EU AUTOMOTIVE: Ford (F Ba1/BBB-[N]/BBB-): S&P Rating

Assumptions of margin improvement at the last update look increasingly unrealistic, raising risk of a downgrade ahead. The S&P rating is pivotal as it holds the average at IG currently, driving index eligibility.

- Earlier this week S&P flagged Ford as at high risk of negative action due to tariffs. It said the OEM has narrow cushion on rating metrics.

- When S&P put Ford on negative outlook in February, we flagged that margin improvement assumptions looked optimistic. FY25 adj. EBIT margin consensus has fallen more than 50bp since then as tariff assumptions have fed through.

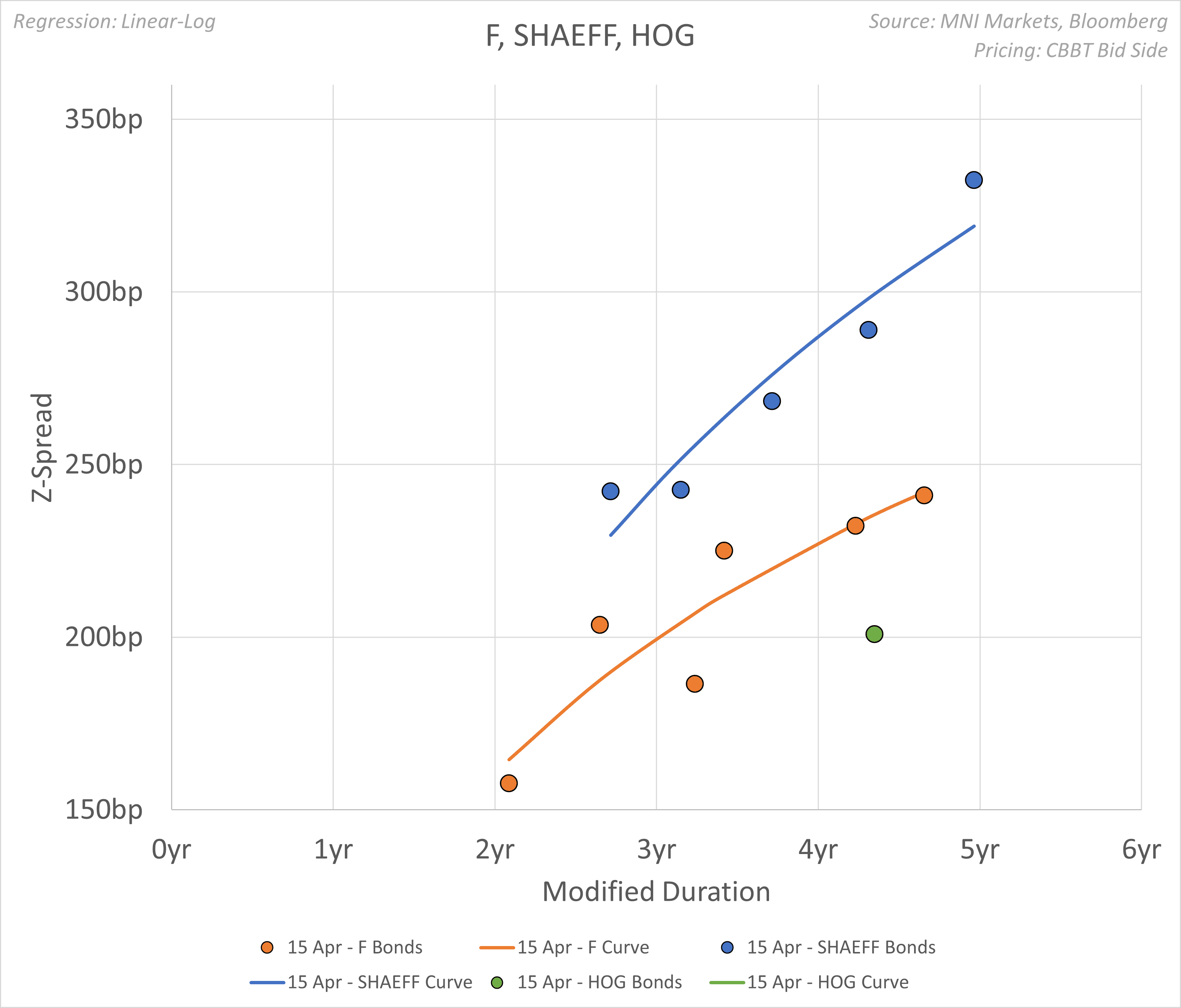

Ford has gone from 6 to 30bp wide to HOG (Baa3/BBB-/BBB+) and is ~60bp through SHAEFF (Ba1/BB+[N]/BB+), which has its own issues and would likely continue to trade wider than Ford after a downgrade.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

OAT: Ratings Relief & Equity Bid Promotes Spread Tightening

OATS continue to benefit from ratings relief, with further tailwinds coming via the uptick in equities.

- That has outweighed domestic political tensions after PM Bayrou chose not to revert the retirement age to 62 from 64. Also note that this choice increases Bayrou’s fiscal credibility, countering at least some of the political risk.

- 10s struggling to break below 67bp vs. Bunds.

- As noted earlier, further downside traction in the 10-Year OAT/Bund spread would generate the lowest close since July ’24, with next support located at ~63bp, the 61.8 retracement of the June-Dec ’24 widening, followed by the July ’24 closing low at 62.7bp.

- Citi note that Friday’s affirmation from Fitch (AA-; Outlook Negative) “kept the onus on fiscal consolidation. The risks ahead come from Fitch’s lower-than-consensus deficit forecast of 5.4%/GDP in ‘25 and view that any defence spending increase will be funded by spending cuts. Still, this eliminates near-term rating risk, unless pension reform is reversed in the coming quarters. While other risks lurk for OATs (including the court verdict on Le Pen and pension reform negotiation deadline in April), the market is likely to wait for these to manifest before building up any fresh shorts”.

NZD: NZDUSD is extending gains through 0.5800

- The NZDUSD is close to 1% up on the day (0.92%), the cross is attempting to clear the 0.5800 figure, so far printing a 0.5803 high, best level since mid December.

- A small resistance is seen at 0.5818, the 12th December high, while better will be seen at 0.5846, the 38.2% retracement of the October/February range.

MNI EXCLUSIVE: The EU is moving towards approving plan for defence loans

The EU is moving towards approving a EUR150 billion plan for defence loans. -On MNI Policy MainWire now, for more details please contact sales@marketnews.com