MNI ASIA MARKETS ANALYSIS: Dual Mandate Progress in Question

HIGHLIGHTS

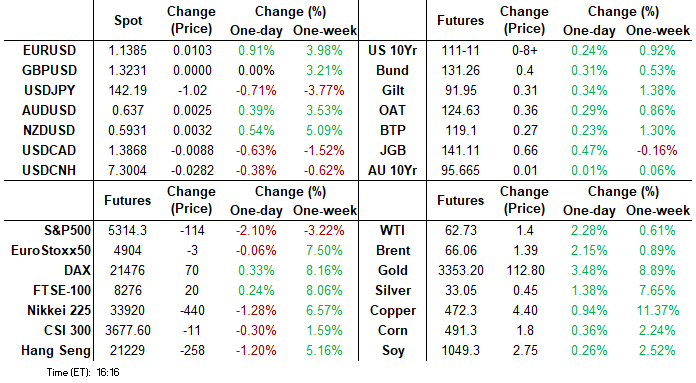

- Treasuries looked to finish at or near session highs Wednesday, Fed Chair comments at Chicago Economics Club added to a gathering risk-off tone in the second half as stocks sold off.

- Chairman Powell warned inflation may be more persistent due to larger than expected tariffs, exacerbated by policy uncertainty.

- "I do think we'll be moving away from" the dual mandate goals "probably for the balance of this year. Or at least not making any progress, and then we'll resume that progress as we can," Powell said.

- Reminder, FI & FX markets close early Thursday, Globex closes at normal time, full market close Friday in observance of Easter.

US TSYS

- Treasuries look to finish near late session highs Wednesday, gathering risk-off support as Fed Chair Powell discussed his outlook at the Chicago Economics Club, stocks extended lows (but drew some buying late). Chairman Powell warned inflation may be more persistent due to larger than expected tariffs, exacerbated by policy uncertainty.

- "I do think we'll be moving away from" the dual mandate goals "probably for the balance of this year. Or at least not making any progress, and then we'll resume that progress as we can," Powell said.

- Treasury Jun'25 10Y futures trade +11 at 111-13.5 after the bell vs. 111-17.5 high, just off technical resistance at 111-25 (50.0% retracement of the Apr 7 - 11 bear leg), 10Y yield at 4.2806% (-.0524). Curves are steeper but off first half highs: 2s10s +1.691 at 50.081, 5s30s +4.769 at 83.808.

- The NY Fed services business activity index was weaker than expected in April as it failed to bounce and instead dipped to -19.8 (cons -12.1, 4 responses) after -19.3 in March. Other important details within the report were notably glum, with the current business climate falling further to -60.7 from -51.7 (-21.8 in Jan having averaged -24.5 in 2024 for example) to its lowest since Feb 2021.

- March industrial production was largely as expected, with headline IP growing contracting by 0.3% M/M (-0.2% survey) but prior upwardly revised by 0.1pp (+0.8%). Manufacturing production rose by 0.3% (0.2% survey 1.0% prior upwardly revised from 0.9%). Capacity utilization fell slightly (77.8% vs 78.2% prior).

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00819 to 4.31994 (-0.00192/wk)

- 3M -0.01032 to 4.26947 (+0.01337/wk)

- 6M -0.01496 to 4.12728 (+0.02928/wk)

- 12M -0.02539 to 3.87643 (+0.02513/wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.36% (+0.03), volume: $2.526T

- Broad General Collateral Rate (BGCR): 4.35% (+0.02), volume: $1.039T

- Tri-Party General Collateral Rate (TCR): 4.35% (+0.02), volume: $999B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $242B

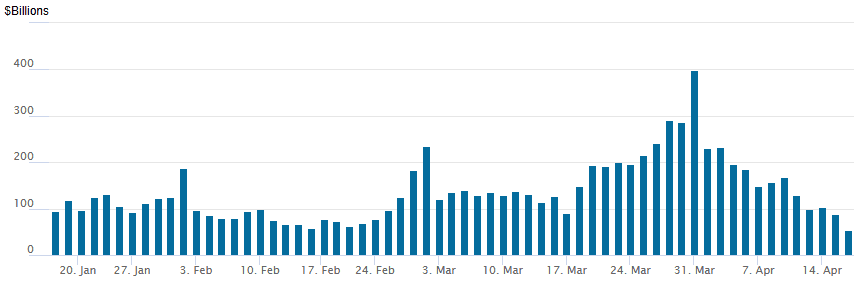

FED Reverse Repo Operation - New Lows

RRP usage falls to $54.772B -- the lowest level since April 2021 this afternoon from $88.878B on Tuesday. Usage had surged to the highest level since December 31, 2024 last Monday, March 31: $399.167B. The number of counterparties rises to 30 from 23 prior.

