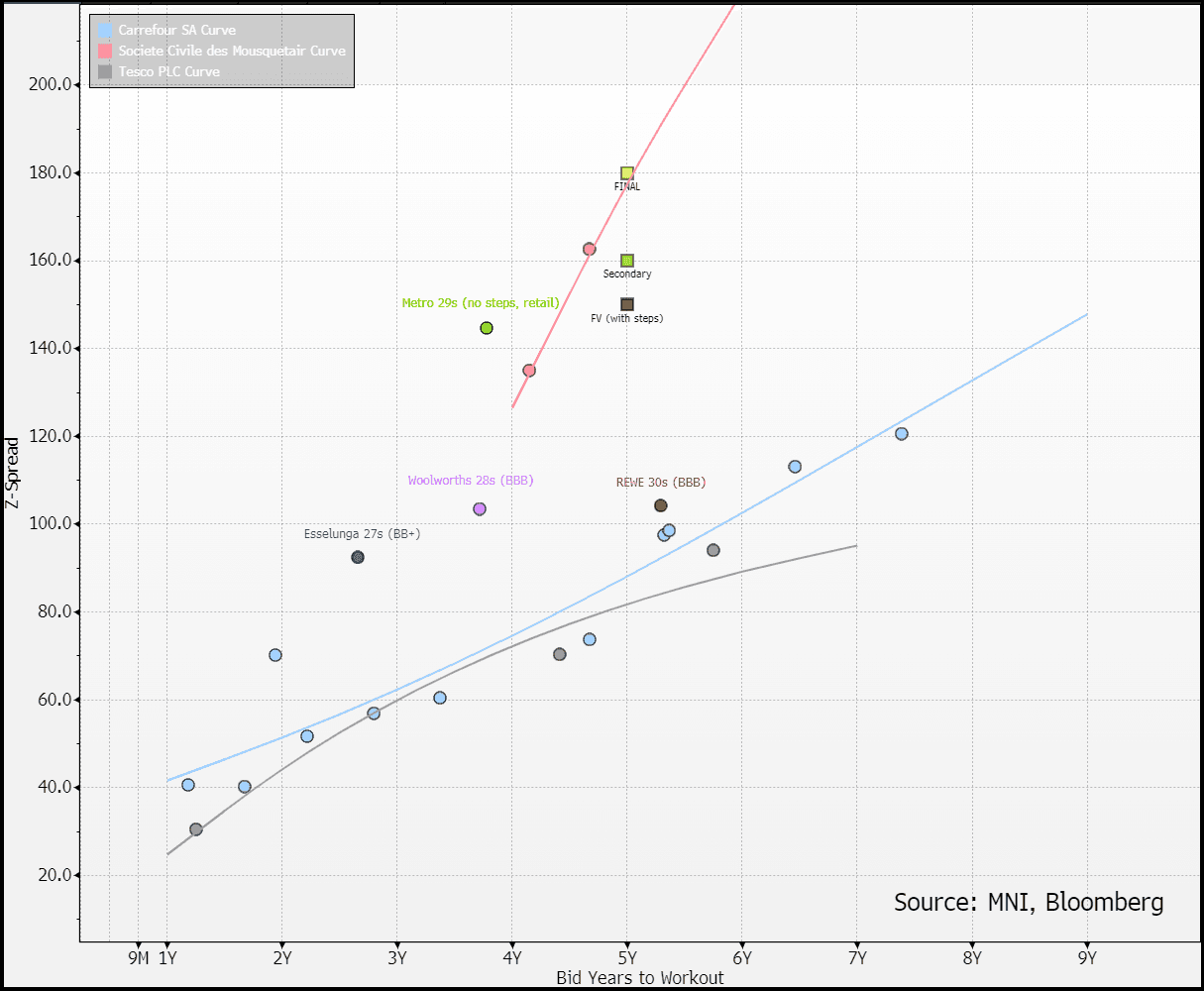

EU CONSUMER STAPLES: Metro AG; secondary

Feb-27 17:21

(MEOGR 29s; NR/BBB- Neg)

+1pt/-20bps in secondary.

- €600m 5Y +180 vs. FV +150 (30bp NIC) now +160

- Not a value view as we priced in a retail premium

We do think there is some confusion in markets on how to price steps. Couple of asides we wanted to make;

- A step-up without a step-down provision on a return into IG (not standard but was the case above) does NOT need to be 'annualised' into spread terms by looking at bond duration etc. - it is a parallel shift in the coupons from a certain date.

- Your max upside above is still limited to 125bps x (4/5=0.8) since you cannot accrue for the first year (even if it is downgraded today). This is standard with docs and check for how it handles final year (in Metro case it will retrospectively adjust the final coupon too).

- Steps - by nature - help those that see the levels as unattractive. Say you believe Metro won't show a recovery this year and therefore see a 100% chance of a downgrade within the next year - at final pricing of +180 your theoretical price including step was +280.

- If you saw a downgrade between year 1-2 (hence step from yr 2 onwards) value would be +255, Yr 2-3 value would be +228, Year 3-4 Z+200 and Yr 4-5 Z+200. The last two are the same given the above retrospective clause adjustment. You can add probabilities to each as you see fit.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US TSYS/SUPPLY: Preview 7Y Auction

Jan-28 17:16

- Tsy $44B 7Y-Note auction (91282CMK4) is at the top of the hour, WI currently running around 4.470%, 6.2bp rich to last month's stop.

- December auction recap: Tsys futures gapped off lows (TYH5 currently 108-17.5 last, -0.5) after the $44B 7Y note auction (91282CMC2) stopped 2.2bp through with 4.532% high yield vs. WI of 4.554%; bid-to-cover 2.76x vs. 2.71x prior.

- Peripheral stats: Indirect take-up jumped to 87.88% vs. 64.08% in November; Direct take-up fell to record low of 2.84% vs. 25.94% prior, Dealers took 9.27% vs. 9.99% prior

- Timing: The 7Y note results will available shortly after the competitive auction closes at 1300ET.

OUTLOOK: Wednesday Data Calendar: 2025 Inaugural FOMC Policy Announcement

Jan-28 17:06

- US Data/Speaker Calendar (prior, estimate)

- 29-Jan 0700 MBA Mortgage Applications (0.1%, --)

- 29-Jan 0830 Advance Goods Trade Balance (-$102.9B, -$105.5B)

- 29-Jan 0830 Wholesale Inventories MoM (-0.2%, 0.2%)

- 29-Jan 0830 Retail Inventories MoM (0.3%, 0.2%)

- 29-Jan 1130 US Tsy $64B 17W Bill auctions

- 29-Jan 1400 FOMC Rate Decision

FED: US TSY TO SELL $95.000 BLN 4W BILL JAN 30, SETTLE FEB 04

Jan-28 17:05

- US TSY TO SELL $95.000 BLN 4W BILL JAN 30, SETTLE FEB 04