ECB: March Projections: Export Growth Weighed Down By Uncertainty

Mar-06 15:46

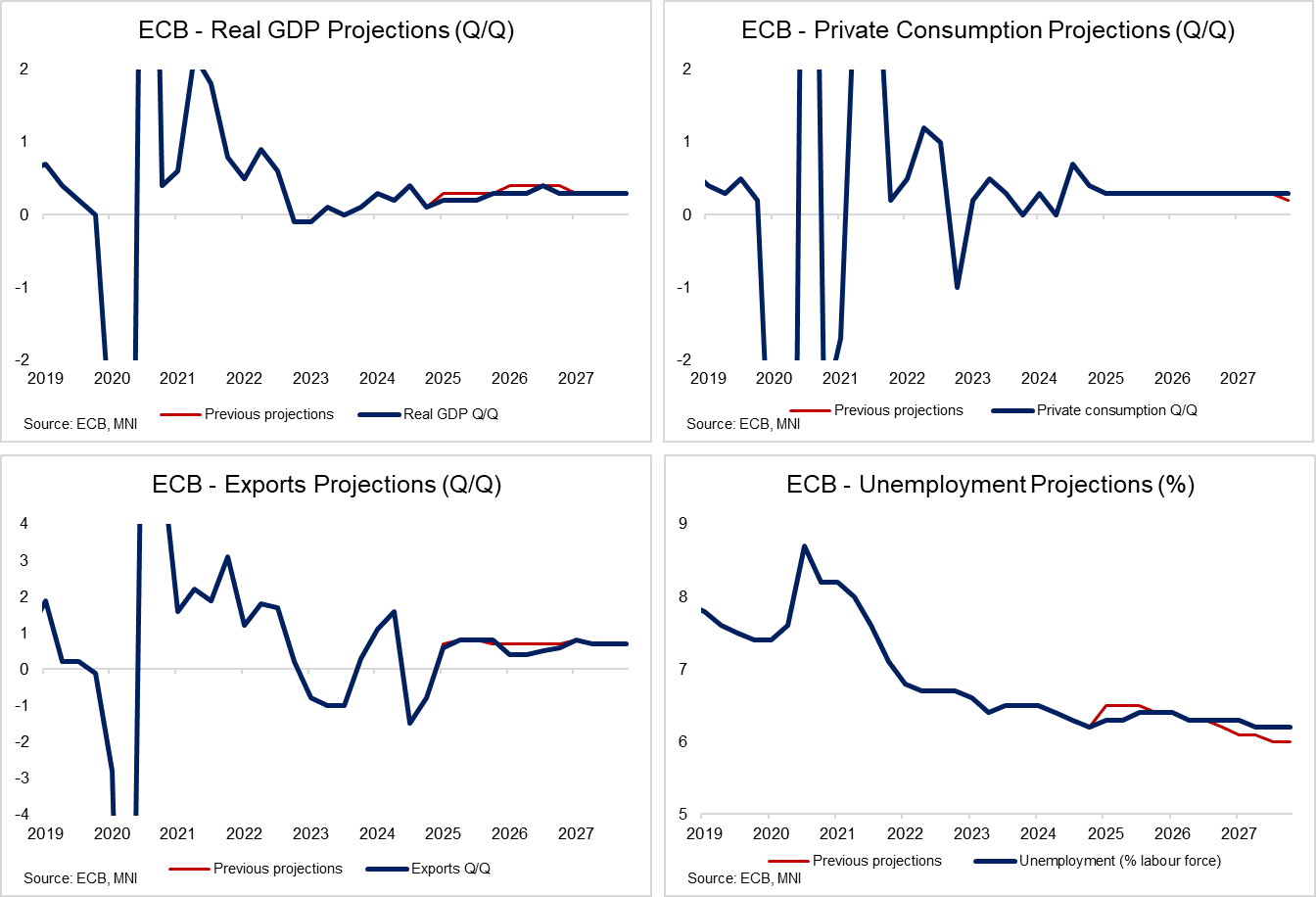

The ECB revised its growth projection a shade lower through 2027 in its March projections. As highlighted in the March policy statement and President Lagarde’s press conference, “persistently high geopolitical and policy uncertainty is expected to weigh on euro area economic growth, slowing down the anticipated recovery”.

- The projections include the impact of initial tariffs on trade between the United States and China (10% on all goods), but do not account for tariffs on Mexico/Canada, the additional 10% tariffs on China, nor the prospect of future barriers on the EU.

- In light of higher uncertainty, the main downward revision was seen in the exports component, particularly in 2026.

- The ECB continues to have confidence in its projection for a consumption-led recovery (resulting from rising real wages and employment growth). The quarterly consumption growth projections were little changed through the forecast horizon.

- On fiscal policy, “the discretionary fiscal policy measures point to some fiscal loosening” relative to December 2024, but the projections of course do not account for the latest German/EU fiscal announcements.

- On monetary policy “The impact on growth of past monetary policy tightening is estimated to have peaked in 2024 and is expected to fade away over the projection horizon”.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

PIPELINE: Corporate Bond Issuance Update: $3B EIB WNG 10Y Priced

Feb-04 15:38

- Date $MM Issuer (Priced *, Launch #)

- 02/04 $3B *EIB WNG 10Y +60

- 02/04 $1.5B #BNG Bank 3Y SOFR+37

- 02/04 $1B KFW 4% 2026 TAP SOFR+20

- 02/04 $Benchmark IDA 10Y SOFR+63a

- 02/04 $Benchmark Altria 3Y +95a, 10Y +145a

- 02/04 $Benchmark Valero Energy 5Y +115a

- 02/04 $Benchmark GATX 10Y +125a, 2054 Tap +140a

- 02/04 $Benchmark BNY Mellon 6NC5 +85, 6NC5 SOFR

- 02/04 $Benchmark National Fuel Gas 5Y +145a, 10Y +175a

- 02/04 $Benchmark National Rural Utilities 3Y +80a. 5Y +90a

- 02/04 $Benchmark NextEra Capital 30.5NC5.25, 30.5NC10.25

- 02/04 $Benchmark L-Bank 5Y SOFR+47a (2Y SOFR dropped)

- 02/04 $Benchmark Foundry JV 6Y +155a, 8Y +180a, 11Y +190a, 12Y +195a, 14Y +205a

OPTIONS: Expiries for Feb05 NY cut 1000ET (Source DTCC)

Feb-04 15:38

- EUR/USD: $1.0300-05(E1.4bln), $1.0315-35(E1.8bln), $1.0400(E570mln), $1.0500(E1.4bln)

- USD/JPY: Y153.15-25($2.0bln)

- USD/CAD: C$1.4240($954mln), C$1.4500($710mln), C$1.4530($847mln), C$1.4600($1.5bln)

GILT SYNDICATION: Coupon size announcement

Feb-04 15:36

The DMO has announced the coupon size of the March-35 gilt to be launched via syndication in the w/c 10 February to be at 4.50%. ISIN will be GB00BT7J0027.

Related bullets

Related by topic

EUR/USD

Bunds

Germany

Euribor

European Central Bank

Schatz

Bobl