EUROPEAN INFLATION: German Services CPI Decelerates But Keeps NSA Pace Elevated

Mar-31 12:39

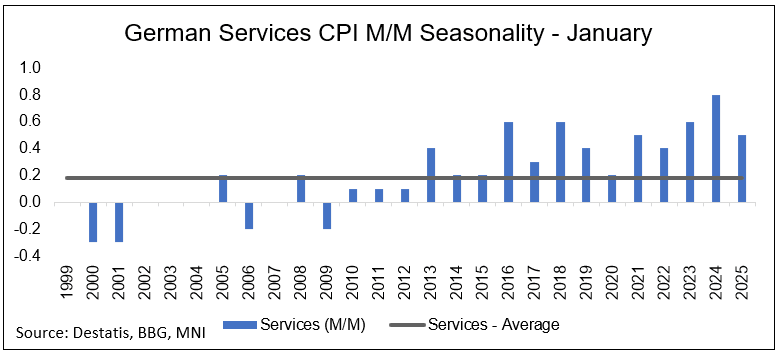

Looking past the headline prints on the German national level inflation data in March, the data confirms the services deceleration expected by analysts ahead of the release, which was also tracked by MNI following this morning's state-level data. Services CPI printed 3.4% Y/Y in March - its lowest yearly rate since April 2024, and the joint lowest since the 3.2% seen in December 2023.

- A back of the envelope calculation suggests services M/M stands at 0.5% this time - while clearly below the 0.8% seen in March 2024, and below the 0.6% seen in in March '23, that remains an elevated pace when compared to the 0.3% average sequential March print between 2010 and 2019. This especially applies as the comparison with last year's sequential print will be skewed due to the Easter holidays partially having been in March then - which put upward pressure on travel related services, including airfares. One way to correct for that will be to compare the combined sequential advances in March and April next month historically.

- Also apart from the services category, the national-level data confirms MNI's tracking estimates from earlier: Food (excl. alcoholic beverages) accelerated by 0.5pp to 2.9% Y/Y (highest rate since January 2024), energy slowed to -2.8% Y/Y (analysts expected that on the back of lower pump prices), while goods overall saw a minor acceleration, by 0.1pp to 1.0% Y/Y.

- Core CPI meanwhile slowed slightly more than we expected, by 0.2pp to 2.5% Y/Y (we've tracked a 2.6% pace).

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US OUTLOOK/OPINION: A Stacked Week Ahead For US Macro

Feb-28 21:45

- Next week sees a series a key risk points, starting with trade policy and Trump’s Mar 4 deadline for an additional 10% tariffs on China (for 20% total) and the imposition of the delayed 25% tariffs on Canada and Mexico. US Treasury Sec Bessent offered a potential offramp here, saying Friday afternoon the US wants to see Canada and Mexico match tariffs on China. Whilst following through with that could see temporary de-escalation in US trade tensions with Canada and Mexico, it would likely stoke greater likelihood of China retaliation and/or further fiscal support.

- It’s bookended by ISM manufacturing (Mon) and services (Wed) reports, watched to see whether sharp increases in manufacturing prices paid seen in other surveys first show up in this broader measure and whether there is sign of spillover to services.

- The main data release of the week comes on Friday though, with the nonfarm payrolls report for February.

- The January report saw a modest miss for nonfarm payrolls but it was more than offset by a robust two-month net revision along with a smaller than expected benchmark revision. Further, the unemployment rate again surprised lower at 4.0% for its lowest since May 2024 in a further step away from the 4.3% the median FOMC member forecast for 4Q25 in the December SEP.

- Early days for the Bloomberg survey see nonfarm payrolls growth at a seasonally adjusted 155k in February and for the unemployment rate to hold at that lower 4.0%.

- Note that the nature of the DOGE “deferred resignation program”, with some 77k federal employees accepting the offer, shouldn’t see any direct impact on payrolls growth (in the establishment survey) until the October report as workers will remain on the payroll in the interim. One area where the direct impact could show however is the household survey. Assuming those who accepted the offer are treated as equivalent to a furloughed worker, they’ll register as unemployed. A word of caution though, it’s a much more volatile survey, with a 90% confidence level of +-600k for employment vs +-136k for payrolls.

- Note that post-payrolls Fedspeak sees a notable addition this time, with Fed Chair Powell set to talk on the economic outlook with both text and Q&A, starting at 1230ET. Data and tariff deliberations should still set the tone, but at this juncture we wouldn’t be surprised to see a continued call for patience in rate cut expectations considering dovish repricing seen over the past week. This is a theme that could be seen from other notable Fedspeakers throughout the week, including permanent voters Williams, Waller and Kugler.

STIR: Significant Dovish Repricing In US Rates This Week

Feb-28 21:14

- The softer growth outlook has dominated signs of renewed inflationary pressures this week - see a key summary of the week's macro developments in the MNI US Macro Weekly here.

- Fed Funds futures have a next 25bp Fed cut now fully priced for June and over the week have added nearly an entire 25bp cut over 2025 with a cumulative 70bp of cuts vs the 50bp implied by the median FOMC dot in Dec.

Significant dovish adjustment over the week:

MACRO ANALYSIS: MNI US Macro Weekly: No Escaping Tariff Distortions

Feb-28 21:12

- We have published and e-mailed to subscribers the MNI US Macro Weekly offering succinct MNI analysis across the range of macro developments over the past week.

- Please find the full report here: https://media.marketnews.com/US_macro_weekly_250228_3f0cf485bb.pdf