EUROZONE DATA: Jan Credit Data Suggests Restrictiveness Waning, But DE/FR Weak

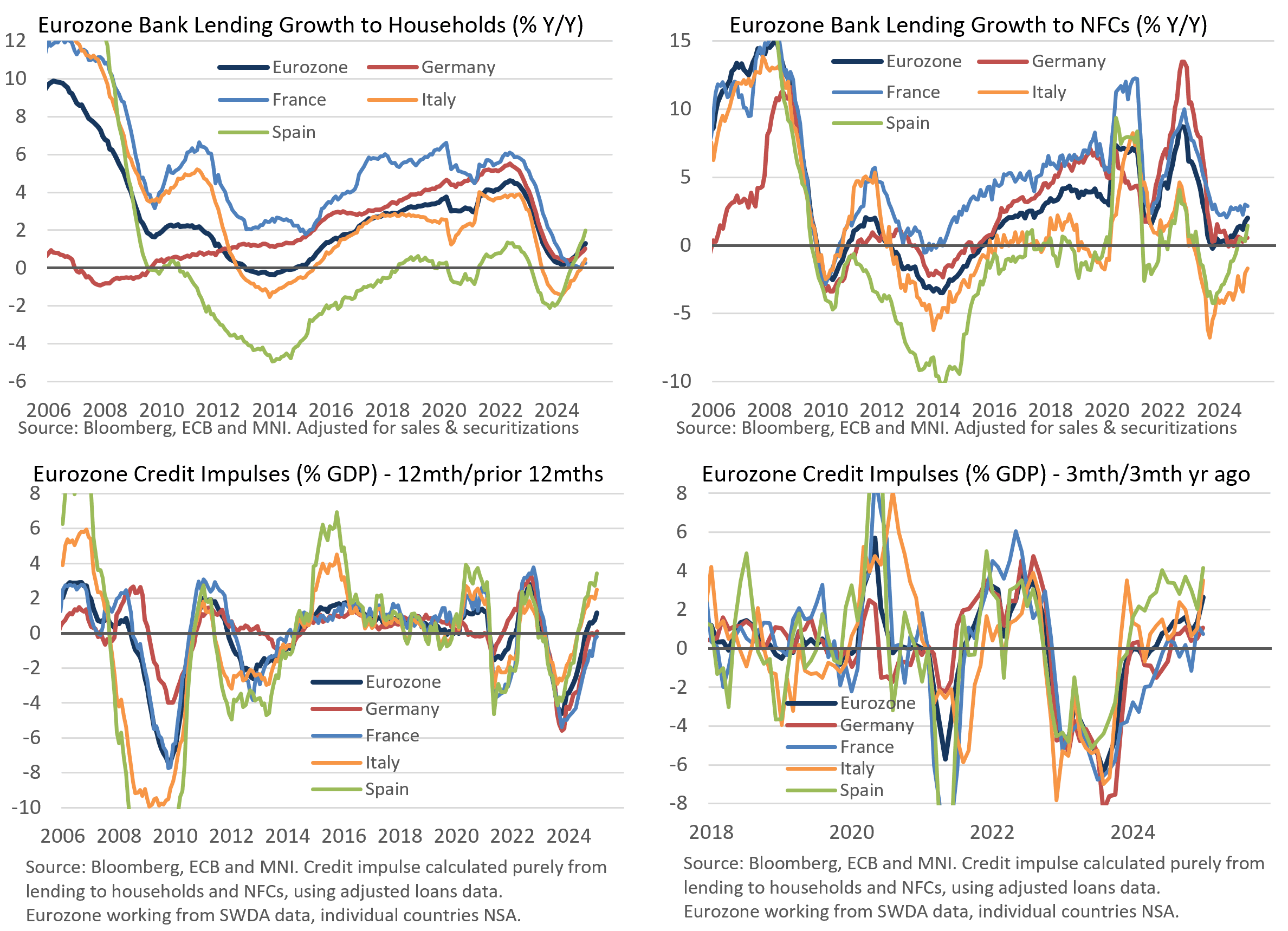

Eurozone lending growth to non-financial corporates (NFCs) and households increased in January, a sign that the restrictiveness of ECB policy is waning. However, accelerations were centred in Italy and (especially) Spain, with German and French growth still relatively subdued. Given the latest Bank Lending Survey signalled a tightening of lending standards alongside increases in loan demand, centrist/dovish policy makers will probably still view financing conditions as tight, with broader economic weakness and tariff uncertainty necessitating additional rate cuts.

- Overall Eurozone lending growth to households rose 1.3% Y/Y (vs 1.1% prior), the highest rate since July 2023. German growth ticked up a tenth to 1.0% Y/Y, while France was steady at 0.3%. Italian (0.5% vs 0.3% prior) and Spanish (2.0% vs 1.5% prior) data saw larger accelerations.

