MNI ASIA MARKETS ANALYSIS: Month End Rebal, Tariff Deadline

HIGHLIGHTS

- Treasuries bounced off late session lows Monday, decent volumes as two-way month end rebalancing tempered early morning support ahead of Wednesday's "Liberation Day" tariff roll-out from the Trump Admin.

- Stocks in turn, reversed early session losses amid asset allocation chatter from some trading desks.

- Markets remain on edge amid rumors that Trump may be pressing his team to devise an aggressive 'Liberation Day' tariff plan that applies to more countries than anticipated.

MNI US TSYS: Month End Rebalancing Tempered Early Tariff Positioning

- Treasuries look to finish mildly higher - well off early morning highs as month/quarter end rebalancing flow tempered Monday morning's risk-off support ahead of Wednesday's US tariff deadline.

- Multiple reports suggest that Trump may be pressing his team to devise an aggressive 'Liberation Day' tariff plan that applies to more countries than anticipated. Stocks opened broadly weaker, but have been consolidating since midmorning amid month end positioning trade desks said.

- Little react to to slightly higher than expected Chicago PMI data, the barometer advancing 2.1 points to 47.6 in March. This is the third consecutive monthly gain, taking the index to its highest level since November 2023, though it remains in contractionary territory for the sixteenth successive month.

- Little new from late session Fed speakers Williams and Barkin: "need an open mind how long tariff impacts last" Williams said, while "to cut rates, got to have confidence on inflation".

- Tsy Jun'25 10Y futures trades 111-10.5 (+4) -- well off initial technical resistance of 111-22.5 (today's intraday high) -- next resistance above at 112-01 (High Mar 4 and a bull trigger), curves mildly flatter: 2s10s -1.269 at 32.276, 5s30s -2.300 at 62.471.

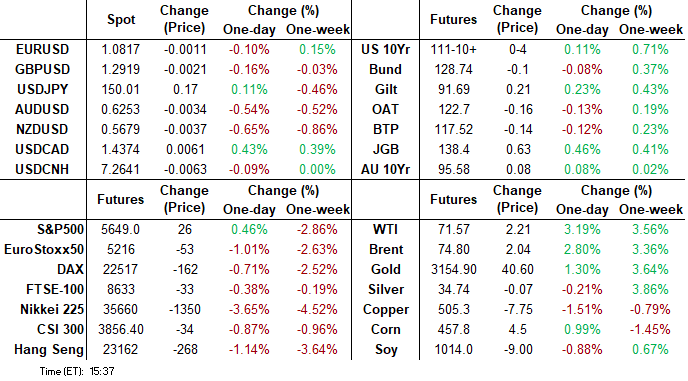

- Cross asset: Stocks near highs (SPX eminis at 5650.0 vs. 5533.75 low), Gold making new highs over 3122.0, Bbg US$ index climbing higher at 1274.25 (+2.38).

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00127 to 4.32365 (+0.00354/wk)

- 3M -0.00156 to 4.29761 (-0.00022/wk)

- 6M -0.00099 to 4.21561 (+0.01095/wk)

- 12M -0.00594 to 4.05286 (+0.02948/wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.34% (-0.02), volume: $2.440T

- Broad General Collateral Rate (BGCR): 4.34% (-0.01), volume: $946B

- Tri-Party General Collateral Rate (TCR): 4.33% (-0.01), volume: $915B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $112B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $286B

FED Reverse Repo Operation

RRP usage surges to highest level since December 31, 2024: just under $400B to $399.167B this afternoon from $286.575B Friday. Compares to $58.770B (lowest level since mid-April 2021) on February 14. The number of counterparties at jumps to 66 from 45.

US SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury option trade remained mixed late Monday, still leaning toward low delta/upside calls even as underlying futures have see-sawed off early morning highs to extending lows in late trade. Curves twisting flatter (5s30s -2.068 at 62.703 compared to 67.406 high (Jan'22 high). In turn - projected rate cuts through mid-2025 have retreated from this morning's levels (*) as follows: May'25 at -4.7bp (-6bp), Jun'25 at -20.1bp (-23.6bp), Jul'25 at -35.1bp (-40.6bp), Sep'25 -51.4bp (-58bp).

