EU CONSUMER STAPLES: Haleon; £33s screens value

(HLNLN; Baa1 Pos/BBB+)

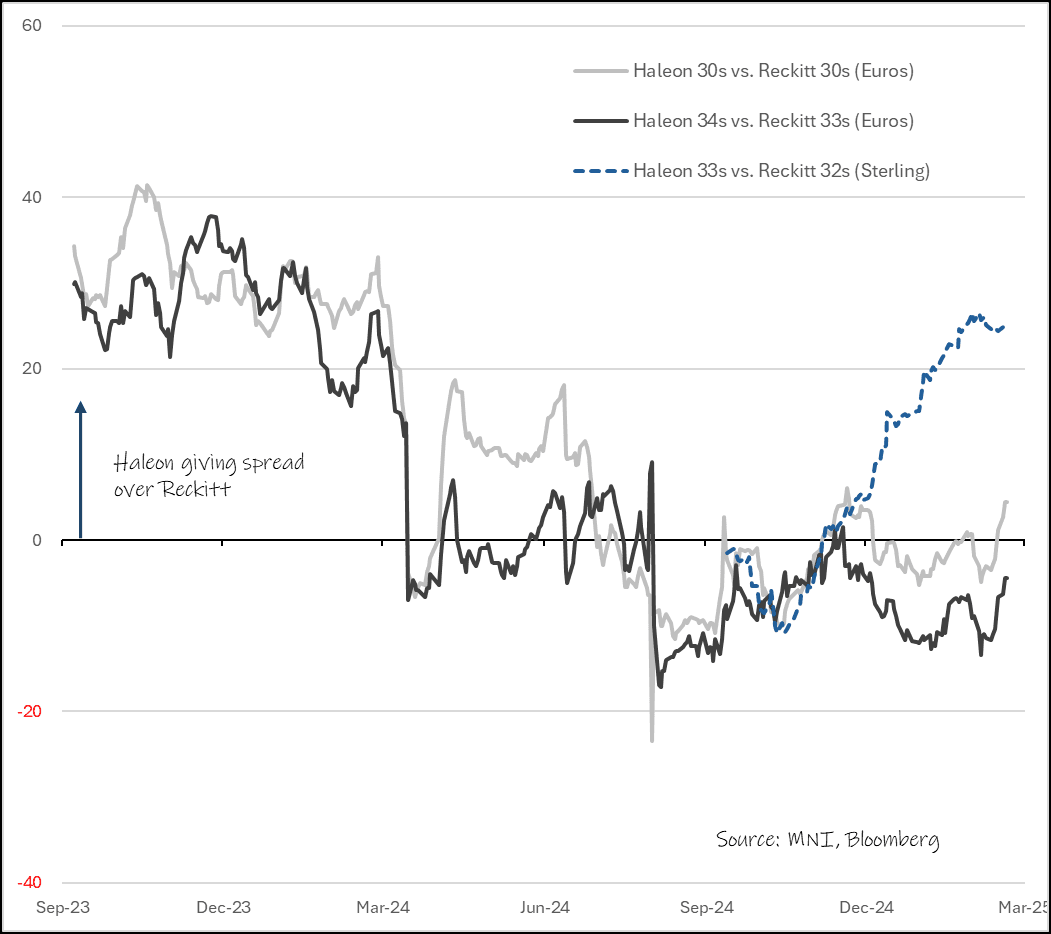

Not sure what is sterling markets are doing on the Haleon/Reckitt spread (below).

Haleon €30s (were) a value view for us starting in June last year after it followed Reckitt wider on a index sell-off (Reckitt high beta then on its litigation woes). Its -30bps in since (vs. €IG -7) and completely reversed the Reckitt/Haleon spread - something we think will continue to move in that direction; Reckitt is still yet to settle bulk federal lawsuits and has tabled 30% of its business for sale with unch leverage through it. Meanwhile Haleon is running mid-single digit organic sales growth, HSD organic EBIT growth and continues to delever post its split from GSK in 2022 (4x to 2.9x, target 2.5x).

Yet sterling markets has sent the spread in the opposite direction (Haleon 33s/Reckitt 32; both 2024 issuances). We do think it is the Haleon 33s that are mispriced/wide vs. broader comps.

FY results; Haleon 27th Feb, Reckitt 6th March.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

ECB: /SWAPS: ECB Survey Highlights Deteriorating Market Liquidity In Autumn 2024

The ECB’s December 2024 SESFOD survey (Survey on credit terms and conditions in euro-denominated securities financing and OTC derivatives markets) reports a tightening in credit terms and conditions between September and November 2024 “as general market liquidity deteriorated”.

- “A small net percentage of survey respondents expected overall terms to tighten further across all counterparty types in the three months ahead (i.e. in the period from December 2024 to February 2025)”.

- “A significant net percentage of survey respondents reported that financing rates/spreads had increased for funding secured against all collateral types”.

- “Survey respondents also reported increased demand for funding across all collateral types. Moreover, they reported a slight deterioration in the liquidity and functioning of collateral markets”.

- A reminder that German paper saw a notable cheapening against swaps through the Autumn, with the Bund ASW (vs 3-month Euribor) tightening from over 25bps at the end of September to below 0bps by mid-November (an all-time/cycle low).

- Despite retracing a portion of those moves in the second half of November, long-end spreads have re-approached those record levels this month. Analysts have highlighted increased free-float from ECB balance sheet run-off and heavy sovereign supply as fundamental drivers of swap spread narrowing in 2025.

- Press release: https://www.ecb.europa.eu/press/pr/date/2025/html/ecb.pr250120~9384966317.en.html

OPTIONS: Expiries for Jan21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0300(E2.0bln), $1.0325(E3.3bln), $1.0400(E2.2bln), $1.0415-20(E1.3bln), $1.0450(E921mln), $1.0490-00(E1.4bln)

- USD/JPY: Y153.00($1.5bln), Y156.00-05($2.2bln)

- EUR/JPY: Y159.40(E1.3bln), Y166.20($1.2bln)

- AUD/USD: $0.6200(A$775mln), $0.6245-50(A$939mln)

- USD/CAD: C$1.4285($703mln)

UK DATA: MNI UK Labour Market Preview: January 2025 Release

- The importance of UK labour market data may have fallen a little for the MPC, but it is still incredibly important for the market, despite growth concerns having picked up recently and activity and PMI data increasingly watched.

- The scope for further revisions make this month’s print even more unpredictable.

- Rounded to 1dp, the majority (6/8) of analyst forecasts we have seen for private sector regular AWE look for a 5.8%Y/Y print in the 3months to November, up from 5.37%Y/Y in the 3-months to the end of October. The other two forecasts we have seen look for 5.7%.

- In terms of the “headline” whole economy AWE numbers, ex-bonus forecasts are generally 5.5%Y/Y in the 3-months to November (from 5.19%Y/Y in the 3-months to October) while the total (including bonus) whole economy AWE forecasts are split between 5.6-5.7%Y/Y in the 3-months to November (with one analyst looking for 5.5%).

For the full preview including summaries of a dozen sellside views click here.