SWITZERLAND DATA: Labour Market Remains On Solid Footing Ahead Of SNB

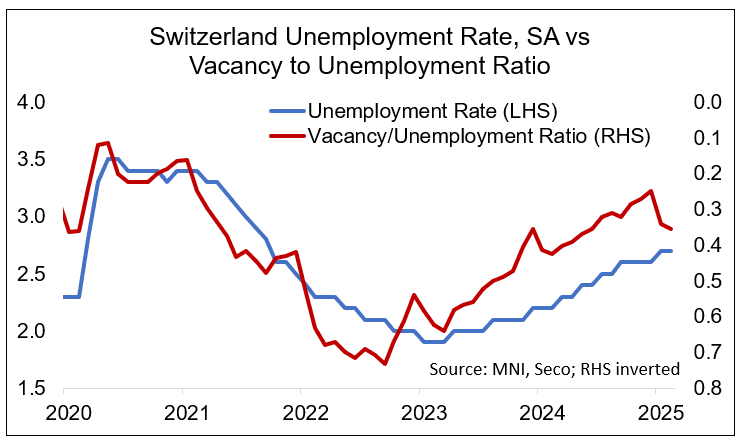

The Swiss labour market continued its trajectory on a solid basis in February, with the seasonally-adjusted unemployment rate, as expected, remaining at 2.7%, amid the number of unemployed ticking up only slightly. On the demand side, vacancies extended their jump seen in January, resulting in the vacancy / unemployment ratio (V/U ratio) increasing back to levels last seen in mid-2024 (after which it drifted upwards).

- This means that the labour market should likely not be of major concern for the upcoming SNB meeting on March 20.

- Specifically, the number of unemployed ticked up 1.6% M/M in February (vs 1.1% Jan), while vacancies saw a +5.6% M/M increase following Jan's +38.6% (all seasonally-adjusted; SECO did not comment further on the jump in last month's press release, which was broad-based across regions - the jump still appears a bit questionable).

- This brings in the V/U ratio to 0.36 in February - slightly higher than January's 0.34 but lower than the 0.42 seen a year ago.

Following the release of the data, markets continue to price around a 90% implied chance of a 25bp move at the upcoming SNB meeting after having moved a bit hawkish following yesterday's stronger-than-expected core CPI and the moves seen in broader European STIR markets. We think however that the core surprise came from categories the SNB has put less focus on in recent history - see our full verdict from the data here.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

SILVER TECHS: Trading At Its Recent Highs

- RES 4: $34.903 - High Oct 23 and the bull trigger

- RES 3: $33.125 - High Nov 1

- RES 2: $32.338 - High Dec 12 and a key resistance

- RES 1: $31.737 - High Jan 30

- PRICE: $31.479 @ 08:05 GMT Feb 4

- SUP 1: $29.704/28.748 - Low Jan 27 / Low Dec 19 and bear trigger

- SUP 2: $28.446 - 76.4% retracement of the Aug 8 - Oct 23 bull cycle

- SUP 3: $27.686 - Low Sep 6

- SUP 4: $26.451 - Low Aug 8

Silver continues to trade at its recent highs. A bear cycle that started on Oct 23 last year remains in play and recent gains are considered corrective. However, the latest move higher does suggest scope for a continuation near-term. An extension would expose key resistance at $32.338, the Dec 12 high. Clearance of this level would highlight a reversal. Support to watch is $29.704, the Jan 27 low, and $28.748, the Dec 19 low and the bear trigger.

USDCAD TECHS: Trend Structure Remains Bullish

- RES 4: 1.5000 Psychological round number

- RES 3: 1.4948 High Mar 2003

- RES 2: 1.4814 High Apr 2003

- RES 1: 1.4600/1.4793 Round number resistance / High Feb 3

- PRICE: 1.4435 @ 08:03 GMT Feb 4

- SUP 1: 1.4398 20-day EMA

- SUP 2: 1.4290 50-day EMA

- SUP 3: 1.4261 Low Jan 20 and a key support

- SUP 4: 1.4178 High Nov 6 ‘24

USDCAD traded sharply higher Monday, before reversing lower into the close. Despite the pullback, Monday’s gains reinforce and strengthen bullish conditions. The break higher has confirmed a resumption of the uptrend and sets the scene for a climb towards 1.4814 next, the Apr 2003 high. Moving average studies remain in a bull-mode position highlighting a dominant uptrend. Initial firm support to watch is 1.4398, the 20-day EMA (pierced).

GILTS: Opening calls

Gilt calls, 92.70/92.74 range.