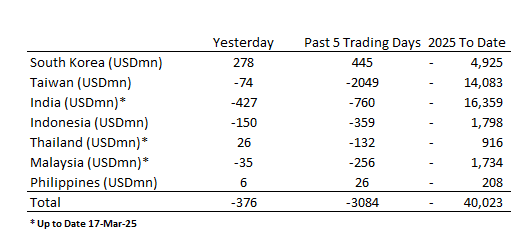

ASIA STOCKS: Korean Inflows Continue.

South Korea recorded a third successive day of inflows as outflows dominated elsewhere.

- South Korea: Recorded inflows of +$278m yesterday, bringing the 5-day total to +$445m. 2025 to date flows are -$4,925m. The 5-day average is +$89m, the 20-day average is -$172m and the 100-day average of -$113m.

- Taiwan: Had outflows of -$74m yesterday, with total outflows of -$2,049 m over the past 5 days. YTD flows are negative at -$14,083m. The 5-day average is -$410m, the 20-day average of -$590m and the 100-day average of -$208m.

- India: Saw outflows of -$427m as of the 17th, with a total outflow of -$760m over the previous 5 days. YTD outflows stand at -$16,359m. The 5-day average is -$152m, the 20-day average of -$288m and the 100-day average of -$197m.

- Indonesia: Posted outflows of -$150m yesterday, bringing the 5-day total to -$359m. YTD flows are negative at -$1,798m. The 5-day average is -$72m, the 20-day average is -$62m the 100-day average of -$35m.

- Thailand: Recorded inflows of +$26m yesterday, totaling -$132m over the past 5 days. YTD flows are negative at -$916m. The 5-day average is -$26m, the 20-day average of -$38m the 100-day average of -$19m.

- Malaysia: Experienced outflows of -$35m as of 17th, contributing to a 5-day outflow of -$256m. YTD flows stand at -$1,734m. The 5-day average is -$51m, the 20-day average of -$45m the 100-day average of -$33m.

- Philippines: Saw inflows of +$6m yesterday, with net inflows of +$26m over the past 5 days. YTD flows are negative at -$208m. The 5-day average is +$5m, the 20-day average of -$3m the 100-day average of -$7m.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

ASIA STOCKS: Chin & Hong Kong Equities Edges Higher On DeepSeek Optimism

Chinese and Hong Kong stocks are extending their recent rally, driven by AI optimism and tech momentum. DeepSeek’s breakthroughs in AI have fueled bullish sentiment, with major players like Tencent, Alibaba Health, and Ping An Healthcare surging. Tencent jumped 7.8% as its Weixin app began beta testing with DeepSeek, while healthcare AI stocks soared on expectations of improved margins and efficiency.

- Strategists at Goldman Sachs, Morgan Stanley, and JPMorgan have turned increasingly bullish on Chinese equities, forecasting further gains. Hong Kong’s options market is seeing record trading volumes, as investors pile into tech and EV bets, pushing the Hang Seng Tech Index to its highest level since 2022, with the Index up 0.40% today.

- Meanwhile, geopolitical concerns remain a headwind, with US tariffs and trade tensions in focus. The HSI Volatility Index has jumped 5pts in February, reflecting renewed market swings. However, the shift in sentiment post-DeepSeek suggests China’s tech sector is now viewed as a legitimate competitor in the AI race, attracting fresh investor flows.

- Key benchmarks in the region are currently: HSI +0.60%, HS China Enterprise +0.50%, HS Property, +1%, CSI 300 +0.10%, CSI 2000 +1.65%, while the Nasdaq Golden Dragon Index rose 2.27% on Friday.

CHINA PRESS: Central Huijin To Become Shareholder Of Five Financial SOEs

Several Chinese financial institutions announced plans to transfer shares to Central Huijin Investment to make the sovereign fund company a controlling shareholder, Economic Information Daily reported. Among the five, three are national asset management companies, including China Cinda, China Orient and China Great Wall, as well as China Securities Finance and China Agricultural Reinsurance. The transfer of equity aims to optimise the governance structure of state-owned financial institutions, strengthen the centralised management of state-owned capital and the ability to integrate resources, and avoid deviating from their core business, the newspaper said citing Zeng Gang, director of the Shanghai Institution For Finance and Development.

CHINA PRESS: Household Credit Demand Remain Weak

Residents’ credit demand remained weak in January despite corporate activity driving new yuan loans to a record high of CNY5.13 trillion, Yicai.com reported, citing analysts. While enterprise loans increased by CNY920 billion when compared to Jan 2024, household loans saw a year-on-year decrease of CNY536 billion, mainly due to mediocre home sales, while the reduction in outstanding mortgage rates also significantly reduced demand for business loans to replace mortgages, Yicai said citing Huaxi Securities analyst Xiao Jinchuan.