MNI ASIA MARKETS ANALYSIS: China Responds, Fed Powell Patient

HIGHLIGHTS

- Treasuries remain well supported late Friday, but off early session highs after headlines filtered through markets that Tsy Sec Bessent was "quietly" attempting to moderate Pre Trumps hardline stance.

- Trump tweeted he had a “very productive call” with Vietnamese Communist Party leader, To Lam, suggesting Trump may be willing to strike country-specific deals.

- Otherwise, market pessimism remains after China implemented their own 34% tariff on US imports in response to Trump's 54% tariff on China

MNI US TSYS: Markets Remain Pessimistic on Tariffs, China Responds, Powell Patient

- Treasuries remain well supported late Friday, but off early session highs after headlines filtered through markets that Tsy Sec Bessent was "quietly" attempting to moderate Pres Trumps hardline stance.

- Brief risk-off unwind late morning after Pres Trump tweeted "this would be a PERFECT time for Fed Chairman Jerome Powell to cut Interest Rates," but Tsys bounced after Chairman Powell's discussion on economy at SABEW conference. Chair Powell expressed patience, now is a "good time to take a step back and let things clarify" while "uncertainty of new policies" decline over time.

- Treasuries dipped then bounced after higher than expected March jobs gain was tempered slightly by down-revision in prior". The latest profile sees 228k after two weak months (111k Jan, 117k Feb) which in turn followed two booming months (261k Nov, 323k Dec).

- Tsy Jun'25 10Y contract is currently +10.5 at 112-31, earlier focus on technical resistance at 114-16 (2.000 proj of the Jan 13 - Feb 7 - Feb 12 price swing) after breaching round number resistance earlier (114-03.5 high). 10Y yield 3.8823% (-.1481) vs. 3.8564 low. Technical support well beow at 112-01 (High Mar 4 and a recent breakout level).

- Curves remain flatter: 2s10s -2.736 at 31.543, 5s30s -5.980 at 68.231. 10Y yield still below 4% at 3.9962 (-.0324) vs. 3.8564% session low.

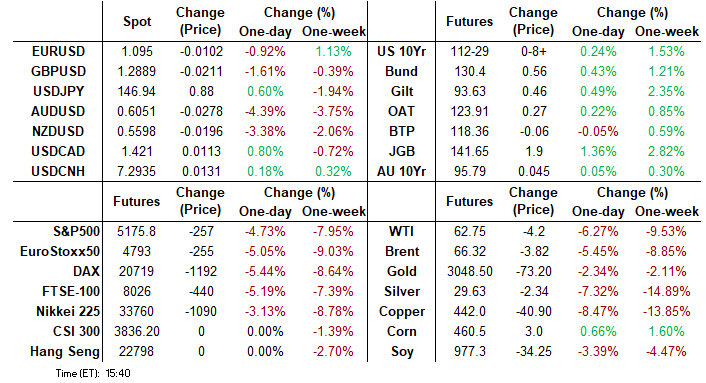

- Cross asset update: Stocks still weaker, but off recent lows SPX eminis currently trading 5168.25 (-261.75) vs. 5107.5 low, BBG US$ index near recent highs +1264.81 (+12.57). Gold sharply lower at 3029.0.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00130 to 4.31984 (-0.00381/wk)

- 3M -0.02571 to 4.25898 (-0.03863/wk)

- 6M -0.05237 to 4.12552 (-0.09009/wk)

- 12M -0.10772 to 3.86343 (-0.18943/wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.39% (+0.02), volume: $2.577T

- Broad General Collateral Rate (BGCR): 4.37% (+0.03), volume: $1.011T

- Tri-Party General Collateral Rate (TCR): 4.36% (+0.02), volume: $976B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $103B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $263B

