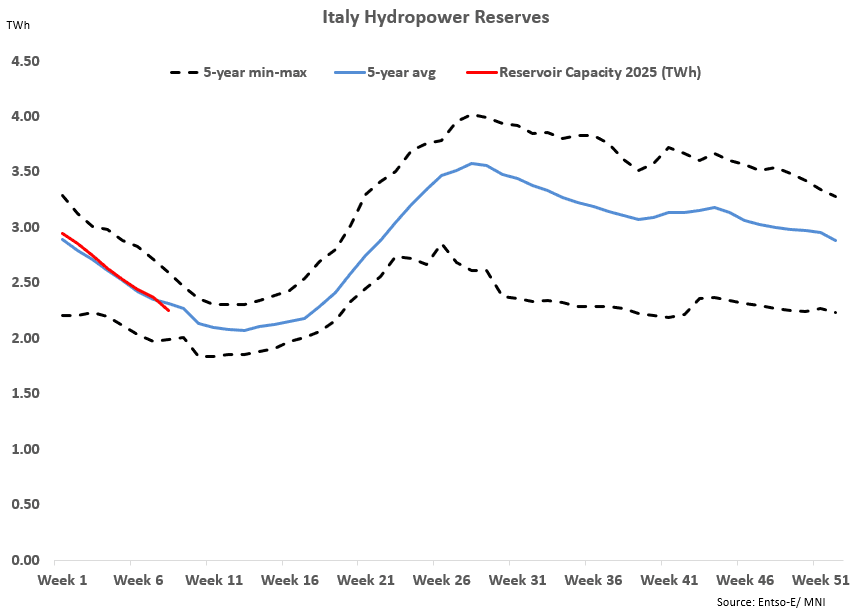

POWER: Italian Hydro Stocks Fall Below Five-Year Average

Italian hydropower reserves last week – calendar week 8 – accelerated the decline to 0.12TWh to 2.25TWh, falling below the five-year average for the first time this year.

- Stocks declined by 0.08TWh the week before.

- Reserves switched to a deficit to the five-year average last week of 0.06TWh, compared with a 0.02TWh surplus the week prior.

- The deficit to 2024 levels also widened to 0.08TWh, from 0.07TWh the week before.

- Power demand in Italy last week edged down to 33.6GW, compared with 33.71GW the week prior.

- There was no precipitation in Torino near Italy’s hydro-intensive region last week, for the fourth consecutive week, hindering inflows into reserves.

- Looking ahead, the latest Bloomberg ECMWF weather forecast for Torino suggests precipitation to total 3.9mm this week – below the 30-year normal of 9mm.

- Mean temperatures in Rome this week are expected be between 10.2C-12.9C, in line with the seasonal average.

- Italy’s hydro balance is forecast to end this week at -4.19TWh. The balance is seen to further narrow to -4.54TWh on 13 March.

Wind generation in Italy for the remainder of this week (Thu-Sun) is forecast relatively low at 743MW to 2.35GW during base-load hours according to SpotRenewables.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EQUITIES: DeepSeek Sell-Off Cemented, Linked Stocks Sit Sharply Lower Pre-Market

Pre-market weakness in both direct and indirectly linked AI names sticks into the cash open - as DeepSeek's success undermines the AI-driven US equity rally.

Pre-market, e-mini S&P off by 2.3%, NASDAQ futs off 3.9%:

- Nvidia shares lower by 11.3%(earnings Feb 26th)

- Meta Platforms lower by 3.8% (earnings on Wednesday)

- Microsoft lower by 6.0% (earnings on Wednesday)

- Tesla lower by 4.3% (earnings on Wednesday)

That primes markets to shed over $700bln in market cap at the open across those four stocks alone. Why is Deepseek different? Deepseek's open-source, free-to-play approach twinned with highly regarded efficiency and accuracy undermines not only the revenue-generating capacity of models produced by OpenAI, Alphabet, Meta and others - but also the significant levels of investment in AI from US firms over the past five years. It also shows the ability of Chinese firms to skirt chip sanctions targeted at limiting their AI capacity.

More here: https://www.mnimarkets.com/articles/deepseek-why-is-this-app-undermining-markets-1737968390827

OPTIONS: Larger FX Option Pipeline

- EUR/USD: Jan28 $1.0400(E1.0bln), $1.0500(E1.2bln)

- USD/JPY: Jan29 Y155.00($1.2bln)

- AUD/USD: Jan28 $0.6300(A$1.5bln)

- USD/CAD: Jan29 C$1.4500($1.1bln)

OUTLOOK: Price Signal Summary - Short-Term Bull Cycle In Gilts Remains Intact

- In the FI space, the pullback from recent highs in Bund futures appears corrective and a short-term bull cycle is in play for now. The Jan 15 rally highlighted a reversal signal - a bullish engulfing candle. It continues to suggest scope for a corrective phase that is allowing an oversold trend condition to unwind. Sights are on 132.15, the 20-day EMA. A clear breach of the average would strengthen the bullish theme. The bear trigger is at 130.28, the Jan 15 low. Initial support lies at 131.00, the Jan 16 / 24 low.

- The medium-term trend condition in Gilt futures remains bearish. However, recent gains continue to highlight a corrective phase and signal scope for a continuation higher near-term. The focus is on 92.75, the 50.0% retracement of the Dec 3 - Jan 13 bear leg. Initial support is at 91.10, the Jan 20 low.