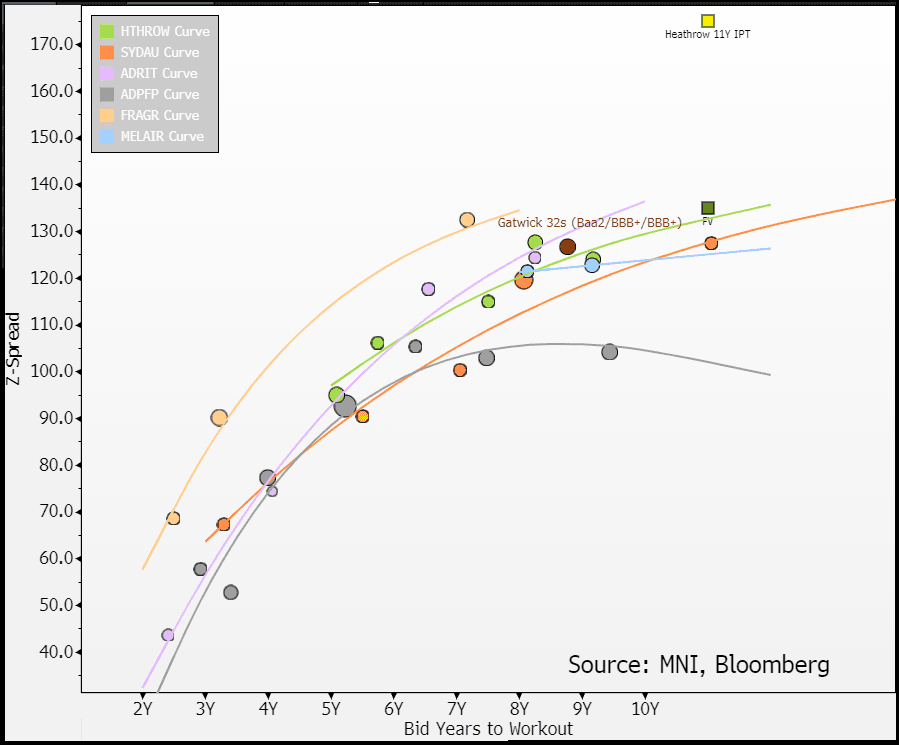

EU TRANSPORTATION: Heathrow 11Y FV (x2)

(HTROW; Class A Opco; NR/BBB+/A-) (private)

- €Bmrk 11Y SLB MS+175-180 vs. FV +135 (-40)

- 7bp pick-up over Sydney Airport 36s (Baa1/BBB+) at FV

- SLB - emission levels measured end of 2030, step-ups applicable from 2033-36 (final 4-years, max 1%=0.25%/yr).

Some ownership changes recently for side-read here - the £2.3b investment is only a uplift of £0.244b from previously planned and CoC should not get triggered (37.6% changing hands is <50%). Gearing ratios (debt against the regulatory asset base) are at 5yr lows but earnings have been flatlining recently on cost inflation. 2/3rd of revenue (FY23) is from airfare charges - it averages the highest rates/passenger which produces the market leading 60-handle EBITDA margins, supporting ratings to hold a higher debt load (levered 7x). Private (unlike ADP & Fraport) but still reports publicly and regularly/quarterly. Unlike Fraport/ADP, Heathrow does not hold stakes in any other airports but it is still similar scale on financials - it is Europe's only airport that makes the global top-10 in traffic.

Relevant pricing from 2024;

- Gatwick (Baa2/BBB+) 9Y at +125 vs. +127 now

- was inaugural €, London's 2nd largest airport

- Sydney Airport (Baa1/BBB+) 8/12Y at +105/+135 vs. +120/+127 now

- Melbourne Airport (Baa1/BBB+) 10.25Y at 128 vs. +123 now

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

MNI EXCLUSIVE: MNI: PBOC To Make Q1 Cut After Stance Shift-Former Officials

MNI looks at the PBOC's first shift in monetary policy stance in 14 years.- On MNI Policy MainWire now, for more details please contact sales@marketnews.com

OUTLOOK: Price Signal Summary - S&P E-Minis Trend Needle Points North

- The S&P E-Minis contract maintains a bullish tone and short-term pullbacks are considered corrective. Recent gains confirm a resumption of the uptrend and signal scope for a continuation near-term. Note that moving average studies are in a bull-mode set-up, highlighting a dominant uptrend and positive market sentiment. Sights are on 6145.26, a 1.236 projection of the Aug 5 - Sep 3 - 6 price swing. Initial support to watch lies at 6014.79, the 20-day EMA.

- EUROSTOXX 50 futures maintain a firmer tone following recent gains. Price has traded through the 50-day EMA, at 4878.04. The clear breach of this average strengthens a bullish theme and note that 4961.00, the Nov 6 high, has also been cleared. This opens 5015.00, the Oct 29 high. Key support is 4699.00, the Nov 19 low. Initial support lies at 4870.94, the 20-day EMA.

SONIA: SOFR - 10/12/24

SOFR FIX - Source BBG/CME

- 1M 4.44652 -0.00543

- 3M 4.39219 -0.00403

- 6M 4.28598 -0.00309

- 12M 4.13085 0.0019