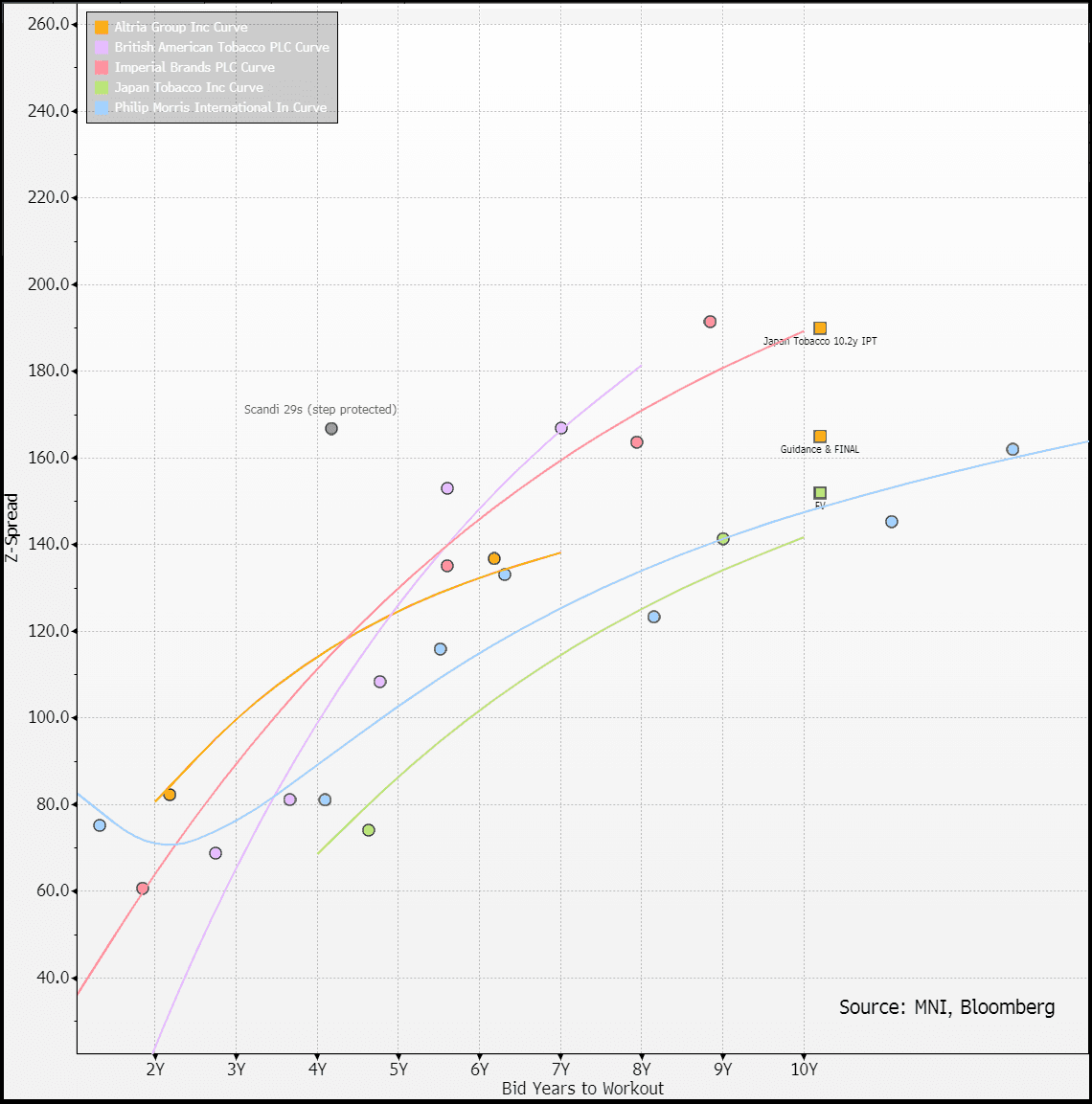

EU CONSUMER STAPLES: Japan Tobacco: FINAL

Apr-10 11:56

(JAPTOB; A2 Stable/A+ Neg) (1/3 gov. owned, no uplift)

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

OUTLOOK: Price Signal Summary - Trend Needle In WTI Points South

Mar-11 11:41

- On the commodity front, Gold is in consolidation mode. The trend condition remains bullish and the recent pullback appears to have been a correction. A stronger rally would refocus attention on $2962.2, a 2.00 projection of the Nov 14 - Dec 12 - 19 price swing. This would also open the $3000.0 handle. On the downside, a resumption of weakness would instead suggest scope for a deeper correction and expose support around the 50-day EMA, at $2826.3. The 50-day average marks a key support.

- In the oil space, a bearish trend condition in WTI futures remains intact and last week’s fresh short-term cycle lows reinforce current conditions. Recent weakness has resulted in a clear breach of support at $70.20, the Feb 6 low. This confirmed a resumption of the downtrend that started Jan 15 and has paved the way for an extension towards $63.61 next, the Oct 10 ‘24 low. Key short-term pivot resistance is seen at $70.36, the 50-day EMA.

BUNDS: USDJPY extends gains

Mar-11 11:38

- USDJPY is helped to session high, taking its cue from the US Tnotes (TYM5) testing session low here.

- Initial support in the contract is seen at 110.21, Yesterday's gap.

- For the USDJPY, Friday's high is situated at 148.20.

GILT SYNDICATION: 1.875% Sep-49 I/L gilt: Allocations out

Mar-11 11:36

- Spread set at 0.125% Aug-48 linker (GB00BZ13DV40) + 1.0bp (Guidance was +1.0/1.5bps)

- Size: GBP5.0bln (larger than the GBP4.0-4.5bln MNI expected) - MNI note: This is the largest ever gilt linker syndication

- Books in excess of GBP67.5bln (inc JLM interest of GBP4bln) - MNI note: That is the largest ever book for a gilt linker syndication

- HR : 90% vs 0.125% Aug-48 linker

- Maturity: 22 September 2049

- ISIN: GB00BT7J0134

- Coupon: 1.875%, long first

- Settlement: 12 March 2025 (T+1)

- JLMs: BofA Securities, J.P. Morgan, Lloyds Bank Corporate Markets (B&D/DM), and UBS Investment Bank

- Timing: Hedge deadline 11:50GMT, pricing later today

From market source / MNI colour