GERMAN DATA: GfK Sees No Sustainable Recovery for Consumer Climate in Sight

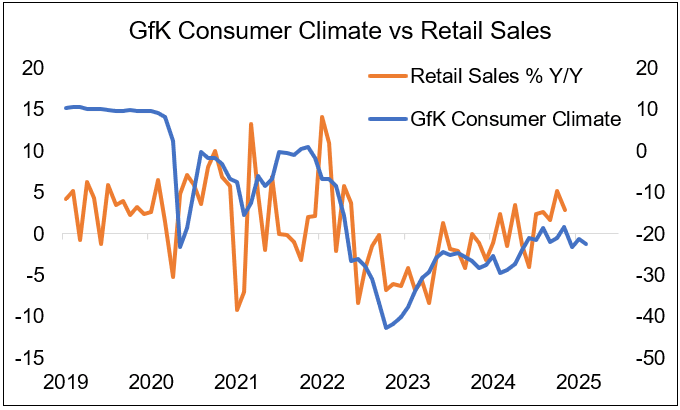

The GfK Consumer Climate for Germany declined in its February advance print, to -22.4 points, compared to January's revised -21.4. While the series remains above December's -23.1, weakness was apparent in all subindicators of the release: economic & income expectations as well as willingness to buy all declined. "A sustainable recovery in the Consumer Climate is currently not in sight", GfK concludes.

- Retail sales in Germany have broadly flatlined on a sequential basis in recent months and remain more than 7% below 2021 highs.

- While current consumer climate levels represent a notable improvement over 2022 lows, a material gap to pre-pandemic norms remain.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

USDJPY TECHS: Trading At Its Recent Highs

- RES 4: 160.00 Round number resistance

- RES 3: 159.45 High Jul 12

- RES 2: 159.26 0.618 proj of the Sep 16 - Nov 15 - Dec 3 price swing

- RES 1: 158.08 High Dec 26

- PRICE: 157.87 @ 06:57 GMT Dec 30

- SUP 1: 155.89/155.01 High Nov 20 / 20-day EMA

- SUP 2: 153.11/150.90 50-day EMA / Low Dec 10

- SUP 3: 149.37 Low Dec 06

- SUP 4: 148.65 Low Dec 03 and the bear trigger

Bullish conditions in USDJPY remain intact and the pair is trading at its recent highs. The breach of 156.75, the Nov 15 high and a bull trigger, confirmed a resumption of the uptrend and has paved the way for a move towards 159.45, the Jul 12 high. Moving average studies are in a bull-mode position highlighting a clear dominant uptrend. Initial firm support is 155.01, the 20-day EMA. A pullback would be considered corrective.

EUROSTOXX50 TECHS: (H5) Corrective Cycle Still In Play

- RES 4: 5040.00 High Dec 9 and a key short-term resistance

- RES 3: 5027 High Dec 13

- RES 2: 5002.00 High Dec 18

- RES 1: 4939.00 High Dec 19

- PRICE: 4910.00 @ 06:35 GMT Dec 30

- SUP 1: 4829.00 Low Dec 20 and key short-term support

- SUP 2: 4800.87 76.4% retracement of the Nov 21 - Dec 9 bull cycle

- SUP 3: 4775.00 Low Nvv 29

- SUP 4: 4727.00 Low Nov 21 and a key support

A bull cycle in the Eurostoxx 50 futures contract remains intact, however, the recent move down highlights a corrective phase. Despite the latest bounce, a short-term bear threat remains present - for now. Key short-term support has been defined at 4829.00, the Dec 20 low. A break of it would confirm a resumption of the bear cycle and open 4800.87, a Fibonacci retracement. Initial resistance is at 4939.00, the Dec 19 high.

CHINA PRESS: China To Further Relax Housing Restrictions

Home purchase restrictions in major cities are expected to be further relaxed next year, with housing mortgage rates likely to fall Securities Daily said in a commentary. Authorities will quicken de-stocking in the housing market by giving local authorities more flexibility in buying up unsold homes for affordable housing in terms of acquisition entities and prices, the newspaper said. Revitalising commercial and office buildings, as well as boosting credit supply to white-listed housing projects to ensure delivery are also necessary, the newspaper said.