EU HEALTHCARE: Healthcare: Week in Review

The week began with an interview with the new FDA Chief Dr Marty Makary which was less antagonistic toward the industry than some would have feared. Pharma companies will lose the ability to sit on approval committees for new drugs but on the plus side, the speed of approval for Rare Disease treatments is likely to increase. In Europe, the CEOs of Novartis and Sanofi wrote to the FT to pressure the EU to spend more on medicines and to match the US speed of new drug approval.

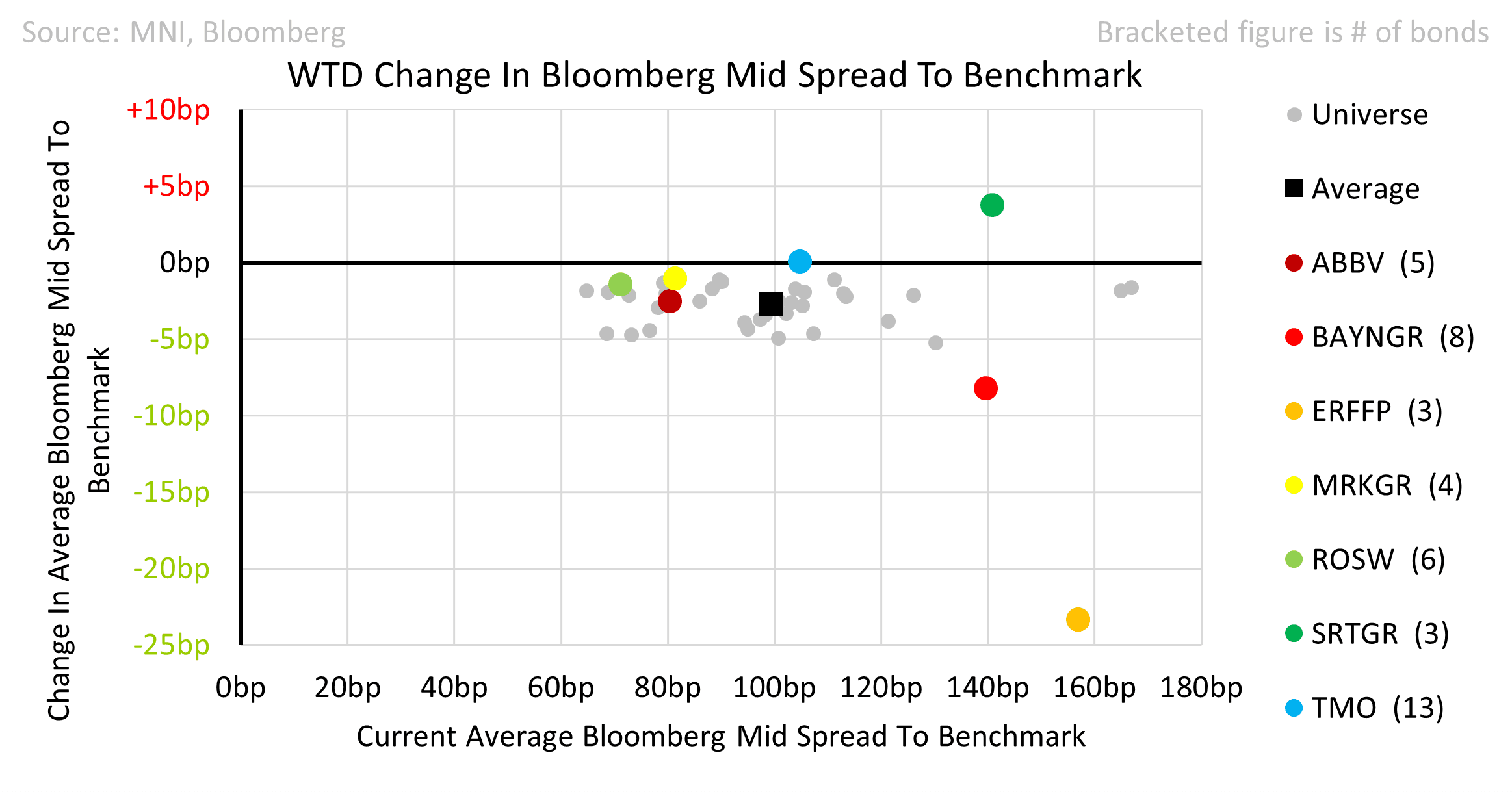

• Eurofins was the outperformer this week, reversing all of the month’s widening. Results came in slightly ahead but importantly the company stated that tariffs would not have a direct material impact.

