FED: Gov Bowman Maintains More Cautious Stance Than Most

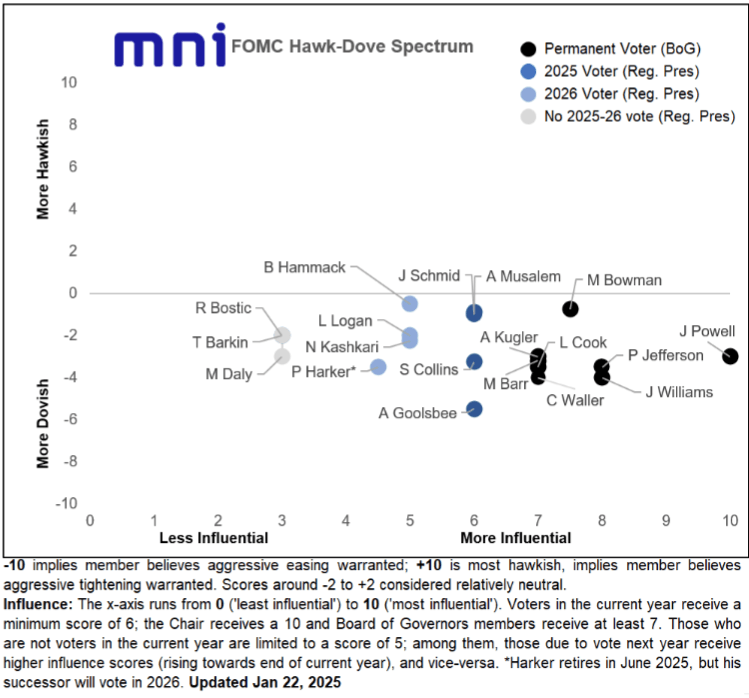

Gov Bowman is the first post-January FOMC meeting Fed speaker, and sticks to her skepticism on whether future rate cuts will be required, saying "I continue to prefer a cautious and gradual approach to adjusting policy." MNI continues to consider her one of the 3 or 4 most hawkish members of the Committee.

- Bowman reminds that she supported the 25bp cut in December because she saw that as the last reduction barring further evidence that the Fed needs to act further: "after recalibrating the level of the policy rate towards the end of last year to reflect the progress made since 2023 on lowering inflation and cooling the labor market, I think that policy is now in a good place to position the Committee to pay closer attention to the inflation data as it evolves."

- She is "concerned that easier financial conditions over the past year may have contributed to the lack of further progress on slowing inflation", and doesn't see the current rate level as "exerting meaningful restraint", seemingly putting her in the minority on the Committee. She seemingly notes the rise in real rates pushing up long-end Treasury yields: "Some have interpreted it as a reflection of investors' concerns about the possibility of tighter-than-expected policy that may be required to address inflationary pressures."

- She is focused on seeing incoming inflation data show further progress after the apparent stalling late last year ("slow and uneven since the spring") - in other words, no need for pre-emptive cuts in anticipation of inflation falling in future: "There is still more work to be done to bring inflation closer to our 2% goal. I would like to see progress in lowering inflation resume before we make further adjustments to the target range. We need to keep inflation in focus while the labor market appears to be in balance and the unemployment rate continues to be at historically low levels."

- On the labor market front, she sees December's 4.1% unemployment rate as "slightly below my estimate of full employment", and eyes next week's benchmark payrolls revisions which she says will "more accurately capture the changing dynamics of immigration and net business creation and bring more clarity on the underlying pace of job growth".

- Interestingly for all of that, she doesn't seem to discount the potential for a cut to be in the discussion at the next meeting in March - though by the same token she leaves the door open to an even more hawkish stance if the data doesn't look favorable: "By the time of our March meeting, we will have received two inflation and two employment reports. I look forward to reviewing the first quarter inflation data, which, as I noted earlier, will be key to understanding the path of inflation going forward. I do expect that inflation will begin to decline again and that by year-end it will be lower than where it now stands."

