COPPER TECHS: (K5) Corrective Pullback

- RES 4: $560.20 - 3.000 proj of the Jan 2 - 17 - Feb 3 price swing

- RES 3: $549.39 - 2.764 proj of the Jan 2 - 17 - Feb 3 price swing

- RES 2: $540.00 - Round number resistance

- RES 1: $537.40 - High Mar 26

- PRICE: $514.10 @ 14:42 GMT Mar 27

- SUP 1: $493.49/471.15 - 20- and 50-day EMA values

- SUP 2: $451.15 - Low Feb 28

- SUP 3: $422.80 - Low Feb 3 and key support

- SUP 4: $403.85 - Low Jan 2 and a bear trigger

A bull cycle in Copper futures remains in play and this week’s gains reinforce the underlying uptrend. The move higher has resulted in a breach of a major resistance at $519.90, the May 20 ‘24 high on the continuation chart. A clear break of it would reinforce bullish conditions and open $542.70, a Fibonacci projection. Support to watch is $493.49, the 20-day EMA. The latest pullback is likely a correction.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EURIBOR OPTIONS: Call spread vs Put

ERZ5 98.25/98.625cs vs 97.75p, bought the cs for -0.75 in 8k (ref 98.05).

US DATA: New Highs For House Prices At End-2025, But Price Discovery Limited

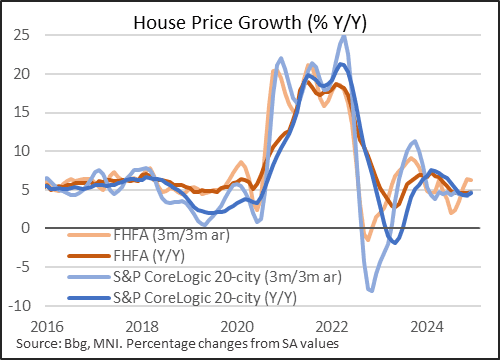

House price gains were steady-to-strong at the end of 2024 according to two of the major aggregate indices.

- The FHFA's index was up 4.7% Y/Y (SA) in December, roughly within the range of the previous five months, albeit with some sign of momentum picking up toward year-end (6.3% 3M/3M annualized).

- The S&P CoreLogic 20-city index showed similar dynamics, up 4.5% Y/Y in December, putting the 3M/3M annual rate at 4.7%.

- As such prices ended 2024 at fresh seasonally-adjusted highs, up over 50% from pre-pandemic levels.

- Of course, this comes alongside some of the lowest transaction volumes for decades for existing home sales, with no imminent sign of activity turning higher.

- That means that price discovery in the housing market has been limited. That could change if unemployment picks up sharply or if mortgage rates start coming down.

GILTS: Underpinned Alongside Tsy Bid, Outperfroming Bunds

Fresh demand for core global FI markets during the NY morning has underpinned gilts, with futures trading to fresh session highs of 93.17.

- Bulls now eye the Feb 13 high (93.50). a break there would reintroduce some momentum to the bullish technical cycle.

- Futures roll activity continues to prop up volumes, latest estimates point to ~77% roll completion ahead of Thursday’s first notice for H5.

- Yields now 6-7bp lower across the curve, 5s outperform.

- UK paper lags the bid in Tsys but comfortably outperforms Bunds across the curve given the prospect of increased fiscal spending in Germany.

- Little of note in terms of market-moving UK news.

- GBP STIRs trade in sympathy with the bid in wider core global FI.

- BoE-dated OIS moves to price ~57bp of cuts through year-end vs. ~52bp late yesterday, but that contract sticks comfortably within the multi-week range.

- SONIA futures flat to +7.0