EM ASIA CREDIT: Lenovo (LENOVO, Baa2/BBB/BBB) affirmed by Fitch

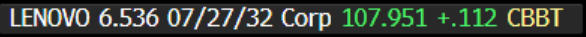

Lenovo (LENOVO, Baa2/BBB/BBB)

"*Fitch Affirms Lenovo at 'BBB'; Outlook Stable" - BBG

- In summary, Fitch states that the companies diversified demand drivers, including upgrades related to new Windows requirements, growing emerging markets and China trade-in subsidies will reduce tariff risks relates to U.S. Tariffs.

- Lenovo generates around 20-25% of group revenues in the U.S., and we wouldn't be surprised to see a reduction in demand, but ultimately expect this to be temporary.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

BTP TECHS: (H5) Resistance Remains Intact For Now

- RES 4: 122.85 High Dec 11

- RES 3: 120.98 61.8% retracement of the Dec 11 - Jan 13 bear leg

- RES 2: 120.45 High Jan 2

- RES 1: 119.75 50-day EMA

- PRICE: 119.02 @ Close Jan 29

- SUP 1: 118.27/117.16 Low Jan 16 / 13 and the bear trigger

- SUP 2: 116.59 76.4% retrace of the Jun - Dec ‘24 bull cycle (cont)

- SUP 3: 116.07 Low Jul 8 ‘24 (cont)

- SUP 4: 115.45 Low Jul 3 ‘24 (cont)

Recent gains in BTP futures highlight a corrective phase. The 20-day EMA has been breached and this exposes the next firm resistance at 119.75, the 50-day EMA. Clearance of the 50-day average would strengthen a bullish condition. The medium-term trend condition remains bearish and the pullback from the Jan 22 high may be an early reversal signal. The bear trigger has been defined at 117.16, the Jan 13 low.

BUNDS: A big spike in Equities

- The German Bund traded in a super tight 9 ticks range overnight, Data release fully picks up as of Tomorrow, so plenty to take in still.

- Early questions are on the spike higher in Equities, this is led by the ASML earnings that saw a beat in early trade, so focus will be on the cash open in under an hour, we could be set for record highs!

- For the German Bund, the contract has seen a tiny upside gap during the Overnight open, this is closed, support remains at the 131.33 gap which held Yesterday.

- The 20 day EMA is down to 132.04, but better resistances are still eyed at 132.22 and 132.57.

- Today sees the Spanish prelim GDP and the US prelim Wholesales, but the Data calendar is packed on Thursday/Friday.

- The main focus is on the Expected unchanged FOMC rate later today.

- SUPPLY: UK £3bn 2033 (equates to 19.4k Gilt) could weigh given the much lower liquidity in early trade. German €4.5bn Bund (Equates to 37k Bund) again could weigh on the lower early traded Volumes.

- SPEAKERS: BoE Bailey, Nathanaël Benjamin, Liz Oakes and Colette Bowe at the Treasury committee, Fed Powell's presser.

EURJPY TECHS: Outlook Remains Bullish

- RES 4: 165.43 High Nov 8

- RES 3: 164.90 High Dec 30 and a key short-term resistance

- RES 2: 164.55 High Jan 7

- RES 1: 164.08 High Jan 24

- PRICE: 162.00 @ 07:00 GMT Jan 29

- SUP 1: 160.96/159.73 Low Jan 21 / 17 and key short-term support

- SUP 2: 159.51 61.8% retracement of the Dec 3 - 30 bull cycle

- SUP 3: 158.67 Low Dec 11

- SUP 4: 158.24 76.4% retracement of the Dec 3 - 30 bull cycle

Despite the latest pullback, EURJPY continues to trade closer to last week’s highs. Resistance at 162.89, the Jan 15 high, has been breached. This undermines a recent bearish theme and highlights scope for an extension higher near term, towards key resistance at 164.90, the Dec 30 high. Key short-term support lies at 159.73, the Jan 17 low. A reversal lower and a break of this level would reinstate the recent bearish threat.