MNI ASIA MARKETS ANALYSIS: Powell Under Pressure

MNI (NEW YORK) - Due to holidays, the next Asia Markets Analysis will be published on Monday April 21 at the US market close

HIGHLIGHTS:

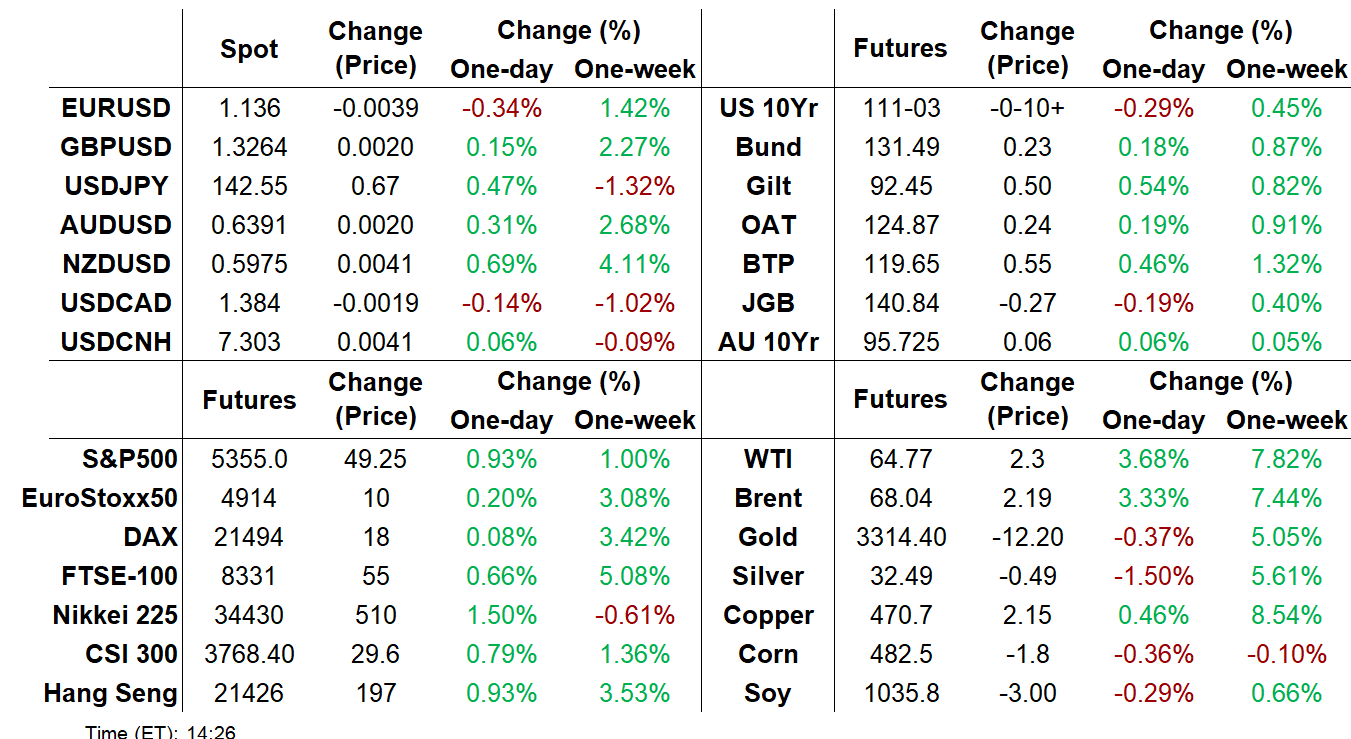

- Treasuries bear steepened ahead of the long weekend as Pres Trump eyed Fed Chair Powell's "termination"

- A dovish ECB cut triggered a rally in European rates, but EURUSD held its ground

- Next week's calendar includes flash April PMIs and a busy week for US corporate earnings

US TSYS: Curve Bear Steepens With Fed Chair Powell's Future In Focus

The Treasury curve bear steepened Thursday.

- In a holiday-shortened session for cash Treasuries, significant attention throughout was on President Trump's criticism of Fed Chair Powell, setting the tone in an early Truth Social post in which he said "Powell's termination cannot come fast enough".

- This saw a brief steepening of the curve, though the market reaction to multiple headlines on this theme later in the session (Trump telling reporters "If I want [Powell] out, he'll be out of there real fast, believe me") had limited impact.

- Recessionary Philly Fed manufacturing data garnered some attention, as did Trump declaring optimism over trade deals, but the biggest market catalyst of the day was the ECB rate cut decision and communications which put emphasis on growth concerns, triggering a rally in European rates.

