RENEWABLES: France Morning Renewable Forecast

Feb-20 08:59

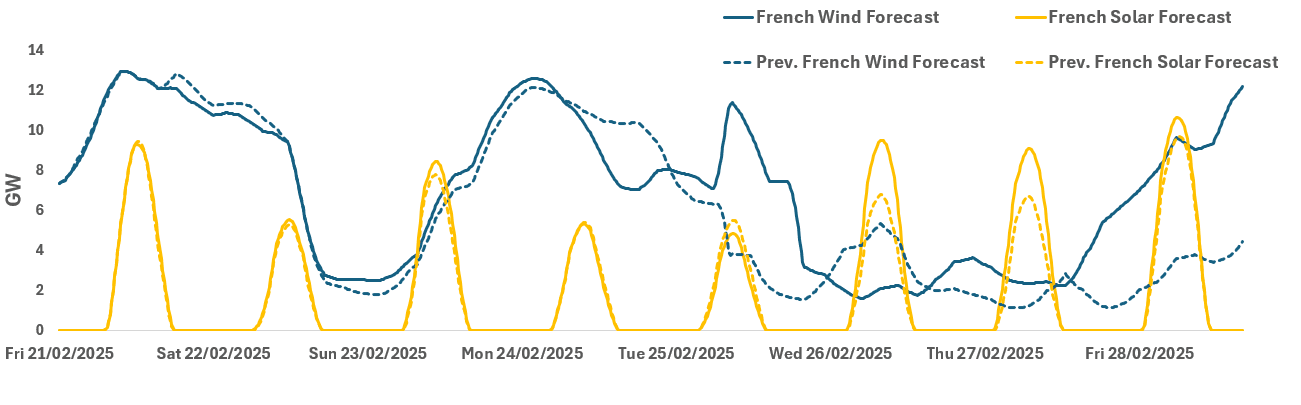

See the latest French renewables forecast for base-load hours from this morning for the next seven days. In contrast to Germany, French wind will be between 10-12% load factors over 26-27 February (Wed-Thur) – which could lead to day-ahead prices to be at a premium to Germany.

French: Wind for 21-28 February

- 21 February: 11.17GW

- 22 February: 7.63GW

- 23 February: 5.75GW

- 24 February: 10.15GW

- 25 February: 8.30GW

- 26 February: 2.28GW

- 27 February: 2.92GW

- 28 February: 8.39GW

French: Solar for 21-28 February

- 21 February: 2.42GW

- 22 February: 1.36GW

- 23 February: 2.15GW

- 24 February: 1.32GW

- 25 February: 1.13GW

- 26 February: 2.47GW

- 27 February: 2.42GW

28 February: 2.90GW

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EGBS: Spreads To Bunds Marginally Wider

Jan-21 08:58

Trump’s apparent focus on imposing tariffs on Mexico & Canada in the coming weeks helps promote some modest EGB spread widening to Bunds today, although the major 10-Year cross-market differentials are within 1bp of yesterday’s closing level.

- Bund futures have pulled back from overnight highs, limiting the spread widening as the risk-off moves fade from extremes.

- 10-Year BTP/Bunds closed below 110bp, with cycle closing lows located at 106.4bp.

- Meanwhile, 10-Year OAT/Bunds last ~77.5bp, with French political and fiscal risks helping keep that spread above 75bp.

- Supply pressure is set to come via the French and Lithuanian syndications, with German green supply also scheduled.

USD: EUR and the Pound are testing their intraday lows

Jan-21 08:50

- The EUR and the Pound are falling back to where they fell Overnight post Trump's Tariffs headline, both EURUSD and Cable are back to their overnight intraday lows.

- Not Yet seeing any broader moves versus G10s at least.

- Small support in Cable comes at 1.2222, and a push all the way down to ~1.2186 would reverse Yesterday's WSJ story on Tariffs.

- EURUSD would need to drift to 1.0320 to reverse that move.

EGB SYNDICATION: 5/15-year LITHUN EMTN: Guidance

Jan-21 08:40

- EUR Benchmark 5Y Fixed (Jan. 28, 2030) MS+70 Area

- Coupon: Annual, act/act ICMA

- EUR Benchmark 15Y Fixed (Jan. 28, 2040) MS+145 Area

- Coupon: Annual, act/act ICMA

- Issuer: Lithuania Government International Bond (LITHUN)

- Settlement: Jan. 28, 2025

- Bookrunners: BNPP (B&D), BofA, JPM

- Co-Lead (no books): SEB Lithuania

- Investor presentation.

- Timing: May price today.

Details as per Bloomberg

Related bullets

Related by topic

Renewables

Energy Data

France

US Natgas

TTF ICE

Asia LNG

Gas Positioning