EU HEALTHCARE: Healthcare: Week in Review

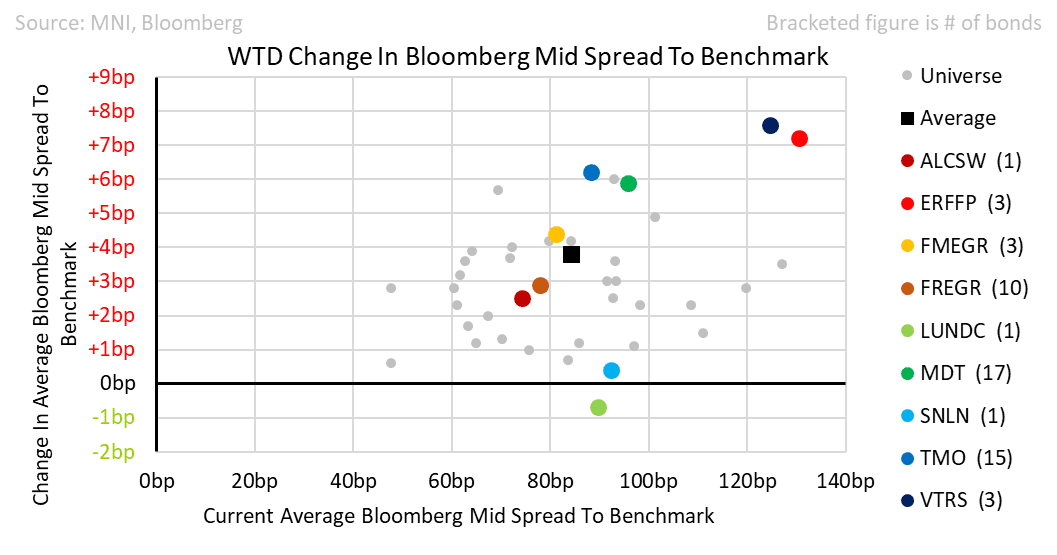

On average 3.5bps wider on the week as risk sentiment soured a little. Alcon, Fresenius SE and Medical had strong results but only LUNDC managed to tighten slightly.

- Viatris deleveraging efforts were overshadowed by a 20% share price fall. The company will face a $500m revenue hit following an FDA warning regarding its Indore production facility; this should not be permanent. Leverage now sits at 2.9x (no further reduction expected) which should be enough for S&P to remove the Neg Outlook at BBB-; Fitch is mid BBB. We expect that the company will front-load share buybacks given the need to support the share price on yesterday’s fall. Bonds +7bps on the week.

- Thermo Fisher opted to tap the CHF market for 1.425bn to fund its $4.1bn cash acquisition of Solventum’s purification business. We calculated that the leverage implications of the deal would be no worst than 0.4x. This is the second deal – after JNJ – to fund immediately rather than to wait. TMO +6bps wider.

- Smith & Nephew rallied 9.5% following results. The company is under break-up pressure from Cevian Capital. Bonds have little protection against significant asset sales (apart from a full takeover). The bounce may alleviate some of the risk for holders.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FRANCE: Greens & PS Criticise PM's Immigration Comments As Budget Talks Halted

Marine Tondelier, leader of the environmentalist Ecologists, has added her voice to the wave of criticism from the left towards PM Francois Bayrou regarding his comments on immigration from 27 Jan. In an interview with LCI on Monday, Bayrou said “Contributions from foreigners are a positive for a people, so long as they remain proportionate. But as soon as you get the feeling of flooding, of no longer recognizing your own country, its lifestyle and its culture, the feeling of rejection appears.”.

- Philippe Brun, a deputy from the centre-left Socialist Party (PS) said on Sud Radio earlier that the PS "suspended our negotiations [on the budget] because the words from the Prime Minister were not dignified," adding that he hopes talks will resume. Tondelier has raised the prospect of bringing a censure motion against the Bayrou gov't over the comments, saying "I don't need him to say something stupid on LCI about immigration to decide to vote for censure,".

- The furore comes at an inopportune time with regards to the budget. The Joint Committee on the Budget meets tomorrow (Thurs 30 Jan) from 0930CET. The Committee includes senators and deputies and will seek agreement between the two chambers on a common text. In the event an agreement is reached, the conclusions will be presented to the Assembly then the Senate on Monday 3 Feb. If an agreement is not forthcoming and Bayrou is forced to use Article 49.3 of the constitution to force a budget through without a vote, the presentation will take place Thursday 6 Jan.

FOREX: AUD Pierces Support as Inflation Softens

- JPY is trading somewhat firmer early Wednesday, with markets eyeing reports overnight that the Japanese finance minister had held talks with his newly-minted US counterpart Bessent, at which the two discussed FX policy on top of financial and geopolitical issues. Given the Trump administration's sensitivity to weaker currencies for trading partners, markets have bid the JPY slightly higher to keep USD/JPY pinned to the Y155.00 pivot level for now.

- Australian inflation data overnight came in modestly softer than expected, leading to AUD weakness headed into the Wednesday open. AUD/USD plumbed a pullback low at 0.6227 - piercing the 50% retracement for the upleg posted off the cycle low in mid-January in the process. As a result, AUD and NZD are the poorest performers in G10 FX so far.

- The Fed decision ahead is the market focus, with markets likely to look through an unchanged decision on rates policy to narrow in on any fresh market pricing for the Fed's terminal rate. Markets are priced for ~50bps of further easing into year-end, and the USD will be sensitive to any direct messaging from Powell on pricing, particularly any suggestion that the Fed could go further with easing in the face of growth and tariff risks this year.

- Equity sensitivity will come into further focus later today, with a raft of earnings set for after-market. AI-adjacent stocks including Tesla, Microsoft, IBM and Meta Platforms are due - within which any reference to the rapid rise of China's DeepSeek will be carefully watched.

EUROZONE DATA: Lending To NFCs and Households Accelerates In December

Eurozone lending to households and firms accelerated in December, in a sign that ECB policy rate cuts are slowly being fed through to the real economy. More data will be required for the ECB to judge its policy settings as neutral (rather than restrictive) though, particularly after the Q4 Bank Lending Survey signalled a tightening in firm lending standards and soft firm loan demand expectations for the next 3 months.

- Adjusted for sales and securitisations, lending to firms grew 1.5% Y/Y (vs 1.0% prior), the strongest annual rate since July 2023. Accelerations were seen in Germany, France and Italy, but fell slightly in Spain.

- Household lending ticked up to 1.1% Y/Y (vs 0.9% prior), with all four major Eurozone countries contributing. A pickup in household consumption is a key tenet of the ECB’s projection for economic growth to recover in 2025.

- As a percentage of GDP, the Eurozone credit impulse continues to recover. Looking at the slow moving 12m/12m measure, new lending provided a 0.7% GDP boost in December (vs 0.5% in November). The impulse on a shorter term 3m/3m year ago measure was larger at 1.4% GDP (vs 0.8% prior).

- 3m/3m year ago credit impulse accelerations were seen in Germany, France and Italy.

- Overall M3 money growth was a little softer than expected at 3.5% Y/Y (vs 3.9% cons, 3.8% prior).

- Focus will be on President Lagarde’s commentary around this data and the Q4 BLS at tomorrow’s press conference.