FRANCE DATA: France PPI Y/Y Remains Negative Though Highest Since Dec'23

Feb-27 09:34

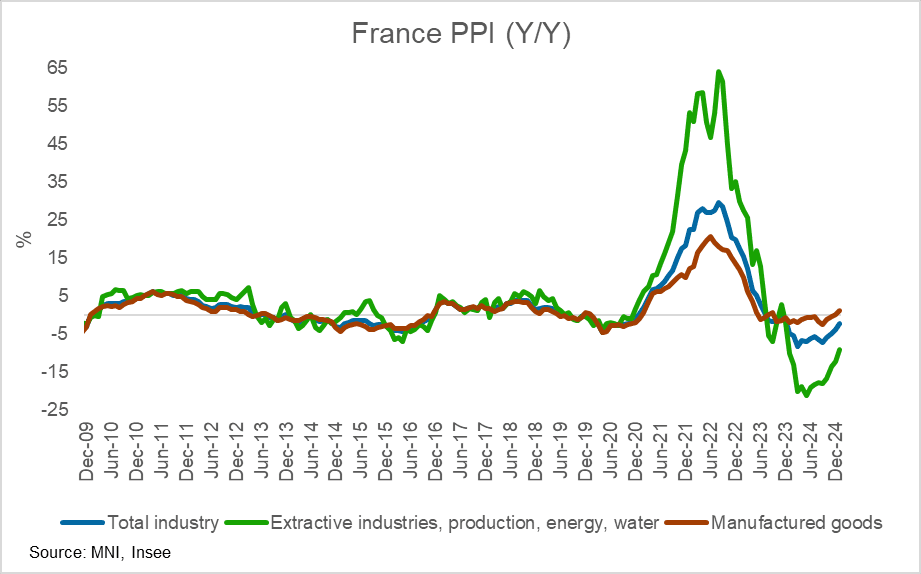

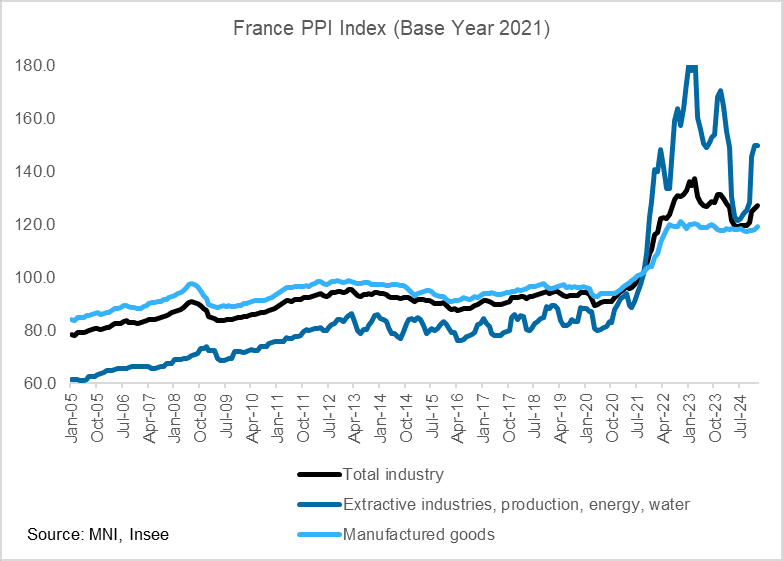

France January PPI fell -2.1% Y/Y (vs -3.8% prior). This is the fourteenth consecutive month where PPI has fallen on an annual basis, though is the highest reading since December 2023.

- On a sequential basis, PPI rose 0.7% M/M (vs 0.9% revised prior from 1.0%). We note that this is non-seasonally adjusted data and the prior four January prints have been large outliers, mainly due to energy costs and suppy chain disruptions. Looking at the decade before that (2011-2020), the average January print is close to flat.

- In broad terms, around half of the change in the Y/Y change was driven by "mining and quarrying, energy, water producer prices" (which accounts for 24% weight of total PPI) which fell by a smaller 8.9% Y/Y (vs a fall of 12.1% in December). This is the fourth successive month where the extent of annual price falls have slowed.

- The remaining 76% of the PPI total weighting is accounted for by manufactured products, where prices rose 1.2% Y/Y, from a rise of 0.3% in December. This is the second consecutive positive Y/Y reading and the highest print since April 2023.

- Within manufactured products, "food products, beverages, tobacco prices" rose 1.9% Y/Y, from 0.7% in December. On a M/M basis, this category saw its highest sequential reading since March 2023 at 0.8% M/M (following +0.5% in December). The press the release notes that this is driven by a rebound in prices of bread and pastries.

- Coke and refined petroleum products prices fell 1.5% Y/Y, from -8.0% in December. On a M/M basis PPI rose sharply by 9.2% after -1.2% in December, which the press release notes is due to world oil prices rising sharply in January.

- "Other manufactured products" PPI rose 1.2% Y/Y (from 0.8% in December), driven by an increase in price of basic chemicals.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

CROSS ASSET: US Treasuries are pushing lower

Jan-28 09:30

- The Risk On tone is starting to take hold, with Europe starting to get dragged by the US.

- US Treasuries are seeing some similar unwind, with further selling interest pushing Futures to their respective lows, nothing fast but still some early notable volumes in the US.

- Immediate target in Bund is at 131.33, Yesterday's opening Gap.

ECB: Q4 BLS: Credit Standards Tightened With Further Tightening Expected (1/2)

Jan-28 09:28

- The ECB's Q4 Bank Lending Survey saw tightening in credit standards generally due to "higher perceived risks" and "banks' lower risk tolerance" (particularly in Germany and Italy for firms). It also saw a general pick up in demand for loans mainly due to "declining interest rates".

- In particular, credit standards for firms tightened (reported by a net balance of 7% of banks) from unchanged in Q3 and the press release notes that this is the "most pronounced tightening seen since Q3 2023". This tightening is expected to continue further in Q1-25 (a net balance of 10% of banks expect further net tightening of credit standards for firms). If we see this outturn, this would be above the historical average of 9%.

- There was further tightening in consumer credit standards of in Q4 (net balance of 6% in Q4 vs 6% in Q3), with the press release stating tightening reflects "concerns about deteriorating asset quality in this loan segment". The net balance is expected to pick up a little further to 7% in Q1-25.

- Credit standards for loans for house purchase were broadly balanced (net balance of 1% in Q4 vs -3% in Q3). This follows three quarters of easing, The net balance of banks which expect credit standards to tighten is expected to pick up 1ppt in Q1-25 to 2%.

EGBS: Most Spreads To Bunds A Touch Tighter As Equities Rally, DSLs Lag

Jan-28 09:23

Most EGBs are marginally tighter vs. Bunds this morning (less than 1bp), with an uptick in European equities helping that move

- Dutch paper the exception, following some pre-DSL auction concession (~0.5bp wider last).

- OAT/Bunds last 73.5bp with November closing lows at ~73bp eyed. A break below there would expose 71.6bp, which protects the psychological 70bp mark.

- French fiscal and political risks continue to limit further tightening pressure at this juncture, with headline cues on that front set to become more prominent in the coming days/weeks.

- BTP/Bunds holds around 110bp, with cycle closing lows at 106.4bp presenting the next downside target.

- Impact of supply from Italy and the Austrian long end syndication eyed for short-term cues.