US SOFR/TREASURY OPTION SUMMARY

Option desks continued to report mixed SOFR & Treasury options Wednesday, vol sellers into rising implieds as derivatives traders readied for an extended Easter Holiday weekend. Underlying futures extended highs after Chairman Powell warned of persistent inflation due to tariffs, exacerbated by uncertain policy. Projected rate hike pricing near steady over the next couple meetings, longer dates gained slightly vs. morning levels (*) as follows: May'25 steady at -4.7bp, Jun'25 at -20.0bp (-21.2bp), Jul'25 at -41.1bp (-40.1bp), Sep'25 -60.4bp (-58.9bp).

SOFR Options:

-3,000 SFRZ5 96.56 straddles, 70.0 ref 96.55

Block/pit, total +20,000 SFRU5 96.00/96.25/96.50 call flys, 4.25 net ref 96.275 to -.28

-9,000 SFRH6 96.12 puts vs. 96.87/97.56 call spds vs. 96.67/0.46%, 0.0 net

-10,000 2QU5 95.93/96.00 put spds, 1.25

+3,100 SFRU5 95.62/95.68/95.75/95.87 put condors, 2.25

+3,000 SFRU5 95.31/95.68 2x1 put spds, 0.25 net

-10,000 SFRU5 96.50/97.00 call spds vs. 95.25/95.75 put spds and +5,000 95.25/95.81 put spds, 8.0

2,500 SFRZ5 96.56 straddles

2,000 SFRN5 96.75/97.25 call spds

4,000 2QU5 96.25/96.75/97.25 call flys ref 96.585

4,400 2QK5 97.37 calls ref 96.655

2,500 0QK5 96.81/97.06/97.31 call flys ref 96.75

2,200 SFRM5 95.62 puts, cab ref 95.94

2,500 SFRZ5 96.25 puts ref 96.53

Treasury Options:

Block, 8,500 TYM5 112.5 calls 31 vs. 110-31/0.28%

5,000 TYM5 107/08 put spds

over 18,000 TYK5 110 puts, 8

2,250 TYM5 108/110.5 put spds ref 111-04

over 7,000 TYK5 109.5/112.5 strangles

over 10,000 TYK5 112/114 call spds, 11 ref 111-01.5 to -02.5

+5,000 TYM5 114 calls, 15

5,000 FVM5 108.5/109 call spds vs. 106/106.5 put spds ref 108-09.25 to -09

+5,800 TYK5 110/111 put spds vs. 111.75 calls, 4 net/put spd over vs. 111-08.5/0.61%

3,600 FVM5 105/106 put spds ref 108-08.25

2,000 USM5 117/118 call spds, 17 ref 114-27

2,000 FVK5 108.5/109.25 call spds ref 108-12.5

1,600 USK5 99 put ref 114-24

MNI BONDS: EGBs-GILTS CASH CLOSE: Bund Yields Pull Back Ahead Of ECB

German instruments outperformed UK counterparts at the short end, but vice versa at the long end Wednesday.

- European core instruments gained in initial morning trade, due in part fo softer-than-expected UK CPI data and some concerns over China-US trade tensions.

- However, risk assets recovered following the publication of a Bloomberg sources piece casting more soothing tones ("China Open to Talks If US Shows Respect"), pushing Bunds and Gilts to the weakest levels of the day.

- Bunds and Gilts would retrace higher, and close near the middle of the session's ranges. On the day, the German curve bull flattened to through the 10Y tenor (a poor auction weighed on the 30Y segment), with the UK's twist flattening.

- Periphery / semi-core EGB spreads were mixed.

- Thursday's highlight is the ECB decision - MNI's preview is here. The ECB is widely expected to cut its three key rates by 25bp this week, taking its deposit rate to 2.25%. As MNI reported in a sources piece today, the Statement could adjust its statement to emphasise that rates are at the upper end of its range of estimates of neutral ("MNI SOURCES: ECB Likely To Adjust Or Remove 'Restrictive'")

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.8bps at 1.748%, 5-Yr is down 2.9bps at 2.061%, 10-Yr is down 2.5bps at 2.509%, and 30-Yr is down 0.1bps at 2.914%.

- UK: The 2-Yr yield is up 1.2bps at 3.974%, 5-Yr is down 1.7bps at 4.093%, 10-Yr is down 4.5bps at 4.603%, and 30-Yr is down 6.7bps at 5.36%.

