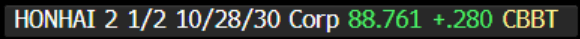

EM ASIA CREDIT: FY Results: Hon Hai (HONHAI, NR/A-/NR) - Beat

"*HON HAI FY OPER PROFIT NT$200.61B, EST. NT$197.56B" - BBG

- Hon Hai (Foxconn) has reported FY results, with operating profits up 20% YoY to NT$201bn and slightly ahead of consensus (NT$198bn). Neutral for spreads.

- In the slide deck, Hon Hai indicates it will sign a CDMS contract (contract design and manufacturing service) with a Japanese client in a couple of months.

- No details on who it may be, most likely Nissan, and the scale of the arrangement.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EUROZONE T-BILL ISSUANCE: W/C February 10, 2025

Italy is due to sell bills today, whilst France, Spain, Belgium, and Finland have already issued this week. We expect issuance to be E22.2bln in first round operations, down from E25.8bln last week.

- Today, Italy will conclude bill issuance for the week by looking to sell E8.0bln of the new 12-month Feb 13, 2026 BOT.

For more on future auctions see the full MNI Eurozone/UK T-bill auction calendar here.

EUROSTOXX50 TECHS: (H5) Northbound

- RES 4: 5466.95 2.382 proj of the Dec 20 - Jan 8 - Jan 13 price swing

- RES 3: 5455.00 2.00 proj of the Nov 21 - Dec 9 - 20 ‘24 price swing

- RES 2: 5434.10 2.236 proj of the Dec 20 - Jan 8 - Jan 13 price swing

- RES 1: 5412.00 Intraday high

- PRICE: 5413.00 @ 06:23 GMT Feb 12

- SUP 1: 5243.32 20-day EMA

- SUP 2: 5117.51 50-day EMA

- SUP 3: 4991.00 Low Jan 15

- SUP 4: 4931.00 Low Jan 13 and a key short-term support

Eurostoxx 50 futures traded higher Tuesday and the contract is holding on to its gains. The move higher confirms once again, a resumption of the uptrend that started on Nov 21 ‘24. Moving average studies are in a bull mode set-up too, highlighting a dominant uptrend. The focus is on 5434.10 next, a Fibonacci projection. Initial firm support to watch lies at 5243.32, the 20-day EMA. The 50-day EMA is at 5094.95.

EURGBP TECHS: Pivot Resistance Remains Intact

- RES 4: 0.8474 High Jan 20 and a key resistance

- RES 3: 0.8420 76.4% retracement of the Jan 20 - Feb 3 bear leg

- RES 2: 0.8388 61.8% retracement of the Jan 20 - Feb 3 bear leg

- RES 1: 0.8378 High Jan 6

- PRICE: 0.8323@ 06:30 GMT Feb 12

- SUP 1: 0.8297/8248 Low Feb 4 / 3 and a bear trigger

- SUP 2: 0.8223 Low Dec 19 and a key support

- SUP 3: 0.8203 Low Mar 7 ‘22 and a lowest point of a multi-year range

- SUP 4: 0.8163 123.6% retracement of the Dec 19 - Jan 20 bull leg

EURGBP is in consolidation mode. Gains last week appear to have undermined a recent bearish threat, however, the pullback from the Feb 6 high does highlight a developing bearish threat. 0.8378, the Jan 6 high, has been defined as a ley short-term resistance. Clearance of it would strengthen a bullish condition and signal scope for a stronger recovery. For bears, a continuation lower would open 0.8248, the Feb 3 low and bear trigger.