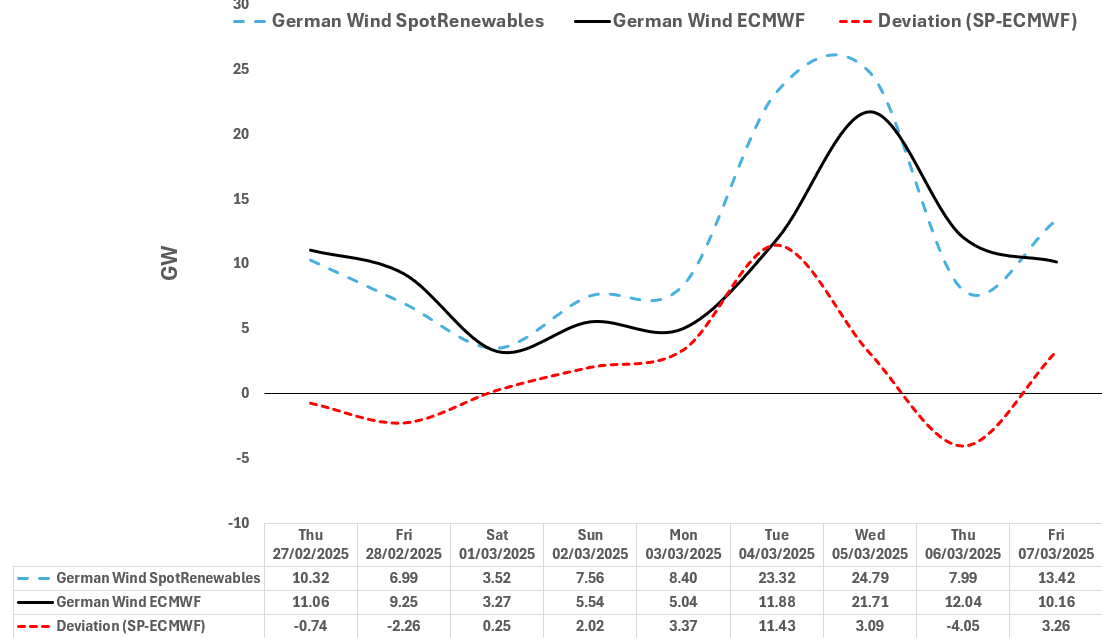

RENEWABLES: German Wind Output Forecast Comparison

See the latest German wind output forecast for base-load hours from SpotRenewables vs Bloomberg’s ECMWF model for the next seven days as of Wednesday afternoon.

- Both models have similar wind forecasts on 27 February and 1 March, with the smallest deviation on those days at between 0.25-0.74GW.

- The largest deviation is seen on 4 March as ECWMF expects wind to be lower compared to SpotRenewables. The deviation on that day is 11.43GW.

Despite these differences, both models suggest wind to be on a general upward trend from 2 March and peaking on 5 March before being on a general downward trend over 6-7 March.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

ECB: Weekly ECB Speak Wrap (Jan 20 – Jan 27)

The World Economic Forum in Davos brought plenty of ECB speakers but little in the way of new policy signals. Consensus amongst analysts, markets and policymakers is firmly for a 25bp cut to be delivered on Thursday (MNI’s full preview will be released tomorrow), with a subsequent 25bp cut in March also appearing very likely.

- The January flash PMIs were stronger-than-expected, with OIS now pricing 6bps fewer cuts through 2025 than a week ago (today’s DeepSeek driven dovish repricing has been fully pared at typing). However, we note that some analysts have raised questions around the seasonality of the PMIs post-Covid, which may have biased readings higher in Q1.

- President Lagarde’s interview with CNBC at Davos stuck to familiar themes. She said that future cuts will depend on data and that "gradual" steps remain reasonable, while noting that she did not see the ECB as “behind the curve” on rate cuts. She also signalled that the debate around neutral (which she placed as between 1.75-2.25%) will start to “get a little bit hotter” soon.

- The usually hawkish Kazimir notably endorsed market pricing for “three or four cuts”, while stating that the “deal is done” on a January cut. Meanwhile, the ever-hawkish Holzmann told Kronen Zeitung that he would prefer to “wait a bit more” before cutting rates again. However, even he admitted that he could be persuaded into supporting a cut if there were “good arguments” presented.

- In the tables below, we provide a summary of ECB-speak between January 20 and January 27: 250127 - Weekly ECB Speak Wrap.pdf

OPTIONS: Expiries for Jan28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0400(E1.0bln), $1.0460($697mln), $1.0500(E1.4bln), $1.0520-30(E929mln), $1.0550(E792mln)

- AUD/USD: $0.6300-10(A$2.0bln)

US TSYS: Post-New Home Sales React

- Treasury futures holding near recent session lows, little reaction to better than expected new home sales for December. Still bid, futures have scaled back overnight risk-off support on weaker stocks tied to China's DeepSeek AI startup.

- Treasury Mar'25 10Y futures currently +16 at 108-31 vs. 109-12 high - just below initial technical resistance of 109-12.5 (50-day EMA).

- Cross asset comparison, stocks are weaker but well off lows (SPX Eminis -103.0 at 6029.50), Gold weaker (-27.33 at 2743.23), US$ index off lows (BBDXY +.21 at 1295.37), volatility index gaining (VIX +3.61 at 18.46).

- Focus remains on Wednesday's FOMC policy annc, as well as heavy corporate earning's docket this week.