SWITZERLAND DATA: Little Pressure For Outsized SNB Moves From External Sector

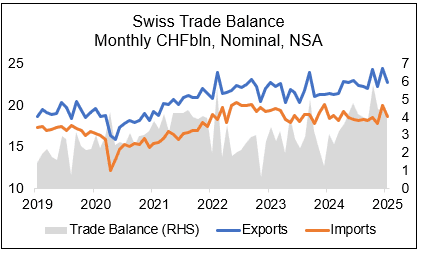

The Swiss trade surplus fell the fourth consecutive time in January, to CHF4.03bln, amid a 3.9% M/M drop in exports, outpacing the 1.9% M/M fall in imports. However, the exports drop was mostly driven by a one-off deterioration in the pharma sector, and on a broader basis, the Swiss trade balance continues to be elevated - as a 12 month rolling sum of GDP, it continued its recovery in place since April 2023 and stands around the 6% mark currently, only 0.5pp below its February 2022 high.

- While the statistics office concludes that when looking at the recent developments, the Swiss export sector overall broadly stagnates, there should be little pressure from the external sector for outsized SNB moves at its March meeting.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EGBS: Spreads To Bunds Marginally Wider

Trump’s apparent focus on imposing tariffs on Mexico & Canada in the coming weeks helps promote some modest EGB spread widening to Bunds today, although the major 10-Year cross-market differentials are within 1bp of yesterday’s closing level.

- Bund futures have pulled back from overnight highs, limiting the spread widening as the risk-off moves fade from extremes.

- 10-Year BTP/Bunds closed below 110bp, with cycle closing lows located at 106.4bp.

- Meanwhile, 10-Year OAT/Bunds last ~77.5bp, with French political and fiscal risks helping keep that spread above 75bp.

- Supply pressure is set to come via the French and Lithuanian syndications, with German green supply also scheduled.

USD: EUR and the Pound are testing their intraday lows

- The EUR and the Pound are falling back to where they fell Overnight post Trump's Tariffs headline, both EURUSD and Cable are back to their overnight intraday lows.

- Not Yet seeing any broader moves versus G10s at least.

- Small support in Cable comes at 1.2222, and a push all the way down to ~1.2186 would reverse Yesterday's WSJ story on Tariffs.

- EURUSD would need to drift to 1.0320 to reverse that move.

EGB SYNDICATION: 5/15-year LITHUN EMTN: Guidance

- EUR Benchmark 5Y Fixed (Jan. 28, 2030) MS+70 Area

- Coupon: Annual, act/act ICMA

- EUR Benchmark 15Y Fixed (Jan. 28, 2040) MS+145 Area

- Coupon: Annual, act/act ICMA

- Issuer: Lithuania Government International Bond (LITHUN)

- Settlement: Jan. 28, 2025

- Bookrunners: BNPP (B&D), BofA, JPM

- Co-Lead (no books): SEB Lithuania

- Investor presentation.

- Timing: May price today.

Details as per Bloomberg