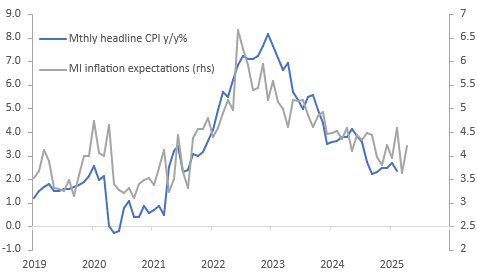

AUSTRALIA DATA: Inflation Expectations Return Above 4%

The Melbourne Institute’s measure of consumer inflation expectations for April rose 0.6pp to 4.2%. March saw a 1pp drop which has now been partially unwound but April is still below February’s 4.6%. They have struggled to hold any moves below 4% though but appear anchored. The cost-of-living remains households’ main concern and the risk to inflation from current global trade tensions may have contributed to the pickup in expectations. On the other hand petrol prices fell at the end of March to their lowest since December. Q1 CPI is released on April 30 and will be a key input into the May 20 RBA decision, which has been clouded by recent US tariff and subsequent market developments.

Australia inflation y/y%

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

CHINA: Central Bank Withdraws Liquidity via OMO.

- PBOC issued CNY37.7bn of 7-day reverse repo at 1.5% during this morning’s operations.

- Today’s maturities CNY38.2bn.

- Net liquidity withdrawal CNY0.5bn.

- The PBOC monitors and maintains liquidity in the interbank market through the daily issuance of reverse repo.

- The CFETS Pledged Repo Deposit Institutions 7 Day Weighted Average is 1.64% from a close of 1.81% yesterday.

- The China interbank overnight repo rate is 1.78% from yesterday’s close of 1.52%.

- The China interbank 7-day repo rate is 1.83% from yesterday's close of 1.82%

CNH: USD/CNY Fixing Steady, Error Term Re-Widens

The USD/CNH fix printed at 7.1741, against a BBG market consensus of 7.2639.

- The fixing error was wider than yesterday's outcome, coming in at -898pips, versus -675pips on Monday.

- The actual fix rose as well, but remains within recent ranges.

- USD/CNH is lower in the first part of Tuesday trade, last near 7.2575, which is close to lows after yesterday's Asia Pac close. Broader USD indices are down thanks to a firmer yen, CHF and EUR levels. CNH is lagging yen and CHF gains though.

JGBS: Sharply Richer With US Tsys, Q4 GDP Revised Down

In Tokyo morning trade, JGB futures are sharply higher, +65 compared to settlement levels, after extending overnight gains.

- Japan's Q4 GDP growth was revised down a touch. The final outcome saw q/q growth at 0.6% (versus 0.7% forecast and initially reported). In annualized terms, growth was 2.2%, also below expectations of 2.8%. Private consumption was revised down to flat, after initially being reported as a modest 0.1% rise. Some offset came from business spending, which was nudged up to 0.6%q/q (from an initial outcome of 0.5%, the market consensus for the revision was 0.4%). Other components weren't changed much. The GDP deflator is slightly stronger at 2.9%y/y.

- Cash US tsys are 5-6bps richer, with a slight steepening bias after yesterday’s robust bull-steepener.

- Cash JGBs are 1-7bps richer across benchmarks, with the futures linked 7-year leading the rally. The benchmark 10-year yield is 5.9bps lower at 1.518% versus the cycle high of 1.584% set yesterday.

- Swap rates are 2-3bps lower. Swap spreads are mostly wider.