- In contrast to the bull steepening seen in Europe, however, Treasury yields would close well off their lows, with bear steepening amid notable weakness at the long end.

- The long-end weakness in turn looked led by higher breakevens (and potentially term premia), possibly linked to concerns over Fed independence.

- Cash closing levels: The 2-Yr yield is up 2.9bps at 3.7982%, 5-Yr is up 3.5bps at 3.9381%, 10-Yr is up 4.8bps at 4.3249%, and 30-Yr is up 5.9bps at 4.798%. In futures: Jun 10-Yr (TY) down 11/32 at 111-02.5 (L: 111-1.5 / H: 111-16)

- Reminder that Treasury markets are closed for holiday Friday. Next week's calendar includes the Fed's Beige Book and flash PMIs.

MNI US EARNINGS SCHEDULE - Staples & Healthcare in Focus

Download Full Report Here

- Healthcare and consumer staples take the focus from financials in the coming holiday-shortened week.

- Key reports include Tesla, IBM, Alphabet, Procter & Gamble and Abbvie. This makes for a busy week, with over 20% of the S&P 500’s market cap set to report.

- Markets will be particularly focused on any signs of front-loading corporate purchases ahead of expected tariffs, the rate at which firms will passthrough costs to the consumer, and the expected impacts of tariffs on the bottom-line for consumer staples.

- This season will see over 50% of the S&P 500 having reported by the end of April, with the week beginning April 28th the busiest of the quarter.

MNI ECB Review: Firmly Dovish As Growth Outlook Sours

Download Full Report Here

Executive Summary

- The ECB cut its three key rates by 25bps, including the deposit rate to 2.25% as firmly expected.

- Any mention of “restrictive” was dropped from the statement but so was neutral, with President Lagarde stressing that it’s not an appropriate concept currently with huge shocks.

- Absent shocks, it would have been consistent with policy at the top of the 1.75-2.25% estimated range.

- The suite of communications made clear that downside growth risks have increased, driving a sizeable rally that started with the decision statement and increased through the press conference.

- The decision to cut 25bp was unanimous, with a number of governors who would have voted for a skip a few weeks ago coming around to another cut.

- June odds of a 25bp cut have climbed from ~70% to ~90%, whilst the terminal has fallen 11bp to 1.59%. The Euribor curve closes at fresh cycle lows for terminal implied yields.

- Our review of analysts ahead of the decision saw a median forecast of 1.75% for terminal, down from 2% with the March decision after various downgrades following US “Liberation Day” tariffs in early April.

- Real-time soft data will continue to grow in importance, starting with flash April PMIs on Wednesday.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

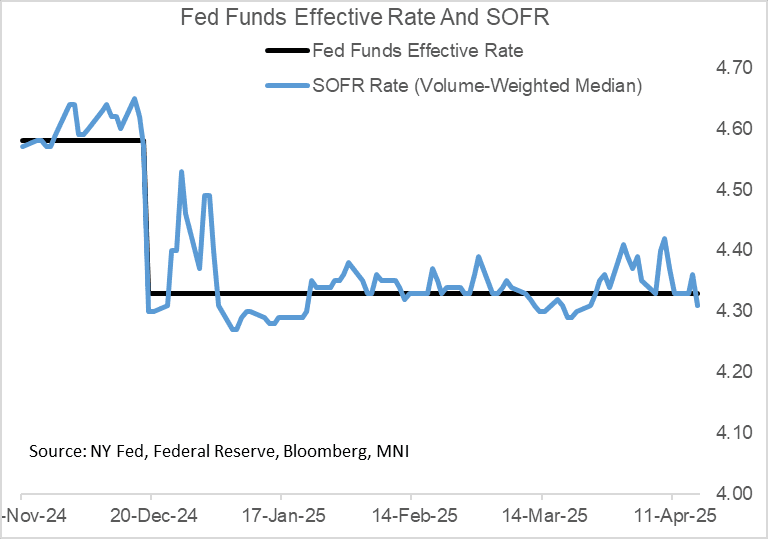

US TSYS/OVERNIGHT REPO: SOFR Pulls Back After Tax Day

Secured rates pulled back sharply Wednesday April 16, after a pickup on Tuesday that appeared related to large tax payments on the annual mid-April deadline date as well as Treasury auction settlements.

- SOFR, BGR, and TGCR each dropped 5bp. This marked a 17-session low for SOFR to 4.31%, moving it 2bp below effective Fed funds (which was unchanged Wednesday as usual at 4.33%).