- Italian BTP spread up 0.5bps at 118.7bps / Spanish down 0.5bps at 70.1bps

MNI EGB OPTIONS: Call Structure Buying Across Contracts

Wednesday's Europe rates/bond options flow included:

- DUM5 107.70/108.00/108.10c ladder, bought for half in 2.1k.

- ERU5 98.25/98.50cs 1x2, bought for 2.5 in 3k

- SFIM5 95.95/9610/96.25c fly, bought for 2.75 in 3k

MNI FOREX: Greenback Consolidates Early Decline, CHF & SEK Outperform

- Wednesday’s US session has witnessed relatively tight ranges in G10 currency markets, allowing the USD index to consolidate its initial move lower across APAC and early European trade. The ICE dollar index currently tracks at 99.35, just 35 pips from the 99.01 cycle lows that were printed last Friday.

- Weakness has been broad based against G10 peers, although the Swiss Franc and Swedish Krona have outperformed. For USDCHF specifically, the pair erased the entirety of the prior session’s bounce and leaves the pair vulnerable to a break below the 0.8100 mark, which would place the pair at fresh ten-year lows. A softer risk backdrop across global markets appears to have resumed the souring sentiment towards the dollar, and USDSEK’s 1% move lower has no idiosyncratic driver behind the move.

- The likes of EUR, AUD and NZD are all rising in line with the adjustment for the greenback, with EURUSD pushing back towards 1.14 and keeping bullish conditions firmly intact. Key focus remains on 1.1495, the Feb 10 2022 high. For AUDUSD, spot continues to edge back towards 0.6400, and a breach of 0.6409 (Feb 21 high) would likely prompt some further short covering for the pair. This may signal scope for a stronger recovery towards the US election highs at 0.6550.

- The Bank of Canada kept rates unchanged at 2.75%, in line with a slender majority of analysts. Together with higher crude prices, the CAD has been a beneficiary which has allowed USDCAD to edge back towards its recent lows. It is worth noting that Monday’s low came within 7 pips of the US election lows, located at 1.3822, a level of key short-term significance. Moving average studies are in a bear -mode position, highlighting a dominant downtrend. Below here, 1.3744 marks the next target, a Fibonacci retracement.

- GBP remains a relative underperformer on Wednesday, reflective of a softer-than-expected set of March inflation data. Although GBPUSD hovers around unchanged on the session, spot remains above the prior breakout level of 1.3207, an important bull trigger for the pair.

- Thursday’s data highlights include New Zealand CPI and Australian unemployment, before the focus turns to the ECB decision, where a 25bp cut of its three key rates is widely expected.

MNI FX OPTIONS: Expiries for Apr17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200(E605mln), $1.1215-25(E1.3bln), $1.1250(E849mln), $1.1350-60(E919mln)

- USD/JPY: Y142.80-00($1.1bln), Y145.00($1.4bln)

- USD/CAD: C$1.4000($1.4bln)

- AUD/USD: $0.6390-00(A$921mln)

- USD/CAD: C$1.3950($1.0bln), C$1.4000($2.0bln)

MNI US STOCKS: Late Equities Roundup: Extending Lows, No Powell Put

- Stocks are extending lows in late Wednesday trade, retreating after Fed Chairman Powell's outlook discussion at the Chicago Economics Club, risk-off tone gathering momentum as Powell warns inflation may be more persistent due to tariffs, exacerbated by policy uncertainty.

- Currently, the DJIA trades down down 862 points (-2.14%) at 39519.82, S&P E-Minis down 161.25 points (-2.97%) at 5268.25, Nasdaq down 700.1 points (-4.2%) at 16126.69.

- Information Technology and Consumer Discretionary sector shares continued to underperform in late trade, semiconductor makers weighed by Pres Trump's curbs: NVIDIA -10.04%, Advanced Micro Devices -9.33%, Palantir Technologies -8.56%, KLA -7.06% and ON Semiconductor -6.69%.

- Autos and broadline retailers weighed on the Consumer Discretionary sector: Tesla -6.48%, CarMax -5.54%, Amazon.com -4.19% and Williams-Sonoma -4.01%. Elsewhere, MGM Resorts fell 4.64%.

- The Energy sector continued to outperform in late trade, leading oil and gas shares include APA +3.46%, Diamondback Energy +2.73%, Devon Energy +2.59%, Occidental Petroleum +2.25%, Coterra Energy +1.94% and Marathon Petroleum +1.87%.