SOFR Options:

4,900 SFRZ5 96.37/96.75/97.12 call flys, ref 96.41

2,000 SFRU5 96.25/96.50/96.75 call trees ref 96.225

Block, 5,000 SFRZ5 96.25/97.00 call spds, 24.0 vs. 96.435/0.30%

Block, 30,000 SFRZ5 96.25/96.50/96.75/97.00 call condors, 5.0 adds to 10,000 earlier at 4.5

+10,000 SFRM5 95.68/95.75/95.81 put flys, 0.75 vs. 95.93/0.05%

+2,500 SFRZ5/3QZ5 97.00 call spds, 2.5 net steepener

+3,500 SFRZ5 96.00/96.25 put spds, 10.5 ref 96.46/0.15%

4,000 0QM5 97.00/97.50 call spds, 7.5 ref 96.62

2,000 0QJ5 96.37/96.50 3x2 put spds ref 96.62

Block/screen, 10,000 SFRU5/SFRZ5 95.68/95.81 put spd spds, 0.0

Block, 5,000 SFRZ5 96.25/96.50/96.75/97.00 call condors, 4.5 ref 96.435

2,000 2QM5 95.62/95.75/95.93 put flys ref 96.60

Block, 5,000 SFRU5/SFRZ5 95.62/95.87 put spd spds, 0.0

Block, 6,000 SFRM5 96.25/96.50 call spds, 2.0 ref 95.955

Block 5,000 SFRZ5 96.25/96.50/96.75 call trees, 13.0

3,000 0QK5 95.75/95.87/96.00/96.12 put condors ref 96.635

1,900 SFRN5 95.56/95.62/95.68 put flys ref 96.245

Treasury Options:

2,000 TYM5 109/111 2x1 put spds ref 111-12

-10,000 TYM5 112 calls, 57 ref 111-14

1,600 FVK5 108.5/109 call spds

4,500 TYM5 109/110 put spds ref 111-16.5

1,150 FVM5 108.5/111 1x3 call spds, 19.5 ref 108-13.25

+15,000 TYK5 111.75/112.75/113 broken call trees, 0.0 ref 111-18.5

over 4,400 TYK5 110.5 puts, 21 last ref 111-19

3,500 FVK5 108.25/109.25 call spds ref 108-14.5

2,000 FVM5 110/111/112 call trees ref 108-13.75

5,000 wk1 TY 110.5 puts, 6 ref 111-19

12,000 TYK5 113.5/115 call spds ref 111-19 to -19.5

1,750 TYK5 112/113 call spds ref 111-21.5

3,000 FVM5 109.25/110 call spds, 10.5 ref 108-14.5

8,000 TYK5 113/114.5 call spds, ref 111-14.5

MNI BONDS: EGBs-GILTS CASH CLOSE: Core Short-Ends Underperform

Bunds underperformed Gilts Monday as an early flight to safety reversed.

- Core FI started strong, as risk aversion picked up following weekend reports that the US could impose more onerous tariffs this week than had been hoped.

- Flash March Euro inflation data were mixed, compared with Friday's below-expected Spanish and French readings: Italy's were above consensus while Germany's (starting with the state-level releases) CPI was broadly in-line.

- The day's rally reversed after a Bloomberg ECB sources piece pointed to increasing appetite among some on the Governing Council for an April rate hold. Cut pricing was pared sharply to around 65% from 85%, impacting EGBs across the curve with Bunds hitting session lows.

- Both the German and UK curves twist flattened on the day.

- Periphery EGB spreads were wider, while French OATs underperformed in semi-core, on a day the RN's Le Pen was deemed ineligible for election.

- Tuesday's schedule includes final March manufacturing PMIs (including the only readings for Spain and Italy), and the flash estimate of March Eurozone HICP. We also hear from multiple central bankers including BOE's Greene, and ECB's Lagarde / Lane.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.7bps at 2.047%, 5-Yr is up 1.9bps at 2.339%, 10-Yr is up 1.1bps at 2.738%, and 30-Yr is down 1.2bps at 3.09%.