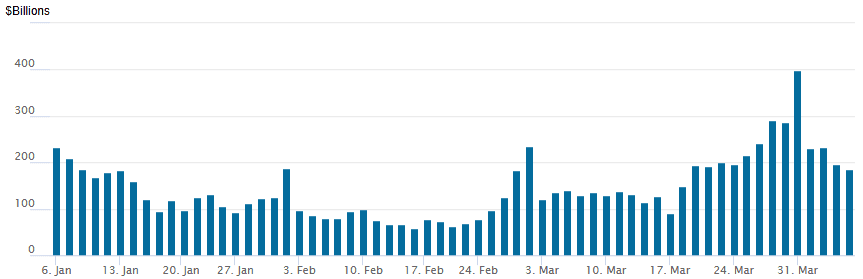

FED Reverse Repo Operation

RRP usage recedes to $184.499B this afternoon from $196.265B on Thursday. Usage had surged to the highest level since December 31, 2024 this last Monday: $399.167B. Compares to $58.770B (lowest level since mid-April 2021) on February 14. The number of counterparties at 40.

US SOFR/TREASURY OPTION SUMMARY

Another heavy session for SOFR & Treasury options as underlying futures surge higher after China retaliated to Trump tariffs with 34% tariffs on US goods. Better call flow has emerged since midmorning. Projected rate cuts through mid-2025 hve eased slightly vs. this morning highs while first full 25bp cut still priced in for June and over a full point by year end. Current levels vs. morning highs (*) as follows: May'25 at -8.6bp (-11.8bp), Jun'25 at -31.5bp (-38bp), Jul'25 at -56.1bp (-62.4bp), Sep'25 -75.8bp (-85bp).