• Sartorius was cut to BBB- Stable on Friday. S&P run out of patience with the pace of deleveraging but did acknowledge that the business is improving albeit around 1-2 yrs slower than they would have expected. Bonds are +21bps wider Month-to-Date. Similar to Ipsen and Viatris.

• Bayer successfully managed to have Federal labelling judged to override state laws in North Dakota. Somewhat immaterial in the grand scheme but they are attempting to do the same in 11 states so it may bode well

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FED: Minneapolis' Kashkari Eyes "Extended" Wait Before Moving On Policy

Minneapolis Fed President Kashkari (non-2025 FOMC voter but votes in 2026) didn't go deeply into current monetary policy considerations at a "Fed Listens" town hall event. But he did make some comments on inflation and policy uncertainty that were consistent with his thinking last month when he said he expected that rates would be "modestly lower" at end-2025.

- Kashkari on inflation progress: "We've made a lot of progress in bringing inflation down... It's above our 2% target. So we have more work to do. That's a big challenge and we're very focused on that and hopefully we can do that while keeping the job market strong...We're trying to land the plane, so to speak... I think the biggest challenge for us right now is to finish the job, and some of the policy uncertainty ... is complicating our analysis of the economy."

- On the uncertainty of tariff impacts: "tariffs on one hand push up prices a little bit. So maybe that's inflationary ... [with] a higher interest rate path if prices are higher. But then they're also slowing economic activity, which would push down interest rates, all else being equal. I look at those two things and say, okay, just it's kind of a wash. [Let's] just sit where we are for an extended period of time until we get clarity."

- (He had said in early February: "We’re in a very good place to just sit here until we get a lot more information on the tariff front, on the immigration front, on the tax front… I would expect the federal funds rate to be modestly lower at the end of this year").

NOK: O/N ATM EURNOK Vols At Highest Since US Election Night Ahead Of Norges Meet

Current analyst consensus tilts in favour of Norges Bank holding rates at 4.50% tomorrow morning (markets currently price 7bps of easing), a move that would go against guidance for a 25bp cut in March made at both the December and January meetings.

- Although a renewal of inflationary pressures will contribute to a more hawkish rate path relative to December, we don’t think a cut can be ruled out entirely. See more in our preview here

- As such, the immediate market reaction is set to be driven by the rate announcement. Overnight ATM EURNOK vols have moved to their highest since last November’s US election. That sees an ATM straddle expiring at tomorrow’s NY cut requiring a ~60 pip swing to break-even.

- Likely stretched downside positioning in xxx/NOK crosses through March may exacerbate the magnitude of any upside correction in the event of a rate cut. On a 14-day RSI basis, EURNOK is currently at its most oversold since August 2022.

- However, rallies short of the 20-day EMA at 11.5516 will be considered corrective. A push towards this level may require a smaller rate path revision in late-2025/2026 than currently expected in addition to a rate cut.

- Should Norges Bank opt to hold rates at 4.50% and make a larger upward rate path revision than currently expected, this would solidify a bearish theme in EURNOK and expose the June 21 2024 low at 11.2625. Clearance of this level would open up 11.1760 (December 2023 low) on the downside.

Figure 1: EURNOK

EURGBP TECHS: Finds Support

- RES 4: 0.8494 High Aug 26 ‘24

- RES 3: 0.8474 High Jan 20 and a key resistance

- RES 2: 0.8428/8450 High Mar 18 / 11 and the bull trigger

- RES 1: 0.8395 High Mar 24

- PRICE: 0.8369 @ 14:41 GMT Mar 26

- SUP 1: 0.8333 Intraday low

- SUP 2: 0.8321 61.8% retracement of the Mar 3 - 11 bull leg

- SUP 3: 0.8391 76.4% retracement of the Mar 3 - 11 bull leg

- SUP 4: 0.8241 Low Mar 3 and a key support

EURGBP has traded lower this week. However, today’s rally from the intraday low highlights a possible reversal. A strong daily close today would strengthen the bullish significance of today’s bounce. Note that MA studies are in a bull-mode position. This suggests that the pullback from the Mar 11 high, has been a correction. Resistance to watch is 0.8395, the Mar 24 high. Key near-term support lies at 0.8333, today’s intraday low.