- UK: The 2-Yr yield is up 0.1bps at 4.196%, 5-Yr is down 1.4bps at 4.284%, 10-Yr is down 1.9bps at 4.675%, and 30-Yr is down 0.6bps at 5.282%.

- Italian BTP spread up 0.7bps at 112.9bps / French OAT up 2bps at 72.5bps

MNI OPTIONS: Outright Call And Put Buying Across Contracts Monday

Monday's Europe rates/bond options flow included:

- DUK5 107.40 calls paper paid 5.5 on 5K

- DUK5 107.40/107.70 call spread paper paid 3.5-4.0 on 17.5K

- OEM5 119 calls paper paid 39-39.5 on 5K

- RXK5 125.00 puts paper paid 7.5 on 5K

- SFIK5 96.00 calls paper paid 1.5 on 8K

MNI FOREX: AUD and NZD Remain Weakest in G10, USDJPY Has Strong Reversal Higher

- Despite the initial USD Index weakness from the open, weighed by the aggressive move lower for USDJPY, the DXY then edged steadily higher through European trade and into the US session. This has culminated in 0.15% gains for the DXY overall.

- USDJPY had initially been very reactive to the waning sentiment for US equities, and the initial dip lower for US yields. However, a solid recovery for equities and yields climbing back to unchanged prompted an impressive USDJPY reversal, to trade positive on the day around 150.00 as we approach the APAC crossover.

- The broad dollar strength worsened the intra-day performance for AUD (-0.68%) and NZD (-0.77%), which although off worst levels, remain comfortably the weakest in G10. For AUDUSD, we continue to narrow the gap to a key short-term support at 0.6187, the Mar 4 low. Importantly, clearance of this level would reinstate a bearish technical theme for the pair.

- Downside momentum picked up for NZDUSD on a break of a cluster of lows around 0.5710, and the intra-day fall now totals 1.10%. 0.5600 remains a key psychological pivot for the pair, while the medium-term target for the move remains at 0.5512.

- In emerging markets, similar sentiment is being felt by MXN, where intra-day weakness has been unperturbed by the latest bounce for major US equity indices. USDMXN traded to a fresh high of 20.4736 as the tariff deadline nears and investors continue to assess the dovish rhetoric from the Banxico committee.

- The Tuesday economic calendar is busy, with both the RBA decision and Japan’s Tankan survey highlights in APAC. Focus then turns to Eurozone inflation readings, before ISM Manufacturing and JOLTS data headline the US schedule.

MNI US STOCKS: Late Monday Equities Roundup: Retailers, Refiners Leading Gainers

- Stocks are extending late session highs amid moderate month-end buying while markets remain on edge ahead of this week's "Liberation Day" Trump tariff rollout on April 2. Currently, the DJIA trades up 269.26 points (0.65%) at 41854.88,

S&P E-Minis up 6.75 points (0.12%) at 5629.75, Nasdaq down 117 points (-0.7%) at 17206.99. - Consumer Staples and Energy related sectors continued to outperform in the second half, broadline retailers and grocers buoyed the former with Dollar Tree +2.46%, Walmart Inc +1.94%, Tyson Foods +1.89% and Kroger +1.71%.

- Oil and gas refiners led gainers as crude rallied (WTI +2.12 at 71.48): ConocoPhillips +1.99%, EOG Resources +1.52%, Diamondback Energy +1.34%, Devon Energy +1.31% andPhillips 66 +1.07%

- On the flipside, Information Technology and Consumer Discretionary sectors continued to underperform in late trade, semiconductor makers weighed on the Tech sector: NVIDIA -3.41%, ON Semiconductor -3.35%, Micron Technology -3.34%, Monolithic Power Systems -2.88% and Broadcom -2.57%.

- A mix of auto and travel shares weighing on the former: Tesla -3.18%; Caesars Entertainment -3.19%, MGM Resorts -2.27%, Booking Holdings -2.09%, Carnival -2.06% and Royal Caribbean Cruises -1.79%.