SOFR Options

Block, -5,000 SFRM5 95.75/95.87 put spds 3.0 over the 96.37/96.50 call spd

+25,000 SFRM5 95.87/96.31 call spds, 15.25-15.5 ref 96.115

+50,000 SFRZ5 96.50/96.87/97.25 call flys, 5.5-6.0 ref 96.50

+16,000 SFRM5 96.31/2QM5 97.00 call spds, 7.5 Green Jun over/flattener

-5,000 SFRJ5 96.00/96.25/96.50 call flys, 5.75 ref 96.11

-11,000 SFRK5 95.62/95.68/95.75 put trees, 0.25 ref 96.10

+5,000 SFRM5 95.75/0QM5 96.00 put spds, 0.75 front June over/flattener

+5,000 2QU5 97.25/97.31 call spds, 2.0 ref 96.915

-5,000 2QU5 97.12/97.25 call spds, 4.0 ref 96.91

+10,000 SFRU5 97.12/97.50 call spds, 5.5

+8,000 SFRJ5 96.87 calls, 1.0 ref 96.13

+10,000 SFRZ5 95.62/95.87 put spds, 2.75 ref 96.75

Block, +10,000 SFRU5 97.12/97.50 call spds 5.0 ref 96.485

3,000 0QM5 96.37/96.62 call spds vs. 96.00 puts

10,000 SFRM5 95.62/95.75 put spds ref 96.115

Block, 6,000 0QM5 96.81/97.00 call spds 10.25/splits

Block, 3,000 SFRM5 96.25/96.50 call spds vs. 95.50/95.62 put spds, 5.0

4,000 SFRK5 96.18/96.31/96.43/96.56 call condors ref 96.19

8,700 2QU5 97.25/97.31 call spds ref 97.00, total over 20k

4,000 0QK5 96.56/96.75 call spds ref 97.13

Block, 6,400 SFRM5 95.75/95.87 put spds 3.75 ref 96.165

Blocks, 9,000 SFRJ5 96.12/96.25 call spds, 3.75-4.0

7,000 SFRM5 SFRM5 95.62/95.68/95.75 put trees ref 96.145

14,000 SFRM5 96.50/97.00 call spds ref 96.135 to -.145

Block, 6,000 SFRK5 96.00/96.12 call spds 5.0 ref 96.135

over 14,000 SFRK5 96.12/96.31 call spds ref 96.04 to -.14

3,500 0QM 97.25/97.50 call spds ref 97.11 to -.09

4,000 SFRM5 95.56/95.68/95.75/95.87 put condors ref 96.16

Block/screen, 11,500 SFRM5 96.25/96.50 call spds 4.75

1,500 SFRZ5 96.50/96.75/97.00/97.25 call condors

5,000 0QJ5 96.68/96.87 put spds ref 96.98

2,000 SFRM5 96.12/96.37 call spds ref 96.055

1,500 0QM5/0QN5 96.56/97.00/97.43 call fly spds

1,500 SFR5 96.25/96.50/96.75/97.00 call condors ref 96.70

2,500 0QJ5 96.50/96.68/96.87 call flys ref 96.96

Block, 2QK56 96.31 puts, 2.0 ref 96.91

Block/screen, 17,500 SFRM5 95.75/96.00 call spds, 12.25 on splits

5,000 SFRM5 95.75 puts, ref 96.035

Blocks, 6,000 SFRU5 96.50/96.75 call spds ref 96.41

10,000 2QU5 97.12/97.25 call spds ref 96.785

Treasury Options:

20,000 TYK5 114/115 call spds, 14 ref 113-05

8,000 TYM5 110/111 2x1 put spds, 3 net, 2 legs over ref 113-004.5

7,500 TYK5 108.5/110.5 put spds

2,800 USM5 113/117 put spds, 38 ref 121-01

Block -8,660 USK5 121 calls, 131 vs. 120-31/0.52%

3,250 USK5 112/USM5 114 put spds ref 120-28 to -25

1,500 USM5 126 calls, 101 ref 121-05

20,000 Wed wkly TY 116/117 call spds

7,800 wk2 TY 113.25/113.75/114.5/115 call condors

2,000 TYK5 116/117 call spds ref 113-30

2,000 USK5 120.5 calls, 215 ref 121-18

1,500 TYK5 113/113.5 call spds ref 113-25.5

1,500 TYK5 113/114/115 call flys ref 113-27

2,000 FVM5 111/113 call spds vs. 107.5 puts ref 109-15.75

8,900 wk2 TY 112 puts, 10 ref 113-09.5

3,000 TYK5 113.25 puts, 52 ref 113-10.5

3,500 wk2 TY 112.75/113.75 strangles, 52 ref 113-08.5 (exp Apr 11)

4,000 TYK5 113.5 calls, 47 ref 113-04.5

4,500 TYK5 114.5 calls, ref 113-07.5 to -09

2,000 TYM5 113.5/115.5 call spds ref 112-31.5

1,800 TUM5 104 puts, 19.5 ref 104-02.75

1,500 FVM5 108/108.75/109.5 call trees ref 109-09.5

MNI BONDS: EGBs-GILTS CASH CLOSE: Yields Close Off Lows, But Curves End Bull Steeper

Continued risk-off fallout from Wednesday's US tariff announcement saw European yields fall sharply for a second consecutive session, with periphery/semi-core spreads widerning.

- The core FI space took its cue from tumbling equities in a flight to safety in early trade, with Gilts and Bunds rallying strongly in a continuation of Thursday's price action as US officials showed no sign of backing down from aggressive tariff implementation, and China announcing retaliatory tariffs of its own.

- Yields picked up from the lows set in late morning European trade though, due in part to Fed Chair Powell expressing a patient stance on rate cuts despite recent developments, and US payroll gains that were marginally more solid than expected.

- Both the UK and German curves bull steepened, with the German short end outperforming overall.

- That capped a week in which both the German and UK curves bull steepened, with Gilts outperforming Bunds: Germany 2Y yields -19bp, 10Y -15bp; UK 2Y yields -26bp, 10Y -25bp.

- Periphery EGB spreads widened as risk appetite evaporated, led by high-beta BTPs / GGBs.

- Attention over the weekend will be on US tariff developments - next week's schedule in Europe includes UK Monthly Activity Data.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is down 12.1bps at 1.827%, 5-Yr is down 10.5bps at 2.128%, 10-Yr is down 7.3bps at 2.578%, and 30-Yr is down 6.3bps at 2.979%.