- Lending to NFCs rose three tenths to 2.3% Y/Y, now up form a low of 0.3% in September 2023. This was driven by a 1.2pp increase in Spain to 1.5% Y/Y. Germany was steady at 0.5%, France fell a tenth to 2.9% and Italy rose three tenths to -1.7%.

- The Eurozone credit impulse (on a slow-moving 12m/12m measure) rose 0.4pp to 1.2% of nominal GDP, its highest since November 2022. The credit impulse remains close to zero in Germany and France.

- There was a larger increase in the 3m/3m year ago credit impulse to 2.6% of GDP (vs 1.4% prior).

- Overall M3 money supply growth was a little weaker than expected at 3.6% Y/Y (vs 3.8% cons, a downwardly revised 3.4% prior).

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

COMMODITIES: WTI Futures Through Initial Support at 20-Day EMA

Monday’s move lower in WTI futures marks an extension of the current corrective cycle. The 20-day EMA has been breached and attention turns to support around the 50-day EMA, at $72.16. A clear break of the 50-day average would suggest scope for a deeper retracement. On the upside, a reversal higher would focus attention on $79.48, the Apr 12 ‘24 high and a key resistance. Despite yesterday’s pullback, Gold is trading closer to its recent highs. A bull cycle is in play and the breach of resistance at 2726.2, the Dec 12 high, reinforces current conditions. Sights are on $2790.1, the Oct 31 all-time high. A break of this hurdle would confirm a resumption of the primary uptrend. On the downside, the first key support to watch is $2671.6, the 50-day EMA. A reversal lower and a breach of this average would reinstate a bearish threat.

- WTI Crude up $0.34 or +0.46% at $73.5

- Natural Gas down $0.04 or -1.08% at $3.65

- Gold spot up $3 or +0.11% at $2743.4

- Copper up $2.1 or +0.5% at $425.1

- Silver down $0.12 or -0.4% at $30.09

- Platinum down $2.13 or -0.22% at $947.69

EQUITIES: E-Mini S&P Back Above Key Short-Term Support

A bull cycle in the Eurostoxx 50 futures contract remains intact and the move lower from last Friday’s high, is considered corrective. A deeper retracement would allow an overbought trend condition to unwind. Moving average studies remain in a bull-mode set-up highlighting a dominant uptrend. The first important support to watch is 5097.39, the 20-day EMA. A resumption of the uptrend would open 5298.50, a Fibonacci projection. The S&P E-Minis contract initially traded lower Monday extending the pullback from last Friday’s high. Key short-term support to watch lies at 5961.75, the Jan 16 low (pierced). For now, the move down appears corrective, however, a clear breach of 5961.75 would strengthen a bearish threat and signal scope for a deeper retracement, towards 5943.94, a Fibonacci retracement. Key resistance is 6178.75, the Dec 6 high.

- Japan's NIKKEI closed lower by 548.93 pts or -1.39% at 39016.87 and the TOPIX ended 1.17 pts lower or -0.04% at 2756.9.

- Across Europe, Germany's DAX trades higher by 85.17 pts or +0.4% at 21367.16, FTSE 100 higher by 46.86 pts or +0.55% at 8549.93, CAC 40 up 19.85 pts or +0.25% at 7926.43 and Euro Stoxx 50 up 14.69 pts or +0.28% at 5203.14.

- Dow Jones mini up 14 pts or +0.03% at 44916, S&P 500 mini up 16.5 pts or +0.27% at 6062.25, NASDAQ mini up 107 pts or +0.5% at 21361.5.

ITALY AUCTION PREVIEW: BTP Short Term and BTPei Auction

Italy will hold a BTP Short Term and BTPei auction this morning. The new 2.55% Feb-27 BTP Short Term (ISIN: IT0005633794) will be launched for E2.75-3.00bln. Alongside this, E1.00-1.25bln of the 1.50% May-29 BTPei (ISIN: IT0005543803) and E1.00-1.25bln of the 1.80% May-36 BTPei (ISIN: IT0005588881) will be on offer.

- The launch size of the BTP Short Term is a little smaller than the previous on-the-run 3.10% Aug-26 BTP Short Term, which saw a E3.5bln launch in July last year.

- The four re-openings of this BTP Short Term between August and November attracted an average bid-to-cover ratio of 1.67x, with amounts issued of between E2-2.75bln. The last re-opening attracted a bid-to-cover ratio of 1.81x for the E2bln issued.

- The 2-year BTP/Schatz (using previous on-the-run lines) spread has tightened since mid-January (alongside 10-year counterparts), last at 28.3bps from a closing high of 37bps on Jan 13.

- On Thursday, Italy will hold an auction to sell 5/10-year BTPs and a CCTeu. On offer will be the on the-run 5-year 3.00% Oct-29 BTP alongside two off-the-run BTPs in the 10-year area (following the new 10-year syndication earlier this month) and the Apr-33 CCTeu.

- The 2.55% Feb-27 BTP Short Term will likely be re-opened on Feb 25.

- Timing: Results will be available shortly after the bidding window closes at 10:00GMT / 11:00CET.