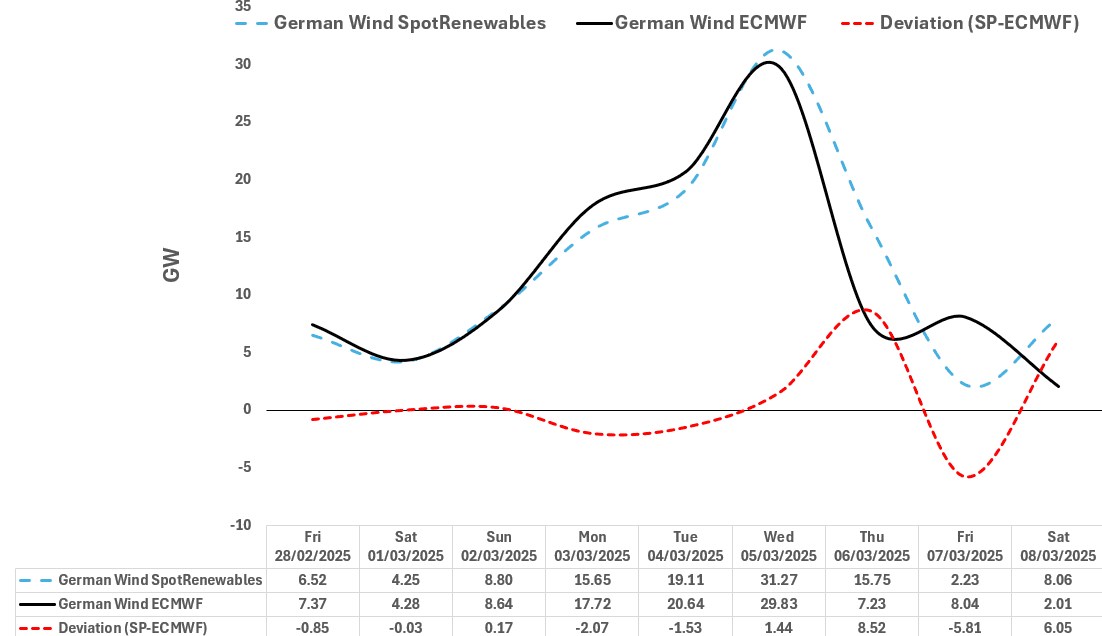

RENEWABLES: German Wind Output Forecast Comparison

Feb-27 15:08

See the latest German wind output forecast for base-load hours from SpotRenewables vs Bloomberg’s ECMWF model for the next seven days as of Thursday afternoon.

- Both models have similar wind forecasts on 28 February-2 March, with the smallest deviation on those days at between 0.03-0.85GW.

- The largest deviation is seen on 6 March as ECWMF expects wind to drop at a much faster pace from 5 March compared to SpotRenewables. The deviation on that day is 8.52GW.

Despite these differences, both models suggest wind to be on a general upward until peaking on 5 March and then being on a general downward trend over 6-8 March.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US TSY FUTURES: Post-Consumer Confidence React

Jan-28 15:06

- Treasury futures remain in negative territory following lower than expected Conference Board Consumer Confidence data.

- Futures had pared losses/climbed to session highs on mini-version of Monday's DeepSeek-tied risk-off move as Nvidia trades weaker again this morning. Reversal soon followed, however:

- Currently, the Mar'25 10Y contract trades -7.5 at 108-29.5, off late overnight low of 108-25.5. Futures remain inside technical ranges: support well below at 108-00/107-06 (Low Jan 16 / 13 and the bear trigger), nearly breached yesterday - resistance above at 109-12+ (50-day EMA).

- Cross-asset moves: Bloomberg US$ index still bid but off highs at 1300.58 (+3.74), Gold +11.45 at 2752.26, stocks firmer (SPX Eminis +9.0 at 6055.75.

EGB SYNDICATION: Austria dual-tranche: Priced

Jan-28 14:59

New 10-year Feb-35 RAGB

- Reoffer price 99.596 to yield 2.997%.

- Spread set earlier at MS+48bps (guidance was MS+51bps area)

- Size: E5bln inc E250mln retained (MNI expected E4.5-5.0bln including E250-500mln retention)

- Books closed in excess of E35bln (inc E3.15bln JLM interest)

- HR 98% vs 2.50% Feb-35 Bund

- Maturity: 20 February 2035

- Coupon: 2.950% Long first

- ISIN: AT0000A3HU25

1.85% May-49 Green RAGB tap

- Reoffer price 77.575 to yield 3.19%

- Spread set at MS+78bps (guidance was MS+80bps area)

- Size: E1.5bln inc E250mln retained (MNI expects E1.0-2.0bln)

- Books closed in excess of E15bln (inc E800mln JLM interest)

- HR 100% vs 1.25% Aug-48 Bund

- ISIN: AT0000A2Y8G4

For both:

- JLMs: BofA Securities, Deutsche Bank, Erste Group, J.P. Morgan, Morgan Stanley and Raiffeisen Bank International

- Timing: Hedge deadline 14:10GMT / 15:10CET

From market source / Bloomberg

CANADA: USDCAD Pulls Lower With No Clear Drivers

Jan-28 14:57

- USDCAD has seen a reasonable pull back from earlier session highs of 1.4420 to 1.4369 over almost two hours and to fully unwind the push higher seen after the FT reported US Tsy Sec Bessent is pushing for new universal tariffs on US imports to start at 2.5% and rise gradually. It's since lifted ~15 pips quickly.

- The push lower stands out considering a step lower in US equity futures (and saw CAD briefly as joint top performer on the day along with the USD) but it’s still small compared to some of the swings seen since President Trump’s inauguration.

- Key directional triggers remain resistance at 1.4516 (Jan 21 high) and support at 1.4261 (Jan 20 low).

- Earlier today, the Globe & Mail reported Ottawa is planning pandemic-level relief for workers and businesses if Trump imposes tariffs.

- Tomorrow sees the BoC decision: https://media.marketnews.com/BOC_Preview_Jan2025_f128d669a0.pdf with the FOMC decision later on: https://media.marketnews.com/Fed_Prev_Jan2025_With_Analysts_c155c1a3c6.pdf

Related bullets

Related by topic

Renewables

Energy Data

Germany

US Natgas

TTF ICE

Asia LNG

Gas Positioning