- Reminder: earnings expected after the close: Liberty Energy, Rexford Industrial, CSX Corp, Alcoa Corp and Kinder Morgan. Thursday's earning's calendar includes: KeyCorp, American Express, DR Horton Inc, Charles Schwab, Marsh & McLennan, Truist Financial Corp, UnitedHealth Group, Blackstone, Ally Financial, State Street and Netflix Inc.

MNI EQUITY TECHS: E-MINI S&P: (M5) Resistance Remains Intact

- RES 4: 5906.75 High Mar 6

- RES 3: 5837.25 High Mar 25 and the reversal trigger

- RES 2: 5701.85 50-day EMA

- RES 1: 5498.03 20-day EMA

- PRICE: 5259.25 @ 1520 ET Apr 16

- SUP 1: 5098.16 61.8% retracement of the Apr 7 - 10 bounce

- SUP 2: 4832.00 Low Apr 7 and the bear trigger

- SUP 3: 4760.88 1.618 proj of the Feb 19 - Mar 13 - 25 price swing

- SUP 4: 4663.75 1.764 proj of the Feb 19 - Mar 13 - 25 price swing

A reversal higher in S&P E-Minis last week highlights the start of a corrective cycle. The trend condition has been oversold following recent weakness and the move higher is allowing this set-up to unwind. Initial resistance to watch is 5498.03, the 20-day EMA. Resistance at the 50-day EMA is at 5701.85. On the downside, key support and the bear trigger has been defined at 4832.00, the Apr 7 low. A break of this level would resume the M/T downtrend.

MNI COMMODITIES: Gold Rises To Fresh Record High, Crude Gains

- Gold has rallied sharply today, notching up gains of around $100/oz as it has continued to benefit from strong haven demand and US dollar weakness amid the tariff uncertainties.

- The yellow metal is currently up by 3.1% at $3,331/oz with this latest extension putting prices back into technically oversold territory on the 14-day RSI – although that's been no barrier to the persistent rally in precious metals in recent weeks.

- Today’s gains in gold reinforce the current bullish technical picture, confirming a resumption of the primary uptrend. The next objective is $3,347.67, a 1.382 projection of the Dec 19 - Feb 24 -Feb 28 swing.

- Copper has also rallied further, buoyed by reports that China may be open to talks with the US. The red metal has risen by 1.0% to $473/lb, taking total gains since last week’s low to almost 16%.

- From a technical perspective, copper futures remain in a bear-mode cycle and the latest recovery appears corrective - for now. However, price has pierced firm resistance at $471.63, the 50-day EMA, a clear break of which would open $490.27, a Fibonacci projection.

- Meanwhile, crude markets have been supported by the potential signs of easing US-China trade tensions, as well as further US sanctions on entities involved in Iran’s oil trade, including another Chinese teapot refiner.

- WTI May 25 is up by 1.6% at $62.3/bbl.

- For WTI futures, initial firm resistance is seen at $64.85, the Mar 5 low and a recent breakout level.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 17/04/2025 | 0600/0800 | ** | PPI | |

| 17/04/2025 | 1100/0700 | *** | Turkey Benchmark Rate | |

| 17/04/2025 | 1215/1415 | *** | ECB Deposit Rate | |

| 17/04/2025 | 1215/1415 | *** | ECB Main Refi Rate | |

| 17/04/2025 | 1215/1415 | *** | ECB Marginal Lending Rate | |

| 17/04/2025 | 1230/0830 | *** | Jobless Claims | |

| 17/04/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 17/04/2025 | 1230/0830 | * | International Canadian Transaction in Securities | |

| 17/04/2025 | 1230/0830 | *** | Housing Starts | |

| 17/04/2025 | 1230/0830 | ** | Philadelphia Fed Manufacturing Index | |

| 17/04/2025 | 1245/1445 | ECB Monetary Policy press conference | ||

| 17/04/2025 | 1400/1000 | * | US Bill 08 Week Treasury Auction Result | |

| 17/04/2025 | 1400/1000 | ** | US Bill 04 Week Treasury Auction Result | |

| 17/04/2025 | 1430/1030 | ** | Natural Gas Stocks | |

| 17/04/2025 | 1530/1130 | ** | US Treasury Auction Result for TIPS 5 Year Note | |

| 17/04/2025 | 1545/1145 | Fed Governor Michael Barr | ||

| 17/04/2025 | 1700/1300 | ** | US Treasury Auction Result for TIPS 5 Year Note | |

| 18/04/2025 | 2330/0830 | *** | CPI |