REPO REFERENCE RATES (rate, change from prev. day, volume):

* Secured Overnight Financing Rate (SOFR): 4.31%, -0.05%, $2513B

* Broad General Collateral Rate (BGCR): 4.30%, -0.05%, $1047B

* Tri-Party General Collateral Rate (TGCR): 4.30%, -0.05%, $1016B

New York Fed EFFR for prior session (rate, chg from prev day):

* Daily Effective Fed Funds Rate: 4.33%, no change, volume: $88B

* Daily Overnight Bank Funding Rate: 4.33%, no change, volume: $258B

US TSYS/OVERNIGHT REPO: ON RRP Takeup Remains Subdued

Takeup of the Fed's overnight reverse repo facility ticked up by $3.8B to $58.6B, remaining near Wednesday's post-2021 low level.

- While the ON RRP is seen as something of an auxiliary of bank reserves, we note that reserve holdings as of last week were near multi-year highs close to $3.5T and very much in "abundant" territory so there is nothing here to be concerned about.

- Later on Thursday, we will get the Fed's latest estimate of reserves as of Wednesday - these are likely to show a dip from last week, given the sharp rise in the Treasury General Account amid the April 15 tax deadline ($185B rise Tuesday to just over $600B, a post-February high for the TGA).

BONDS: EGBs-GILTS CASH CLOSE: Dovish ECB Drives Bull Steepening

Bunds rose sharply Thursday on the ECB decision, with European curves bull steepening.

- The ECB cut by 25bps as expected, removing the word "restrictive" from the statement (as flagged by MNI sources prior to the meeting).

- The message that downside growth risks have increased drove a sizeable rally in Eurozone rates (MNI's ECB meeting review is here).

- Implied ECB easing through terminal increased by 11bp, and implied probability of a June cut rose to 90% implied (vs 70% prior).

- This drove short-end outperformance, and both the German and UK curves bull steepened on the day.

- Periphery EGB spreads tightened, with semi-core mixed.

- Next week's calendar includes flash April PMIs, and multiple ECB/BoE speakers at the IMF annual meetings in Washington.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is down 6.2bps at 1.686%, 5-Yr is down 4.2bps at 2.019%, 10-Yr is down 3.7bps at 2.472%, and 30-Yr is down 1.8bps at 2.896%.

- UK: The 2-Yr yield is down 5.4bps at 3.92%, 5-Yr is down 4.9bps at 4.044%, 10-Yr is down 3.7bps at 4.566%, and 30-Yr is down 2.1bps at 5.339%.

- Italian BTP spread down 1.4bps at 117.3bps / French OAT up 0.1bps at 76.5bps

OPTIONS: More Limited Trade On ECB Day

Thursday's Europe rates/bond options flow included:

- 0RK5 98.25/98.12ps 1x2, bought for 1 and 1.25 in 3k

FOREX: USDCHF Rises 1.15%, Extending Bounce From 10-Year Lows

- Topside momentum for NZDUSD gathered pace on Thursday following a break above the prior 0.5944 highs. The pair has risen as high as 0.5976 as we approach the close, and the latest strength signals scope for a stronger recovery to the Nov 07 high at 0.6038.

- Domestically, Q1 inflation printed higher than expected at 0.9% q/q, bringing the annual rate to 2.5% up from 2.2% in Q4. This may be providing an additional tailwind for NZD today, which remains among the best performers in the G10 FX space.

- Higher US yields have worked against the Swiss Franc and the Japanese Yen. For USDJPY, following a fresh cycle low of 141.62 made overnight, the pair looks set to close around 100 pips off these levels around 142.60. USDCHF stands out on the session, having risen 1.1% to 0.8220. This widens the gap to the most recent cycle lows and key support level, located at 0.8099.

- A late bid for equities on Trump headlines suggesting a good trade deal with China will be found has emphasised the dynamic of supported high beta currencies and pressure on the low yielders.

- The ECB cut rates by 25bps as expected, which had little impact on EURUSD which remains 0.4% weaker on Thursday. However, the likes of EURNZD and EURAUD are showing larger declines, potentially on the back of the governing council acknowledging greater downside risks to growth. Trade tensions are weighing on the ECB view on the euro area economy, seeing it as a potential demand shock increasing downside risk to economic growth, Lagarde said in the policy statement.

- In EM, this is being highlighted best by USDMXN, which has fallen to new post US election lows below 19.75. Lower levels of liquidity could be exacerbating the price action, owing to the local holiday. However, the short-term sentiment surrounding the broader dollar weakening trend appears to be prevailing here.

