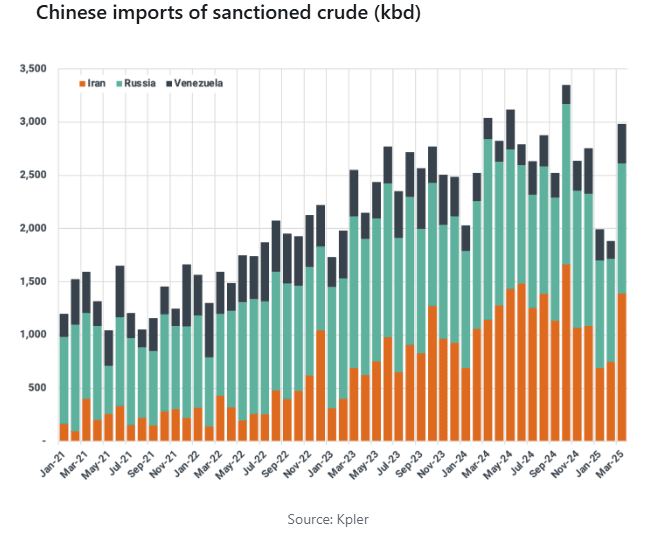

OIL: Kpler Sees 50% Probability of US–Iran Talks Breakthrough

Apr-23 15:58

Kpler sees a 50% probability of a breakthrough in US–Iran negotiations following a second round of talks last weekend with potential for substantial implications for commodity flows.

- Approximately 97% of Iranian crude is purchased by China, with the majority going to its Shandong private “teapot” refiners.

- If no deal is reached, and no military action, then Iranian crude production and exports are expected to drop 500 kb/d by summer. Chinese teapot refiners may reduce Iranian purchases under increasing pressure from US sanctions, threatening reduced refinery runs and tighter global supply.

- A renewed nuclear agreement would stabilize exports around 1.65 mb/d with a potential 100 kb/d increase and Iranian crude discount margins would narrow. India could resume purchases while additional demand possible from Northeast Asia and the European Mediterranean.

- Iranian crude exports could collapse in a highly speculative event of a military escalation due to US strikes on vital infrastructure like Kharg Island. A third of global seaborne crude exports would be at risk from cuts to Shandong refinery run rates or blockading the Strait of Hormuz. Exports via the alternative Jask terminal would not compensate with operational capacity just 300 kb/d.

Source: Kpler

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US STOCKS: Midday Equities Roundup: Risk-On as Tariffs Turn Targeted

Mar-24 15:46

- Stocks are firmer ahead midday, risk sentiment improving as the Trump administration's universal tariff plans take a narrower focus ahead of the April 2 "Liberation Day" implementation. Currently, the DJIA trades up 550.62 points (1.31%) at 42531.49, S&P E-Minis up 90.25 points (1.58%) at 5808.5, Nasdaq up 343.5 points (1.9%) at 18127.15.

- Consumer Discretionary and Information Technology sectors outperformed in the first half, retail buyers helping Tesla rally over 9%, outperforming other Discretionary sector shares: Deckers Outdoor +5.85%, Darden Restaurants +4.66%, Ralph Lauren Corp +4.16%, Royal Caribbean Cruises+3.95% and DoorDash +3.87%.

- Semiconductor makers buoyed the Tech sector in the first half as AI demand for high performance chips continued: Advanced Micro Devices +6.42%, ON Semiconductor +5.46%, NXP Semiconductors +5.31% and Palantir Technologies +5.21%.

- On the flipside, Utilities and Consumer Staples underperformed ahead midday, water and independent energy providers weighed on the former: AES Corp -1.99%, NextEra Energy -0.75%, American Water Works -0.69% and CenterPoint Energy -0.62%.

- Meanwhile, Consumer Staples weighed by food producers & distributors: Hormel Foods -1.93%, Brown-Forman -1.44%, Kraft Heinz -1.20% and Dollar General -0.85%.

FED: US TSY 13W BILL AUCTION: HIGH 4.190%(ALLOT 78.18%)

Mar-24 15:32

- US TSY 13W BILL AUCTION: HIGH 4.190%(ALLOT 78.18%)

- US TSY 13W BILL AUCTION: DEALERS TAKE 29.14% OF COMPETITIVES

- US TSY 13W BILL AUCTION: DIRECTS TAKE 8.23% OF COMPETITIVES

- US TSY 13W BILL AUCTION: INDIRECTS TAKE 62.63% OF COMPETITIVES

- US TSY 13W BILL AUCTION: BID/CVR 2.96

FED: US TSY 26W BILL AUCTION: HIGH 4.085%(ALLOT 8.07%)

Mar-24 15:32

- US TSY 26W BILL AUCTION: HIGH 4.085%(ALLOT 8.07%)

- US TSY 26W BILL AUCTION: DEALERS TAKE 20.74% OF COMPETITIVES

- US TSY 26W BILL AUCTION: DIRECTS TAKE 5.58% OF COMPETITIVES

- US TSY 26W BILL AUCTION: INDIRECTS TAKE 73.68% OF COMPETITIVES

- US TSY 26W BILL AUCTION: BID/CVR 3.27