GLOBAL MACRO: Global Factors Signalling Further Disinflation Ahead

Various global factors are currently pointing towards inflation moderating further as heightened uncertainty related to US tariff announcements has weighed on various commodities and freight rates. Food prices are one of the few items trending upwards but that can vary across countries such as Thailand reporting a decline in vegetable prices in April due to increased supply.

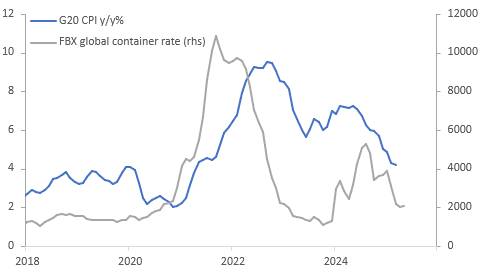

- Global freight rates for bulk goods and containers are down around 30% on a year ago in May but are slightly higher on the April average as hopes increase that trade deals will be made with the US. One is due to be announced on Thursday, likely with the UK according to NY Times.

Global inflation vs container rates

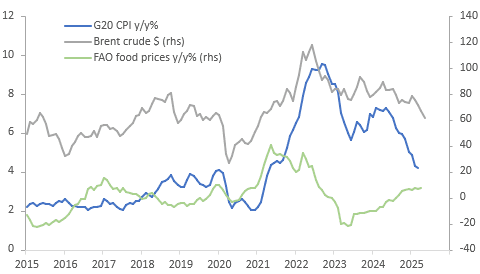

- Oil sold off sharply on concerns that increased protectionism would weigh on global energy demand. May average Brent is down 7.7% m/m after 6.7% in April to be -25.6% y/y. This will impact headline inflation globally and possibly core with a lag if lower transport and input costs feed through to other prices.

- FAO food prices rose 1% m/m in April to be +7.6% y/y up from 6.8% y/y driven by higher prices for cereals, dairy and meat. However, rice has been declining with processed -40.5% y/y in May and rough rice -30.5% y/y, which is important especially for Asia.

- Other commodities are generally lower with the LME metal price index down 5.8% y/y in May but currently up 2.2% m/m after a 6.9% decline in April. Iron ore is -0.7% in May, the third consecutive monthly fall, to be down 15.9% y/y, as lower expected activity and already implemented US steel tariffs are likely to weigh on demand. Wool prices turned higher in Q4, an important textiles input, but is down 3.8% m/m in May, the first monthly fall since September.

Global inflation vs oil & food prices

Source: MNI - Market News/LSEG

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUSSIE BONDS: Cheaper But At Bests, Tracking US Tsys, CC Down, BC Unch

ACGBs (YM -12.0 & XM -16.5) are significantly cheaper but at session highs after today’s domestic confidence data.

- Westpac’s measure of consumer confidence sank 6% m/m in April to 90.1 down from 95.9 in March, which had been boosted by February’s rate cut. Both current conditions and expectations were lower.

- NAB’s March business survey was little changed from February with confidence down 1 point to -3 and conditions up 1 point to +4. The result is in line with moderate growth. The survey results don’t suggest any worry about a global trade war before US reciprocal tariffs were announced, which were higher than expected.

- However, the key driver of today’s intra-session move is likely to be US tsys. Cash US tsys are showing a bull-steepener, with benchmark yields flat to 3bps lower, in today's Asia-Pac session after yesterday’s extremely heavy session.

- Cash ACGBs are 11-16bps cheaper with the AU-US 10-year yield differential at +10bps.

- Swap rates are 8-13bps higher, with the 3s10s curve steeper.

- The bills strip has cheapened dramatically, with pricing -5 to -12.

- RBA-dated OIS pricing is 4-14bps firmer across meetings today. A 50bp rate cut in May is given a 44% probability, with a cumulative 110bps of easing priced by year-end.

AUSTRALIA DATA: NAB Business Survey Little Changed Ahead Of US Tariffs

NAB’s March business survey was little changed from February with confidence down 1 point to -3 and conditions up 1 point to +4. The result is in line with moderate growth but doesn’t signal any pickup in the pace of the recovery, likely given heightened uncertainty. The survey results don’t suggest any worry about a global trade war before US reciprocal tariffs were announced, which were higher than expected.

- On the inflation side, labour costs remained elevated at 1.5% 3m/3m after 1.6% and purchase costs were steady at 1.4%. However, the rise in final product prices held at a subdued 0.4%

- The pickup in conditions was driven by a 2 point increase in profitability to +1, while employment was steady at +4 and trading fell 1 point to +6. Capex rose 1 point to +7.

- Forward looking orders rose 1 point to -2, while stocks increased 2 points to +5, which may be indicating preparation for stronger demand as capacity utilisation rose almost 1pp to 82.9%.

- On the external front, exports were flat at 0 and sales rose 1 point to +1.

AUSSIE BONDS: ACGB Jun-34 (Green) Auction Result

The AOFM sells A$400mn of the 4.25% 21 June 2034 Green Bond:

- Average Yield (%): 4.1725 (prev. 4.4693)

- High Yield (%): 4.1750 (prev. 4.4725)

- Bid/Cover: 4.8875x (prev. 5.1833x)

- Allotted at Highest Accepted Yld as % of Bid at that Yld (%): 51 (prev. 39.5)

- Bidders: 41 (prev. 38), 13 (prev. 12) successful, 6 (prev. 6) allocated in full