EM ASIA CREDIT: Indonesia (INDON, Baa2/BBB/BBB) intervenes in markets

Indonesia (INDON, Baa2/BBB/BBB)

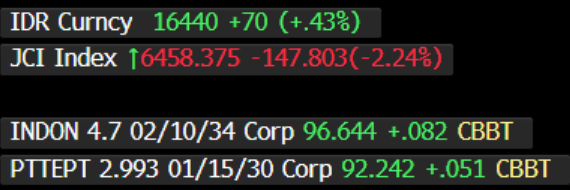

- Indonesian equity markets under pressure today, utilities and banks driving markets lower. In addition, the Bank Indonesia is also stepping in to support the rupiah.

- The timing and size of U.S. Tariffs, and how to respond, are the many known, unknowns that are creating a risky backdrop now.

- In terms of $ govie/agency bonds, the bias today is for tighter spreads, notably for Indonesia and Thailand, which cut rates yesterday.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

SCHATZ TECHS: (H5) Resistance Remains Intact

- RES 4: 107.065 High Jan 2

- RES 3: 106.965 High Jan 3

- RES 2: 106.695 High Jan 21 / 22

- RES 1: 106.692 20-day EMA

- PRICE: 106.545 @ 05:35 GMT Jan 28

- SUP 1: 106.450/435 Low Jan 24 / 15 and the bear trigger

- SUP 2: 106.375 Low Oct 31 (cont) and a key support

- SUP 3: 106.342 2.764 proj of the Dec 2 - 6 - 12 price swing

- SUP 4: 106.255 3.000 proj of the Dec 2 - 6 - 12 price swing

A medium-term bear cycle in Schatz futures remains intact and recent gains appear corrective. The Jan 15 recovery highlighted a short-term reversal and the start of the corrective phase. Key near-term resistance at 106.692, the 20-day EMA, remains intact for now. A break of the EMA would signal scope for a stronger bounce. 106.435, the Jan 15 low has been defined as the bear trigger. Clearance of this level would confirm a resumption of the downtrend.

GBPUSD TECHS: Tests Resistance At The 50-Day EMA

- RES 4: 1.2667 High Dec 19

- RES 3: 1.2610 38.2% retracement of the Sep 26 ‘24 - Jan 13 swing

- RES 2: 1.2576 High Jan 7

- RES 1: 1.2520/23 50-day EMA / High Jan 27

- PRICE: 1.2445 @ 06:00 GMT Jan 28

- SUP 1: 1.2387/2294 20-day EMA / Low Jan 23

- SUP 2: 1.2229 Low Jan 21

- SUP 3: 1.2100 Low Jan 10 and the bear trigger

- SUP 4: 1.2087 0.764 proj of the Sep 26 - Nov 22 - Dec 6 price swing

A bull cycle in GBPUSD remains in play. The pair has cleared the 20-day EMA, marking an extension of the reversal that started Jan 13. Attention is on the 50-day EMA, at 1.2520 and an important resistance. Clearance of the average would highlight a stronger bull cycle. Medium-term trend signals are unchanged, they remain bearish. A reversal lower would refocus attention on 1.2100, the Jan 10 low and bear trigger.

BOBL TECHS: (H5) Monitoring Resistance

- RES 4: 117.820 High Jan 3

- RES 3: 117.627 50-day EMA

- RES 2: 117.490 Low Dec 30

- RES 1: 117.133/180 20-day EMA / High Jan 22

- PRICE: 116.800 @ 05:37 GMT Jan 28

- SUP 1: 116.550/280 Low Jan 24 / Low Jan 14 / 15 and bear trigger

- SUP 2: 116.210 Low Jul 12 2024 (cont)

- SUP 3: 115.980 Low Jul 11 ‘24 (cont)

- SUP 4: 115.745 1.50 proj of the Oct 1 - 31 - Dec 2 ‘24 price swing

A short-term bullish corrective phase in Bobl futures is in play - for now - despite the pullback from its recent highs. The Jan 15 rally highlighted a reversal and the start of the correction. An extension higher would allow an oversold trend condition to unwind. Key short-term resistance is seen at 117.133, the 20-day EMA. On the downside, a break of 116.280, Jan 14 / 15 low, would resume the downtrend.