TURKEY: Household 12-Month Inflation Expectation Unchanged at 59.3%

- The central bank has been funding lenders at a rate of around 48% in recent days, Bloomberg report citing weighted average cost of funding data, higher than the benchmark 46% interest-rate. The rate is likely to help dispel concerns that Turkey’s rate hike earlier this month wouldn’t result in actual policy tightening. That was because the CBRT had been using the overnight lending rate of 46% since the recent political turmoil, but last week it said that it would resume one-week repo auctions – i.e. using its main rate which was raised to 46% – implying no change to the cost of funding despite a 350bp rate hike.

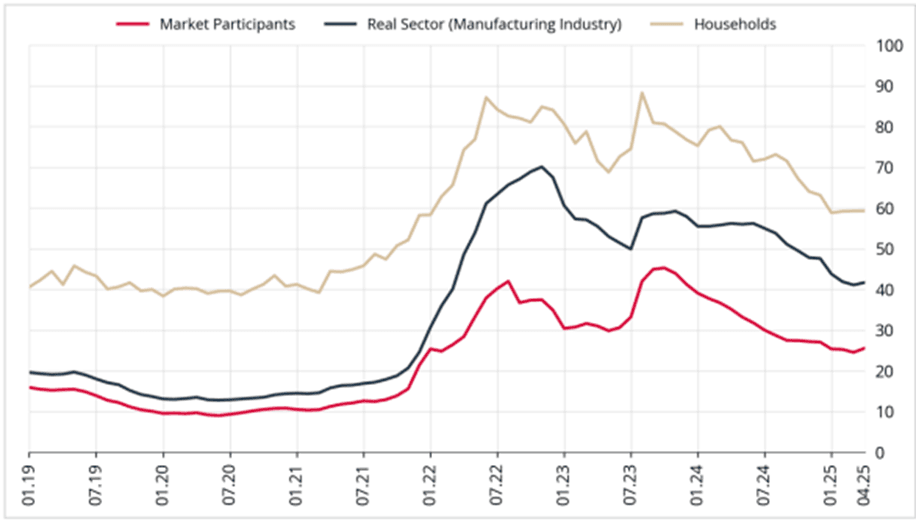

- Turkey's 12-month household inflation expectation was unchanged at 59.3% in April from March, according to the CBRT. Meanwhile, the real-sector's inflation expectation rose to 41.7% from 41.1%. There remains a significant wedge between expectations of households and market participants, with the 12-month ahead expectation for the latter up 1ppt to 25.6% in April.

Chart 1: 12-month ahead inflation expectations (Source: CBRT)

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GILT TECHS: (M5) Approaching The Bear Trigger

- RES 4: 94.00 Round number resistance

- RES 3: 93.79 High Mar 4 and a bull trigger

- RES 2: 93.06 Low Mar 4 and a gap high on the daily chart

- RES 1: 92.00/93.01 20-day EMA / High Mar 20 and a S/T bull trigger

- PRICE: 91.02 @ Close Mar 25

- SUP 1: 90.93 Low Mar 25

- SUP 2: 90.71 Low Mar 6 and a bear trigger

- SUP 3: 90.49 1.618 proj of the Feb 6 - 20 - Mar 4 price swing

- SUP 4: 90.19 1.764 proj of the Feb 6 - 20 - Mar 4 price swing

The short-term trend outlook in Gilt futures remains bearish and recent gains appear to have been a correction. This week’s move lower reinforces a bear theme. Key short-term resistance has been defined at 93.01, the Mar 20 high. A break of this level is required to highlight a bullish condition. For now, attention is on support at 90.71, the Mar 6 low and bear trigger. A break of this level would resume the downtrend.

GOLD TECHS: Northbound

- RES 4: $3106.8 - 2.764 proj of the Nov 14 - Dec 12 - 19 price swing

- RES 3: $3100.0 - Round number resistance

- RES 2: $3079.2 - 2.618 proj of the Nov 14 - Dec 12 - 19 price swing

- RES 1: $3057.5 - High Mar 20 and the bull trigger

- PRICE: $3026.5 @ 07:21 GMT Mar 26

- SUP 1: $2999.5 - Low Mar 18

- SUP 2: $2970.1/2889.7 - 20-day EMA / 50-day EMA

- SUP 3: $2832.7 - Low Feb 28 and key support

- SUP 4: $2758.3 - Low Jan 30

A clear uptrend in Gold remains intact and the yellow metal is holding on to the bulk of its recent gains. Last Thursday’s fresh trend high reinforces the bull theme and sights are on $3079.2 next, a Fibonacci projection. Note that moving average studies remain in a bull-mode position, highlighting a dominant uptrend and positive market sentiment. Support is at $2970.1, the 20-day EMA.

BUNDS: Finding a bid post Cash Open

- It was a tight 12 ticks Overnight session for the German Bund, the contract did gap a few ticks lower on the Overnight Open but this was closed following the UK Inflation data coming a touch below expectations, but Overall some tiny moves in Europe.

- Initial upside of interest is at the Monday's gap of 128.48, then 128.66, but better resistance is still seen towards 128.83.

- The initial support now comes at 127.45.

- It is a lighter day on the front front for Europe with only the Spanish prelim GDP of note. More focus will be on the prelim US Durable Goods this afternoon.

- The main event for the UK is the Spring Statement.

- SUPPLY: Italy €3bn 2027 (equates to 23.6k short 2yr BTP) could weigh, the 2029 linker won't impact the futures.

- Germany 2041, 2046 (equates to 10.8k combined Buxl) could weigh. US sells $28bn 2yr FRN Reopening, and $70bn of 5yr Notes.

- SYNDICATION: Belgium USD Benchmark.

- SPEAKERS: ECB Villeroy, Knot, Cipollone but don't expect anything new until Tariffs are more Concrete. Fed Kashkari and Musalem are also scheduled.

- UK Reeves delivers her Spring statement.