EM LATAM CREDIT: Latin America Medium Beta Sovereign Bond Commentary

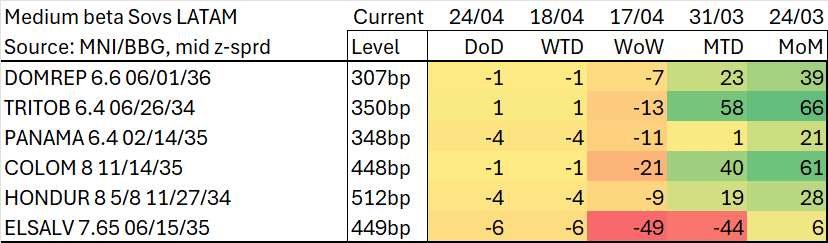

Amid a rallying market, El Salvador outperformed WoW as a relatively high yielding name with an improving credit profile. Colombia was next in line, tightening 21 bps, recovering from indigestion after absorbing USD3.8bn of fresh bond supply the previous week. Notably, Colombia was still one of the weakest performers in the sovereign space MTD with oil prices still down 11% in just the past few weeks from USD71 for WTI, last at USD63. Trinidad and Tobago (TRITOB) widened 66 bps MTD, likely for that same reason.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

OPTIONS: US Options Roundup - Mar 26

Wednesday's U.S. rates options flow included:

- SFRZ5 95.62/95.37ps, bought for 1.75 in 60k total (pit and screen)

- SFRM5 95.50p, bought for half in 20k

EURGBP TECHS: Finds Support

- RES 4: 0.8494 High Aug 26 ‘24

- RES 3: 0.8474 High Jan 20 and a key resistance

- RES 2: 0.8428/8450 High Mar 18 / 11 and the bull trigger

- RES 1: 0.8395 High Mar 24

- PRICE: 0.8365 @ 16:47 GMT Mar 26

- SUP 1: 0.8333 Low Mar 26

- SUP 2: 0.8321 61.8% retracement of the Mar 3 - 11 bull leg

- SUP 3: 0.8391 76.4% retracement of the Mar 3 - 11 bull leg

- SUP 4: 0.8241 Low Mar 3 and a key support

EURGBP has traded lower before a mid-session rally. Wednesday’s strength off the intraday low highlights a possible reversal. A strong daily close Wednesday would strengthen the bullish significance of today’s bounce. Note that MA studies are in a bull-mode position. This suggests that the pullback from the Mar 11 high, has been a correction. Resistance to watch is 0.8395, the Mar 24 high. Key near-term support lies at 0.8333, today’s intraday low.

COMMODITIES: Crude Climbs, Copper Extends Gains Amid Tariff Threat

- Crude prices are trading higher today amid signs of rising tensions in the Middle East. Supply-side risks remain from increased US sanctions against Iran and tariff threats for countries importing Venezuelan oil.

- WTI May 25 is up by 1% at $69.7/bbl.

- Despite recent gains, a bearish trend condition in WTI futures remains intact. However, a key pivot resistance at $69.14, the 50-day EMA, has been pierced. A clear breach of this hurdle would strengthen a bullish theme and open $70.98, the Feb 25 high.

- For bears, a reversal lower would expose the bear trigger at $64.85, the Mar 5 low.

- Meanwhile, copper has risen further today amid reports that US tariffs on copper imports could be coming earlier than expected, within the next several weeks.

- Copper is currently up by 0.5% at $523/lb, having reached a record high at $537 earlier in the session.

- While copper prices are technically overbought, history shows they can tolerate extended periods of stronger prices for a longer duration than the current rally.

- From a technical perspective, a bull cycle in copper futures remains in play, with price testing resistance at $537.30, the 2.5 projection of the Jan 2 - 17 - Feb 3 price swing earlier. A break of this level would open round number resistance at $540 next.

- Spot gold is unchanged today at $3,019/oz, as the yellow metal consolidates below last week’s record high at $3,057.

- A clear uptrend in gold remains intact, with sights on $3,079.2 next, a Fibonacci projection.