- UK: The 2-Yr yield is down 7.6bps at 3.934%, 5-Yr is down 7.6bps at 4.018%, 10-Yr is down 7.2bps at 4.448%, and 30-Yr is down 6.8bps at 5.116%.

- Italian BTP spread up 6.9bps at 119bps / Greek up 7.7bps at 89.1bps

MNI EGB OPTIONS: Mixed Rates Trade Closes A Largely Upside-Leaning Week

Friday's Europe rates/bond options flow included:

- DUK5 106.70p, bought for 3 in ~5.35k

- ERK5 97.6875/97.625/97.5625p ladder, bought for half in 5k

- ERK5 97.875/98.00/98.125c fly, bought for 3.75 in 2.5k.

- ERM5 97.875/98.00cs vs ERU5 98.125/98.25cs, bought the Sep for -0.75 (receive) in 5k.

- ERM5 98.0625/98.25cs, bought for 1.75 in 6k

MNI FOREX: Risk Sensitive Currencies Plummet Amid Tariff Turmoil, AUD Falls 4.7%

- Risk sentiment continues to be significantly dented amid the pivotal turning point for global trade policy. While pessimism was more centred around the US on Thursday, contributing to the sharp dollar declines, Friday’s broad deterioration for risk has moderately propped up the greenback. However, dynamics have weighed substantially on higher beta currencies, with the 4.7% decline for AUDUSD best displaying the severity of the moves.

- AUDUSD broken a number of important support levels between 0.6200-0.6100, exacerbating the selloff. The pair hovers just above the psychological 0.600 mark as we approach the close, the lowest level since April 2020, shortly after the onset of the covid pandemic.

- At points of the day, moves in AUDJPY and AUDCHF were even outpacing the AUDUSD decline, as investors flocked to the low yielding safe havens. Indeed, record lows for AUDCHF leave the cross sub-0.5200, and down over 5% today. AUDJPY breached the August carry unwind lows below 90.00, prompting a sharp spike down to 87.41, fresh two-year lows.

- NZDUSD sits down 3.6% on the session, while GBPUSD is also 1.5% in the red. 8% losses for crude futures have also weighed heavily on the Norwegian Krone, with USDNOK the best part of 4% higher on the session.

- The USD index is around half a percent firmer, and this magnitude of move has been echoed by the Euro. EURUSD is significantly off the 1.1144 highs from Thursday, at 1.0985, but remains only 0.6% lower on Friday as the focus fell elsewhere.

- In emerging markets, CE3 currencies and the ZAR have all been heavily impacted, dipping around 1.5% against the dollar, but it is LatAm FX that has predominantly bore the brunt of the risk selloff. USDMXN is 2.7% higher, whereas gains for USDBRL and USDCLP have eclipsed 3% amid the poorer commodity backdrop.

MNI FX OPTIONS: Expiries for Apr07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1000(E1.1bln)

- USD/JPY: Y146.00($1.4bln), Y146.50($569mln)

MNI US STOCKS: Late Equities Roundup: Near Lows, Energy & Financials Underperforming

- Stocks continued to retreat in late Friday trade, adding to this week's post-Liberation Day rout after China responded to Trump's tariff's with their own 34% duty on US imports. Energy and Financial sectors continued to underperform in late trade with Industrials, Materials and Information Technology sectors not far behind.

- Currently, the DJIA trades down 1725.49 points (-4.26%) at 38818.64, S&P E-Minis down 260.25 points (-4.79%) at 5172.75 vs. 5136.00 low (7% circuit breaker at appr 5055.0), Nasdaq down 775.9 points (-4.7%) at 15774.3.

- As noted, Energy sector shares underperformed as crude prices fell back to early 2022 levels (WTI 60.59 low): APA Corp -12.46%, Schlumberger -11.07%, Baker Hughes -10.77% and Diamondback Energy -10.58%.

