EU HEALTHCARE: Healthcare: Week in Review

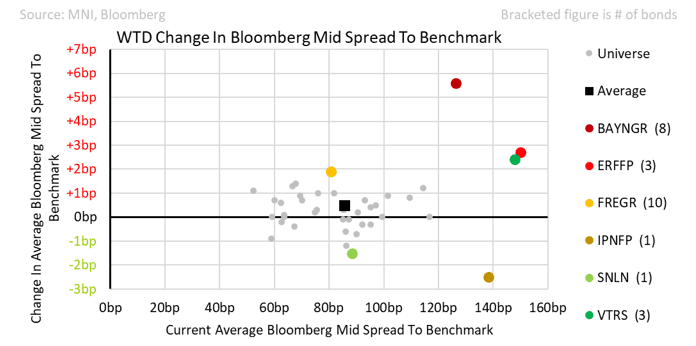

Healthcare was the second-best performer this week, only Real Estate was better. Except for Novo Nordisk, the sector has little to fear from Tariffs and demand is largely non-cyclical. No new issues printed.

• Bayer lost a recent court case in Georgia where a jury awarded $2.1bn in damages. This will be appealed but further reminders of litigation risk are unwelcome for the credit. Last week’s news that the State of Georgia was likely to permit Federal Labelling laws to override local state rules is good but too late for this particular case. In other news, Elliott Management are said to be discussing an activist campaign to gauge interest in Bayer’s Consumer Health Unit. At 3x sales, this could potentially be sold for €18bn. Given that the market cap of Bayer is only €22bn it shows the extent of value destruction due to litigation. We examined the Pharma competitors on an EV/Sales basis and even with Litigation costs considered Bayer is trading on a very low multiple. A vote on Equity issuance will be held on 25th April.

• Fresenius Medical announced a Tender and New Issue mandate. It will print Exp €1bn dual Short 4yr and 7yr with a simultaneous €250m tender for two 2026 bonds.

• Merck & Co was upgraded to Aa3. The curve flattened with he 2054s tightening 4bps.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EUROPEAN INFLATION: MNI Eurozone Inflation Preview - February 2025

Time For Some Progress On Services?

- The Eurozone February flash inflation round is spread across three days, with Spain kicking off proceedings on Thursday (Feb 27), before France, Italy and Germany report figures on Friday (Feb 28). Together, the four major economies should give a good read on price pressures ahead of the Eurozone-wide print on Monday (Mar 3).

- There is not yet a Bloomberg consensus for the Eurozone data, but analyst forecasts compiled by MNI point to a pullback in headline and core inflation to 2.3% (vs 2.5% prior) and 2.6% (vs 2.7% prior) respectively.

- The ECB’s confidence in the 2025 inflation outlook has been predicated on an easing of labour costs which should filter through into lower services inflation readings. In a recent hawkish interview with the FT, ECB Executive Board member Schnabel suggested services inflation “should start to come down in February”. However, analysts only expect a moderate deceleration to 3.8% Y/Y from 3.9% prior.

- The February flash inflation round shouldn’t impact market pricing for the ECB’s March 6 decision, with a 25bp fully priced well embedded into analyst (and presumably policymaker) consensus. However, a lack of progress on core metrics may still leave Q2 pricing vulnerable if hawks’ (led by Schnabel) bargain for a more cautious approach to future easing after a March cut.

US-EU: Euronews: Kallas-Rubio Meeting On Ukraine Cancelled At Short Notice

Jorge Liboreiro at Euronews posts on X: "The expected meeting between [European Commission] High Representative [for Foreign Affairs and Security Policy] Kaja Kallas and [US] Secretary of State Marco Rubio has been cancelled, Euronews has learned. Kallas is already in Washington. She will meet with representatives from Congress and Senate and speak at two different events."

- The missed meeting will come as a further concern for the EU as it fears being shut out of talks involving the US and Russia on ending the war in Ukraine.

- Rubio missed a meeting of EU foreign ministers in late January shortly after his confirmation. Kallas spoke publicly of the invite, with the lack of any response from the State Department viewed as a notable snub.

- The reason for the meeting's cancellation is unclear at present. It may relate to Kallas' comments earlier in the week regarding the alleged 'strength' of the representation of Russia's war narrative in Washington, D.C.

- Kyiv Independent reported "Kallas stressed that no agreement regarding Ukraine or Europe can work without their participation. The EU's top diplomat said she plans to discuss "these and other issues" with Rubio and other officials in the U.S. [...]. Kallas also suggested that "the messages coming out of the U.S." regarding the elections in Ukraine suggest that "the Russian narrative is very strongly represented there."

EUR: EUR Nears Tried-and-Tested Trendline on 15m Candle Chart

- EUR/GBP edges to new daily lows, breaking out of the relatively tight daily range and now tests yesterday's lows at 0.8285, which are holding for now. In similar price action, EUR/USD slipping on a modest pickup in volumes: EUR futures see comfortably the best activity of the day so far on the latest sell-off, with over 2,500 contracts changing hands at 1253GMT/0753ET.

- Importantly, the 15min candle chart shows the pair testing support at the uptrendline drawn off the Feb 3rd AM low of 1.0223. This uptrendline has been tested and has held well on several occasions in the past few weeks - so slippage through here today (last at 1.0474) could well draw focus.