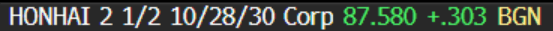

EM ASIA CREDIT: Hon Hai (HONHAI, NR/A-/NR) guides for "significant growth" in Q1

Hon Hai Precision Industries (HONHAI, NR/A-/NR)

- Hon Hai Precision Industries (Foxconn) has released its December revenues update. Importantly they also included a business update for Q1/2025, as quoted below by the company, which looks quite positive with regards to revenues.

"In the first quarter of 2025, overall operations have gradually entered the traditional off-season. Even with record high revenue in the fourth quarter of 2024, the sequential performance of the first quarter will reach roughly similar levels that are average to the past five years; compared with a year ago, it should show significant growth" - Hon Hai

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUSTRALIA: VIEW: Westpac Forecasting Q4 CPI 6-Monthly Rate To Fall Into Band

Westpac is forecasting the November headline CPI to rise 0.4% m/m and 2.2% y/y up from 2.1%, in line with consensus. This release will be important as it includes updates for some services components that are only done once a quarter. Currently it is projecting a 0.2% q/q & 2.4% y/y rise in Q4 CPI with the trimmed mean posting 0.6% q/q and 3.4% y/y, in line with the RBA, but the 2-quarter annualised rate moderating to 2.9% from 3.3%.

- Westpac notes that “with such a mix of rebates, it is not clear how much of the various rebates remain unused in November, in particular, the $1,000 Qld rebate. Therefore, we don’t have a good way to estimate what the possible lift in electricity prices could be in November and so have pencilled in a 2% increase.”

- Westpac estimates that state & federal government electricity rebates will detract 0.35pp from Q4 CPI, which should be offset by increases in holiday-related prices and alcohol & tobacco. It expects headline inflation to trough at 1.9% in Q2 2025.

- Housing is another area to monitor. “Due to the increase in government assistance, rents rose just 0.1% in September and fell –0.3% in October, while the ABS noted that rents would have lifted 0.5% in September and October had it not been for the increase in assistance. We have pencilled in a 0.5% increase in rents in November.”

- “Dwelling prices fell –0.1% in September and rose just 0.1% in October. We suspect that recent changes to the support offered to first home buyers could have suppressed dwelling prices as they are reported in the CPI.”

AUD: A$ Rises As APAC Equities Strengthen

Aussie is generally stronger versus other majors during today’s APAC trading and seems to be driven by regional equity trends. AUDUSD is up 0.1% to around 0.6252, after an intraday high of 0.6254 which followed a low of 0.6237. The US dollar is range trading after Monday’s 0.6% drop.

- AUDUSD looked through the weak November building approvals print which saw the total number fall 3.6% m/m after rising 5.2%.

- The yen is underperforming today leaving AUDJPY 0.4% higher at 98.89, close to the intraday high. AUDNZD is little changed at 1.1066 after a peak of 1.1073. AUDEUR is up 0.2% to 0.6019 and AUDGBP +0.1% to 0.4992 after approaching but not breaching 0.5000.

- Equities are generally stronger with the ASX up 0.2% and CSI 300 +0.2% but the S&P e-mini is flat and Hang Seng down 0.3%. Oil prices are continuing to trend moderately lower with WTI -0.2% to $73.40/bbl. Copper is down slightly and iron ore is lower at around $97/t.

- Later the Fed’s Barkin speaks and US November trade, JOLTS job openings, December services ISM and preliminary December euro area CPI and November unemployment rate are released.

AUSTRALIA DATA: Australia Nov Total Dwellings Approved -3.6%

The November 2024 seasonally adjusted estimate:

- Total dwellings approved fell 3.6%, to 14,998.

- Private sector houses fell 1.7%, to 9,028, while private sector dwellings excluding houses fell 10.8%, to 5,285.

- The value of total residential building fell 0.5%, to $8.36b.

- The value of non-residential building rose 18.4%, to $5.96b.