EU FINANCIALS: Financials - Week in Review - 14/03/2025

Mar-14 14:11

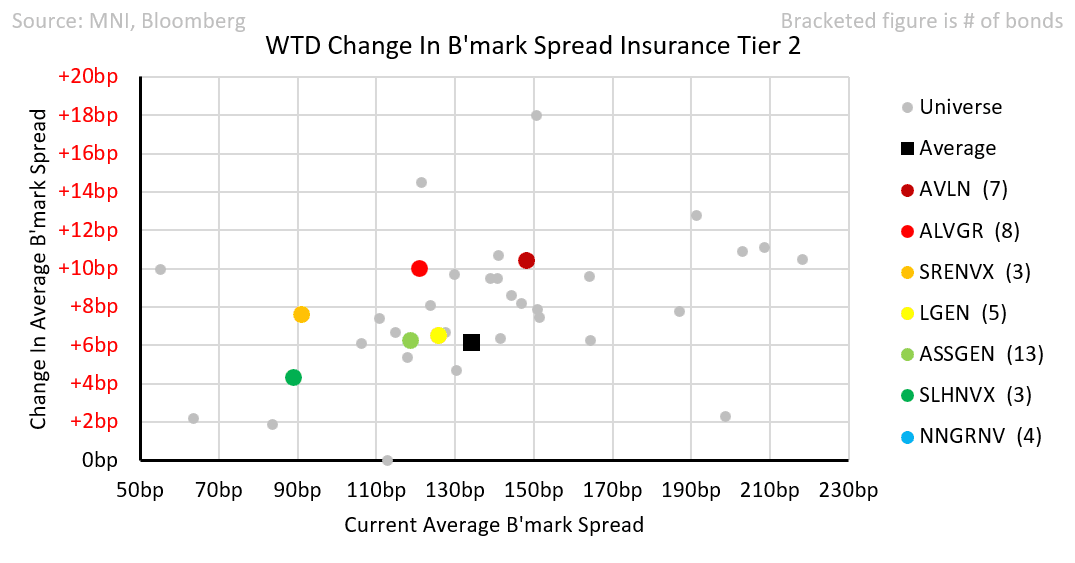

- Markets were cautious after the previous week's sharp government bond moves. Financial spreads were on average +7.7 bps higher over the week, the largest underperformer of the sectors we follow. Within financials bank senior bonds did particularly poorly, up 7bps on average while tier 2 bank and insurance bonds were only 5.5bps and 6.3bps wider respectively

- Generali FY results surprised on the upside due to good P&C performance - https://mni.marketnews.com/3Rbsnew

- L&G's positive results were driven by bumper bulk annuity sales, despite a touch market environment elsewhere - https://mni.marketnews.com/4bTByd2

- Hannover RE - Excellent P&C performance confirms results uptick from prelim report

- Swiss Life's lower insurance result caused results to disappoint - https://mni.marketnews.com/41T7IRo

- Grenke's results were weak as provisioning was much higher than expected - https://mni.marketnews.com/4kM7S5L

- Market caution extended to the new issue market which saw higher NIC's, especially in the second half of the week. The only AT1 issue came early, with both Bank of Ireland pricing in line with our FV at 6.125% https://mni.marketnews.com/4hqxIcx

- Credit Agricole Assurance issued an RT1 at 6.25% compared to our FV of 6.125%

- In Tier 2 space Mediobanca priced at +175, Credit Agricole at +165 (vs our FV of +155) and BCPPL - despite its potential positive catalyst of joining the IG index soon, could only tighten 10bps from IPT to price at +215 (vs our FV of +195) - https://mni.marketnews.com/4iw5gY8

- 4 Issuers came with senior bail in issues BNP - with a FRN - Standard Chartered, SEB Group and AIB. All came slightly wide of our FV's

- BCEE and Islandsbanki issued senior preferred bonds, both came slightly wide of our FV, we highlight the gap between Icelandic banks and European banks with similar ratings - https://mni.marketnews.com/3R87iSb

- CXGD and BCPPL were both upgraded by S&P following its upgrade of the Portuguese sovereign. The agency also moved Deutsche Pfandbriefbank outlook to stable

- UniCredit was given the all clear by the ECB to own 29.9% of Commerzbank - they already effectively owned the position through derivatives.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GILTS: Futures Through Initial Support On U.S. CPI

Feb-12 14:06

Gilts sell off on the back of the U.S. CPI data.

- Futures as low as 92.33, breaking through the 20-day EMA (92.63).

- Our technical analyst’s next support of note isn’t seen until the Jan 24 low (91.52).

- Intermediate support seen before there at the 38.2% retracement of the move from the ’25 low to ’25 high (92.29), followed by the Jan 29 low (91.96)

- Yields 5-7bp higher, curve steeper.

- 10s still 4.5bp below next resistance at the Jan 29 high (4.622%).

- 10s 2bp wider to Bunds on the day, last 209.5bp.

- BoE-dated OIS showing 56bp of cuts through year-end vs. ~58bp seen ahead of the U.S. data.

- SONIA futures +0.25 to -4.5.

STIR: Effective Fed Funds Rate

Feb-12 14:03

FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $92B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $278B

SECURITY: Return To Ukraine's Pre-2014 Borders "Unrealistic" - Hegseth

Feb-12 14:02

US Defense Secretary Pete Hegseth has stated at the first Ukraine Contact Group meeting since President Donald Trump returned to the White House, that although the US wants to see a "sovereign Ukraine," returning to Ukraine's pre-2014 borders is "unrealistic".

- Hegseth says Trump "intends to end the war through diplomacy". Adds that Ukraine's NATO membership should not be part of a peace plan and says "lower energy prices will help bring Russia to the table."

- Hegseth says, "as part of any security guarantee there will not be US troops deployed in Ukraine," noting that Europe needs to do more to cover the cost of Ukraine's security. Hegseth reiterates a Trump position that European NATO members should raise defence budgets to 5% of GDP - a target that only Poland is close to hitting.

- Hegseth says the US, "will no longer tolerate an unbalanced relationship," and says a greater division of labour needs to be struck so the US can prioritise other threats, including from China.

- Today's meeting is the first event in a flurry of diplomacy designed to kickstart peace talks. VP JD Vance will meet Ukrainian President Volodymyr Zelenskyy on Friday at the Munich Security Conference. Vance will be joined by Trump’s special envoy for Ukraine and Russia, Keith Kellogg, who is expected to travel onwards to Kyiv.

- Bloomberg reports Kellogg “plans to gather input” from Munich and Ukraine to “present Trump with options in the coming weeks to end the war”.

- US Treasury Secretary Scott Bessent will travel to Ukraine this week to discuss with Zelenskyy efforts to resolve the war and a plan for the US to secure access to critical minerals.