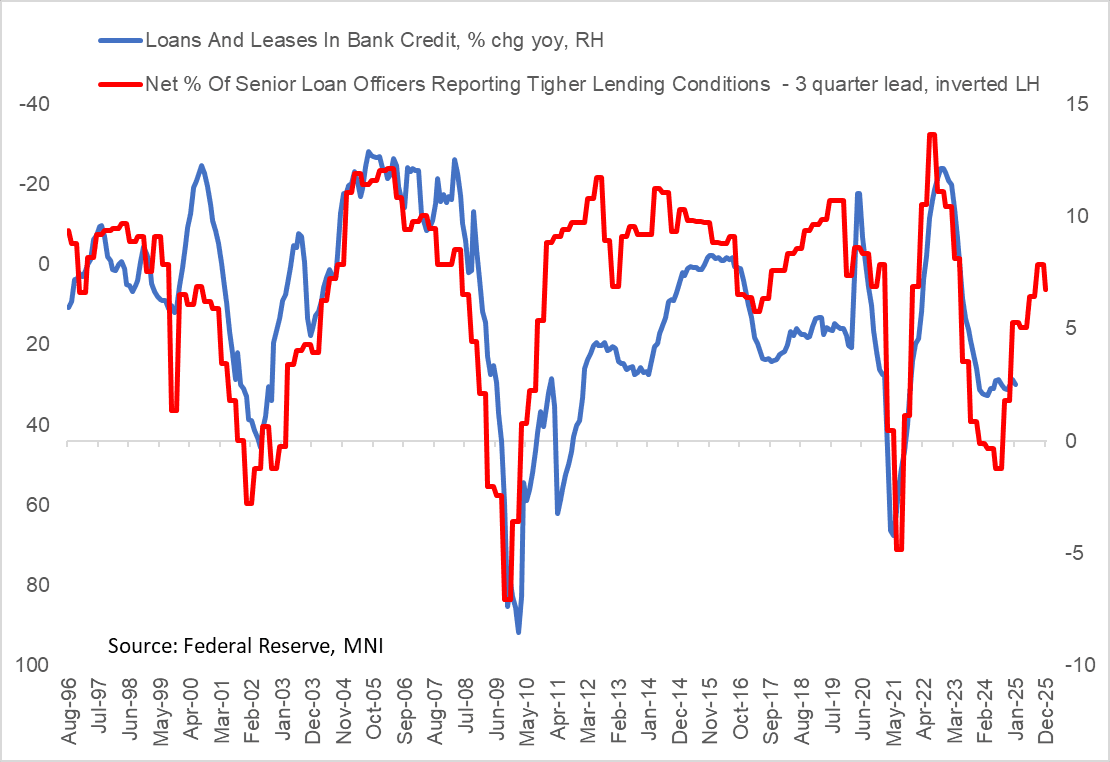

The Fed's quarterly Senior Loan Officer Survey for January cast a positive light on bank lending prospects in 2025, albeit slightly less positive than in the previous survey.

- The net percent of respondents reporting tightening lending standards for large/medium business loans ticked up to 6.2%, versus zero (ie unchanged standards) in the previous survey for Q4 2024.

- That puts conditions a little closer to Q3 (7.9%), but that's still a far looser set of conditions than in 2023 (50+%) amid concerns over banking sector health after the collapse of Silicon Valley Bank and other lenders.

- As a leading indicator, it suggests that Loans and Leases in Bank Credit can continue to tick higher in 2025, from a 2.0% Y/Y low in March (2.5% Y/Y in January).

- Demand for commercial and industrial (C&I) loans also picked up, though the outlook for household lending was more mixed than it was for businesses. Those and other key findings from the Fed report included:

- "banks generally reported tighter standards and basically unchanged demand for commercial real estate (CRE) loans."

- "For loans to households, banks reported, on balance, basically unchanged lending standards and weaker demand across most categories of residential real estate (RRE) loans. In addition, standards reportedly tightened for credit card loans and remained basically unchanged for auto and other consumer loans, while demand weakened for credit card and other consumer loans but remained basically unchanged for auto loans. Further, banks reported basically unchanged lending standards and demand for home equity lines of credit (HELOCs)."

- "The January SLOOS included a set of special questions inquiring about banks’ expectations for changes in lending standards, borrower demand, and loan performance over 2025. Banks reported expecting lending standards to either ease or remain basically unchanged and demand to strengthen across all loan categories. In addition, banks generally reported expecting loan quality to improve for loans to businesses but to either deteriorate or remain basically unchanged for most consumer loan types."

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

ASIA: Coming Up In Asian Markets On Monday

Jan-05 21:10

| 0030GMT | 0830HKT | 1130AEDT | Singapore Dec S&P PMI |

| 0145GMT | 0945HKT | 1245AEDT | China Dec Caixin PMIs |

| 0330GMT | 1130HKT | 1430AEDT | Thailand Dec CPI |

| 0500GMT | 1300HKT | 1600AEDT | India Dec F HSBC PMIs |

ASIA: Coming Up In Asia Pac Markets On Monday

Jan-05 21:05

| 2200GMT | 0600HKT | 0900AEDT | Australia Dec F S&P PMIs |

| 0030GMT | 0830HKT | 1130AEDT | Japan Dec F Jibun Bank PMIs |

| 0145GMT | 0945HKT | 1245AEDT | China Dec Caixin PMIs |

JGB TECHS: (H5) Returns Lower

Jan-03 23:45

- RES 3: 149.55 - High Mar 22 (cont)

- RES 2: 147.74 - High Jan 15 and bull trigger (cont)

- RES 1: 144.48/146.53 - High Nov 11 / High Aug 6

- PRICE: 142.12 @ 15:01 GMT Jan 03

- SUP 1: 141.65 - Low Dec 30

- SUP 2: 141.56 - 1.764 proj of the Aug 6 - Sep 3 - 9 price swing

- SUP 3: 141.05 - 2.000 proj of the Aug 6 - Sep 3 - 9 price swing

Markets slipped on the hawkish Fed and are yet to fully recover, touching 141.65 on the way lower. Medium-term trend signals on the continuation chart continue to point south. A resumption of the trend would pave the way for a move towards 141.56, a Fibonacci projection point on the continuation chart. A stronger recovery would open 144.48, the Nov 11 high. Further out, key resistance is at 146.53, the Aug 6 high (cont).