- She echoes Chair Powell's comments on having the ability to wait and see what Trump administration policiies emerge before making any monetary policy decisions: "the current policy stance also provides the opportunity to review further indicators of economic activity and get clarity on the administration's policies and their effects on the economy. It will be very important to have a better sense of the actual policies and how they will be implemented, in addition to greater confidence about how the economy will respond."

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US TSYS: Tsy Curves Look To Finish 2024 at June'22 Highs

- Treasuries look to finish the last trading session of 2024 lower after reversing Tuesday morning support. Markets closed Wednesday for New Years day, resume full trade Thursday.

- The Mar'25 10Y contract trades 108-25.5 (-5.5) late in the day, 10Y yield near session high of 4.5871%. Curves bounced off flatter levels, 2s10s climbing to 34.344 -- the highest level since June 2022.

- Short end support, in turn, helped projected rate cuts into early 2025 gain momentum vs. late Monday levels (*) as follows: Jan'25 steady at -2.8bp, Mar'25 -14.6bp (-13.6bp), May'25 -20.6bp (-19.5bp), Jun'25 -29.8bp (-28.8bp).

- No substantive reaction to this morning's housing and regional Dallas Fed services activity data. Looking ahead to Thursday data (prior, est): Initial Jobless (219k, 221k) and Continuing Claims (1.910M, 1.890M) at 0830ET; S&P Global US Manufacturing PMI (48.3, 48.3) at 0945ET; Construction Spending MoM (0.4%, 0.3%) at 1000ET.

- Treasury supply: $85B 4- & $80B 8W bill auctions at 1130ET, $64B 17W bill auction at 1300ET.

COMMODITIES: WTI Futures, Gold Holding Higher

WTI futures are trading higher today as the contract extends recent gains. A stronger reversal to the upside would refocus attention on key short-term resistance at $76.41, the Oct 8 high. Initial firm resistance is unchanged at $71.97. A bear threat in Gold remains present. The yellow metal traded sharply lower on Dec 18 and the move undermines a recent bull theme. A resumption of weakness would open key support at $2536.9, the Nov 14 low.

- WTI Crude up $0.9 or +1.27% at $71.88

- Natural Gas down $0.32 or -8.13% at $3.618

- Gold spot up $19.24 or +0.74% at $2625.86

- Copper down $6.95 or -1.7% at $402.3

- Silver down $0.1 or -0.34% at $28.8383

- Platinum up $3.96 or +0.44% at $908.02

US STOCKS: Late Equity Roundup: Tech & Interactive Media Sectors Underperforming

- Stocks are trading near session lows after reversing early session gains. Though off this year's record highs (SPX Eminis 6178.75, DJIA 45,073.63, Nasdaq 20,204.58) major averages will finish the year with double digit gains: SPX Eminis +19.5%, DJIA +13.1%, while the Nasdaq gained 29.9%!

- Currently, the DJIA trades down 92.19 points (-0.22%) at 42474.46, S&P E-Minis down 28 points (-0.47%) at 5929.75, Nasdaq down 147 points (-0.8%) at 19337.13.

- Information Technology and Communication Services shares underperformed continued to underperform late Tuesday, shares of software and semiconductor makers weighing on the tech sector: Nvidia -1.61%, Advanced Micro Devices -1.36%, Crowdstrike Holdings -1.28%.

- Interactive media and entertainment shares weighed on the Communication Services sector: Alphabet -0.9%, Live Nation -0.76%, Netflix -0.60%, Meta -0.41%.

- On the positive side, Energy and Materials sectors outperformed in the second half, oil & gas stocks buoyed the Energy sector as crude prices continued to rise (WTI +1.0 at 71.99): APA Corp +3.59%, Marathon Petroleum +2.46%, Occidental Petroleum +2.15%.

- Meanwhile, shares of chemical & fertilizer makers supported the Materials sector: Mosaic +2.44%, Celanese +1.42%, Dow +1.37%.

- Looking ahead, the next round of quarterly earnings kicks off mid-January with Blackrock, Bank of NY Melon, Wells Fargo, JP Morgan, Goldman Sachs, Citigroup, US Bancorp, M&T Bank and PNC all reporting between January 13-16.