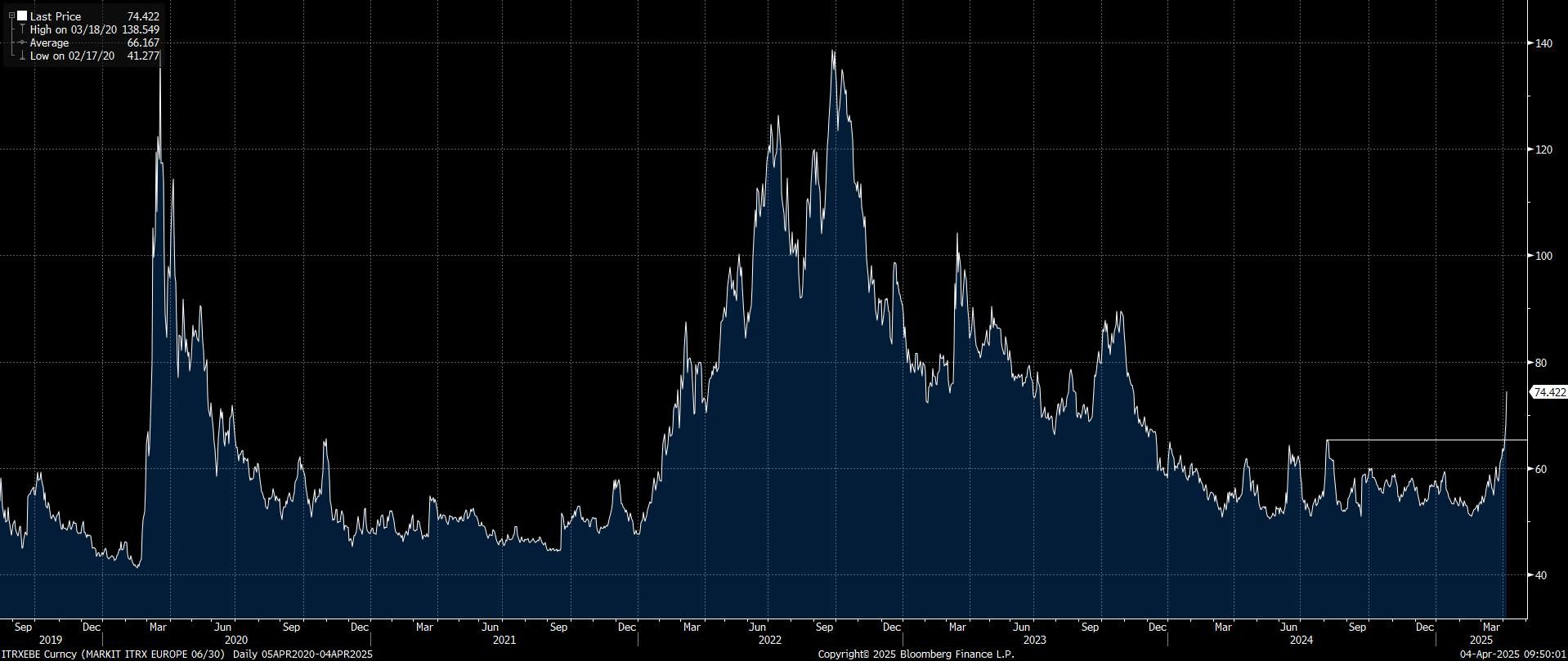

CDS: Markit iTraxx EUR Main Index Through '24 Highs Following U.S. Tariffs

We have seen a clean break above the ’24 highs for the Markit iTraxx EUR Main index over the past couple of sessions, as markets price growing European corporate default risk in the wake of the “Liberation Day” tariff announcements.

- The index is on track to lodge the largest 2-day widening seen since early ‘23

- This comes alongside the well-documented weakness in European equities.

- Our credit team suggests that there is still room for stocks to catch up to the move in CDS at this stage, presenting a further source of downside risk for equities.

- The Markit iTraxx EUR Main index tracks CDS of 125 of the most liquid EUR IG credit names, placing them into a tradable, liquid index.

Fig. 1: Markit iTraxx Europe Main Index

Source: MNI - Market News/Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

MNI: EUROZONE FINAL FEB SERVICES PMI 50.6 (FLASH: 50.7); JAN 51.3

- MNI: EUROZONE FINAL FEB SERVICES PMI 50.6 (FLASH: 50.7); JAN 51.3

- MNI: EUROZONE FINAL FEB COMPOSITE PMI 50.2 (FLASH: 50.2); JAN 50.2

BOBL TECHS: (M5) Pierces Support

- RES 4: 119.040 High Feb 28 and a reversal trigger

- RES 3: 118.950 High Mar 3

- RES 2: 118.310 Low Mar 3

- RES 1: 118.090 Intraday high

- PRICE: 117.870 @ 08:40 GMT Mar 5

- SUP 1: 117.650 Intraday low

- SUP 2: 117.600 Round number support

- SUP 3: 117.490 2.00 proj of the minor Feb 28 - Mar 3 - 4 price swing

- SUP 4: 117.318 2.236 proj of the minor Feb 28 - Mar 3 - 4 price swing

Bobl futures are trading sharply lower this morning. The contract has gapped down and price action is likely to remain volatile near-term. A key short-term support at 117.850, the Feb 20 low, has been pierced. This undermines a recent bullish theme. A continuation lower would signal scope for an extension towards the 117.600 handle. On the upside, key short-term resistance has been defined at 119.040, the Feb 28 high.

MNI: GERMANY FINAL FEB SERVICES PMI 51.1 (FLASH: 52.2); JAN 52.5

- MNI: GERMANY FINAL FEB SERVICES PMI 51.1 (FLASH: 52.2); JAN 52.5

- MNI: GERMANY FINAL FEB COMPOSITE PMI 50.4 (FLASH: 51.0); JAN 50.5