MNI EQUITY TECHS: E-MINI S&P: (M5) Pierces Key Support

- RES 4: 5896.39 50-day EMA

- RES 3: 5837.25 High Mar 25 and a key resistance

- RES 2: 5778.68 20-day EMA

- RES 1: 5651.25 Low Mar 21

- PRICE: 5633.00 @ 1430 ET Mar 31

- SUP 1: 5559.75/52.00 Low Mar 13 and the bear trigger / Intraday low

- SUP 2: 5500.00 Round number support

- SUP 3: 5483.50 2.00 proj of the Dec 6 ‘24 - Jan 13 - Feb 19 swing

- SUP 4: 5396.00 2.236 proj of the Dec 6 ‘24 - Jan 13 - Feb 19 swing

S&P E-Minis traded sharply lower Friday and the contract maintains a softer tone. Attention is on key support and the bear trigger at 5559.75, the Mar 13 low. It has been pierced, a clear break of it would confirm a resumption of the downtrend that started Feb 19, and open 5483.30, a Fibonacci projection. MA studies are in a bear-mode position, highlighting a dominant downtrend. Key short-term resistance has been defined at 5837.25, the Mar 25 high.

COMMODITIES

MNI AMERICAS OIL: WTI Crude Oil is higher after headlines on Russian sanctions

Americas End-of-Day Oil Summary: WTI Crude Oil is higher after headlines that European nations are considering further sanctions on Russia, raising supply risks. The market was already weighing prospects of reduced Russian and Iranian supply after US President Trump’s threat to impose primary and secondary tariffs on the two nations’ oil.

- Trump is proposing “secondary” tariffs on those who buy oil from Russia and Iran, which would have a significant effect on China. This follows an order to charge importers of Venezuelan oil and gas a 25% “secondary” tariff from April 2, whether it comes indirectly or directly. However, Trump implied that measures against Russia weren’t imminent. Trump and Putin are due to speak later this week.

- OPEC+ are still set to raise output from April, but members remain under pressure to comply with targets. The group will likely continue to raise oil output in May, Reuters said. The JMMC monitoring committee are due to meet on April 5.

- The US has revoked further licenses to operate in Venezuela, as Trump increases pressure on Venezuelan oil exports, including those for Repsol, M&P and Eni.

- Oil will likely fall to the low $60s/bbl as markets remain oversupplied, according to Macquarie Group cited by Bloomberg.

- WTI May futures were up 3.1% at $71.48

- WTI June futures were up 3.0% at $70.99

- RBOB Apr futures were up 2.2% at $2.28

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 01/04/2025 | 0630/0830 | ** | Retail Sales | |

| 01/04/2025 | 0715/0915 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0745/0945 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0750/0950 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0755/0955 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0800/1000 | ** | S&P Global Manufacturing PMI (f) | |

| 01/04/2025 | 0815/0915 | BoE's Greene on ‘UK MP/macro conjuncture’ | ||

| 01/04/2025 | 0820/1020 | ECB's Cipollone At Croatian National Bank Meeting | ||

| 01/04/2025 | 0830/0930 | ** | S&P Global Manufacturing PMI (Final) | |

| 01/04/2025 | 0900/1100 | *** | HICP (p) | |

| 01/04/2025 | 0900/1100 | ** | Unemployment | |

| 01/04/2025 | - | *** | Domestic-Made Vehicle Sales | |

| 01/04/2025 | 1230/1430 | ECB's Lagarde At AI Conference | ||

| 01/04/2025 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 01/04/2025 | 1300/0900 | Richmond Fed's Tom Barkin | ||

| 01/04/2025 | 1345/0945 | *** | S&P Global Manufacturing Index (final) | |

| 01/04/2025 | 1400/1000 | *** | ISM Manufacturing Index | |

| 01/04/2025 | 1400/1000 | * | Construction Spending | |

| 01/04/2025 | 1400/1000 | *** | JOLTS jobs opening level | |

| 01/04/2025 | 1400/1000 | *** | JOLTS quits Rate | |

| 01/04/2025 | 1430/1030 | ** | Dallas Fed Services Survey | |

| 01/04/2025 | 1530/1130 | * | US Treasury Auction Result for Cash Management Bill | |

| 01/04/2025 | 1630/1830 | ECB's Lane At AI Conference | ||

| 02/04/2025 | 0030/1130 | * | Building Approvals |