- The Financials sector was weighed by services and insurance names in late trade: Apollo Global Management -9.87%, MetLife -8.72%, Globe Life -8.71%, Progressive -8.60% and Discover Financial Services -8.14%.

- On the positive side, Consumer Discretionary sector shares outperformed in late trade: DR Horton +6.79%, NVR +6.20%, Deckers Outdoor +5.73%, PulteGroup +5.29% and Williams-Sonoma +5.03%.

- Meanwhile, Broadline retailers and home centers traded higher in the second half: Builders FirstSource +3.52%, Dollar Tree +2.50%, Lowe's Cos +2.04%, Target Corp +1.82% and Home Depot +0.92%.

- Reminder, the next earnings cycle kicks off next week Friday with several banks reporting including: Bank of New York Mellon, Wells Fargo, First Bancshares Inc, JPMorgan Chase, Blackrock and Morgan Stanley.

MNI EQUITY TECHS: E-MINI S&P: (M5) Bear Cycle Extends

- RES 4: 5837.25 High Mar 25 and a reversal trigger

- RES 3: 5773.25 High Apr 2

- RES 2: 5723.04 20-day EMA

- RES 1: 5435.00/5564.75 Intraday high / High Apr 3

- PRICE: 5235.75 @ 15:17 BST Apr 4

- SUP 1: 5172.00 1.000 proj of the Feb 19 - Mar 13 - 25 price swing

- SUP 2: 5120.00 Low Aug 5 ‘24 (cont)

- SUP 3: 5015.00 1.236 proj of the Feb 19 - Mar 13 - 25 price swing

- SUP 4: 5000.00 Psychological round number

S&P E-Minis have traded in a volatile manner and traded sharply lower this week. A bearish theme remains intact and the latest fresh cycle lows, strengthens current conditions. Scope is seen for an extension towards 5172.00 next, a Fibonacci projection. Moving average studies are in a bear-mode position, highlighting a dominant downtrend. Key short-term resistance has been defined at 5837.25, the Mar 25 high.

MNI COMMODITIES: Crude Extends Losses, Copper Slumps As Trade War Fears Mount

- Commodities have come under significant pressure Friday, as risk sentiment has deteriorated further amid the historic shift in global trade policy.

- In particular, crude has extending losses, amid concerns for global energy demand and following the surprise OPEC+ announcement to speed up the pace of its voluntary cut unwinding.

- WTI May 25 is down by 7.4% at $62.0/bbl, its lowest level in four years.

- OPEC+ will raise production by a larger-than-expected 411kb/d in May, compared to the 135kb/d initially planned.

- The impulsive sell-off in WTI futures has resulted in the breach of a number of important support levels, signalling scope for a continuation lower. Sights are on $59.39 next, a Fibonacci projection.

- Meanwhile, spot gold has fallen by 2.8% $3,027/oz, taking the pullback from yesterday’s record high to over 4%.

- Next support is seen at $2,999.5, the Mar 21 low.

- Silver has underperformed again, falling by another 7.7% today, taking the gold/silver ratio above 102, its highest level since May 2020.

- Copper has also slumped by 8.6% to $441/lb, leaving the red metal almost 13% lower since Wednesday. The decline extended after China said it would impose reciprocal 34% tariffs on all US imports today.

- The sell-off signals scope for an extension towards $435.37, the 76.4% retracement of the Jan 2 - Mar 26 bull cycle. A break of this level would open $422.80, the Feb 3 low.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 07/04/2025 | 0600/0800 | ** | Trade Balance | |

| 07/04/2025 | 0600/0800 | ** | Industrial Production | |

| 07/04/2025 | 0900/1100 | ** | Retail Sales | |

| 07/04/2025 | 0945/1145 | ECB's Cipollone At CBDC Conference | ||

| 07/04/2025 | 1430/1030 | Fed Governor Adriana Kugler | ||

| 07/04/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 07/04/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 07/04/2025 | 1700/1300 | * | US Treasury Auction Result for Cash Management Bill | |

| 07/04/2025 | 1900/1500 | * | Consumer Credit |