GERMAN DATA: Limited Signs Of Chinese Trade Diversion Deflationary Impact in PPI

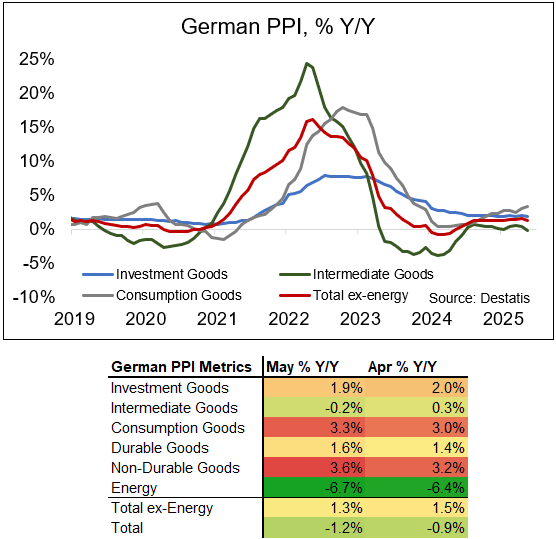

German PPI fell to -1.2% Y/Y in May, inline with consensus expectations and a lower rate compared to April's -0.9% Y/Y.

- Consistent with German CPI in May, energy deflation saw relatively little change in May, at -6.7% Y/Y (vs -6.4% prior).

- That leaves ex-energy PPI also lower vs April, at 1.3% Y/Y - broadly in line with yearly rates seen ever since August 2024.

- Looking at the non-energy categories, intermediate goods arguably are in the focus currently following potential Chinese trade diversion into the EU, and the category indeed saw its lowest yearly rate since June 2024 at -0.2%. On a 3m/3m basis, intermediate goods PPI was unchanged at -0.6% in May, however.

- Eurozone trade data indicated that at least up until April, China trade diversion was only notable in pharmaceuticals - a detailed look at that data indicates this is unlikely to be troubling from a disinflation angle.

- The ECB has been listing such potential re-routing of excess supply as a downside risk to inflation since US tariff policies first emerged although its magnitude appears a point of contention on the Governing Council.

- Recall that ECB's Schnabel reiterated on June 12 in a slide deck that "trade diversion from China to the EU is expected to be limited". Previously, speaking on June 7 she said "I would argue that this effect is actually quantitatively quite small."

- See also our note from earlier this month on "No Clear Signs Of Chinese Trade Diversion Into EU In May" looking at Chinese data.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US: Johnson Makes Progress On Big Beautiful Bill, Rules Hearing In Progress

House Speaker Mike Johnson (R-LA) appears to have struck tentative agreements with conservatives and SALT Republicans to unlock support for a final vote on the ‘One Big Beautiful’ reconciliation bill as soon as today.

- According to Politico, Johnson struck a “tentative deal late Tuesday to boost the cap on SALT deductions to $40,000” – an offer Politico notes conservatives “appear willing to swallow”.

- Politico adds that Johnson’s team is working to accelerate the phase-out of clean energy tax credits in the Biden-era Inflation Reduction Act, as a sweetener to conservatives.

- Both concessions, likely to facilitate the bill’s progression through the House Rules Committee, were flagged as probable in yesterday’s MNI US Daily Brief.

- The breakthroughs came after President Donald Trump addressed the House Republican conference yesterday, browbeating moderates and conservatives to accept offers on the table.

- A final revised bill text is expected to be released at some point during the ongoing House Rules meeting, which gavelled in at 01:00 ET 06:00 BST. Later today, the panel is expected to vote to discharge it to the floor. Hardline conservatives no longer hold a veto on the panel, so they cannot block the bill without support from moderate committee members. As Johnson is using ‘same day authority’, he can hold a full vote on the House floor as soon as today.

- CBO Director Philip Swagel confirmed in a letter to Democrats yesterday that analysis of “most, but not all, provisions of the bill” shows “an increase in the federal deficit of $3.8 trillion”.

OPTIONS: Sizeable EUR Strikes Could Contain Range into NY Cut

FX options set to expire at tomorrow's cut include sizeable strikes in EUR/USD that could encourage range-play, while lumpier notional rolls off in GBP/USD on Thursday, after tomorrow's consequential CPI print. Full list here:

Expiries for May21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1140-50(E1.3bln), $1.1200(E809mln), $1.1250(E1.1bln), $1.1270(E500mln), $1.1390-05(E2.1bln)

- USD/JPY: Y142.00($878mln), Y144.50($610mln)

OPTIONS: Larger FX Option Pipeline

- EUR/USD: May22 $1.1175(E1.9bln); May23 $1.1145-50(E1.1bln), $1.1180-85(E1.1bln), $1.1300(E1.0bln), $1.1330-50(E1.3bln), $1.1400(E1.1bln)

- USD/JPY: May23 Y144.00($1.5bln), Y145.00($2.0bln); May26 Y150.00($1.8bln)

- GBP/USD: May22 $1.3260-70(Gbp1.5bln)

- USD/CAD: May22 C$1.4050($1.3bln); May23 C$1.4000-15($1.2bln); May26 C$1.4000-15($1.2bln)

EGBS: Bund Futures Through Support; Core FI Weakness Broad-based

Bearish momentum remains intact with Bunds through previously identified support at 129.71, currently -61 ticks at 129.63. Key short-term support has been defined at 129.13, the May 15 low.

- Although the UK April CPI report was stronger-than-expected, Bund weakness gathered momentum from the European cash open, without an obvious headline driver. There hasn’t been an obvious fundamental driver of the wider core FI weakness.

- German yields are 3-6bps higher today, with 10s underperforming in the lead-up to today’s E4bln 10-year Bund auction (results were published at 1030BST). Cover ratios were much healthier than the previous outing in April.

- European equity sentiment has been soft, prompting a widening of 10-year peripheral spreads to Bunds. The BTP/Bund spread has moved back away from the 100bps handle, currently at 102bps.

- Today’s regional data calendar has been light, but there are several ECB speakers scheduled. At an MNI event this morning, Kazak’s said that “If the current baseline holds, we will soon reach the terminal rate”. He has previously suggested that a June cut is quite probable.

- Centeno, Lane and Escriva are scheduled later, with Lane speaking on “Negative interest rates and the impact of monetary policy”.

- Focus remains on tomorrow’s May flash PMIs and Friday’s Q1 negotiated wages data.