- The long holiday weekend sees the focus turn to Fedspeak on Tuesday and Eurozone flash PMIs scheduled on Wednesday.

EQUITY TECHS: E-MINI S&P: (M5) Resistance Remains Intact

- RES 4: 5906.75 High Mar 6

- RES 3: 5837.25 High Mar 25 and the reversal trigger

- RES 2: 5686.31 50-day EMA

- RES 1: 5479.72 20-day EMA

- PRICE: 5326.25 @ 14:31 BST Apr 17

- SUP 1: 5098.16 61.8% retracement of the Apr 7 - 10 bounce

- SUP 2: 4832.00 Low Apr 7 and the bear trigger

- SUP 3: 4760.88 1.618 proj of the Feb 19 - Mar 13 - 25 price swing

- SUP 4: 4663.75 1.764 proj of the Feb 19 - Mar 13 - 25 price swing

A reversal higher in S&P E-Minis on Apr 9 highlights the start of a corrective cycle. The trend condition has been oversold following recent weakness and the move higher is allowing this set-up to unwind. Initial resistance to watch is 5479.72, the 20-day EMA. Resistance at the 50-day EMA is at 5686.31. On the downside, key support and the bear trigger has been defined at 4832.00, the Apr 7 low. A break of this level would resume the M/T downtrend.

DATA/EVENTS CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 18/04/2025 | 2330/0830 | *** | CPI | |

| 18/04/2025 | 1500/1100 | San Francisco Fed's Mary Daly | ||

| 21/04/2025 | - | ECB's Lagard and Cipollone in IMF/WB Meetings | ||

| 21/04/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 21/04/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 22/04/2025 | 0600/0800 | ** | Unemployment | |

| 22/04/2025 | 1230/0830 | * | Industrial Product and Raw Material Price Index | |

| 22/04/2025 | 1230/0830 | ** | Philadelphia Fed Nonmanufacturing Index | |

| 22/04/2025 | 1255/0855 | ** | Redbook Retail Sales Index | |

| 22/04/2025 | 1330/0930 | Philly Fed's Pat Harker | ||

| 22/04/2025 | 1400/1000 | ** | Richmond Fed Survey | |

| 22/04/2025 | 1400/1600 | ** | Consumer Confidence Indicator (p) | |

| 22/04/2025 | 1700/1900 | ECB's De Guindos at MIT/ICADE Finance Club | ||

| 22/04/2025 | 1700/1300 | * | US Treasury Auction Result for 2 Year Note | |

| 22/04/2025 | 1800/1400 | Minneapolis Fed's Neel Kashkari | ||

| 23/04/2025 | 2300/0900 | *** | Judo Bank Flash Australia PMI | |

| 23/04/2025 | 2301/0001 | * | Brightmine pay deals for whole economy | |

| 23/04/2025 | 0030/0930 | ** | Jibun Bank Flash Japan PMI | |

| 23/04/2025 | 0600/0700 | *** | Public Sector Finances | |

| 23/04/2025 | 0630/0730 | DMO remit revision following FY24/25 CGNCR | ||

| 23/04/2025 | 0715/0915 | ** | S&P Global Services PMI (p) | |

| 23/04/2025 | 0715/0915 | ** | S&P Global Manufacturing PMI (p) | |

| 23/04/2025 | 0730/0930 | ** | S&P Global Services PMI (p) | |

| 23/04/2025 | 0730/0930 | ** | S&P Global Manufacturing PMI (p) | |

| 23/04/2025 | 0800/1000 | ** | S&P Global Services PMI (p) | |

| 23/04/2025 | 0800/1000 | ** | S&P Global Manufacturing PMI (p) | |

| 23/04/2025 | 0800/1000 | ** | S&P Global Composite PMI (p) | |

| 23/04/2025 | 0800/1000 | ECB Wage Tracker | ||

| 23/04/2025 | 0830/0930 | *** | S&P Global Manufacturing PMI flash | |

| 23/04/2025 | 0830/0930 | *** | S&P Global Services PMI flash | |

| 23/04/2025 | 0830/0930 | *** | S&P Global Composite PMI flash | |

| 23/04/2025 | 0900/1100 | ** | Construction Production | |

| 23/04/2025 | 0900/1100 | * | Trade Balance | |

| 23/04/2025 | 1030/1130 | BOE's Pill speech at University of Leeds | ||

| 23/04/2025 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 23/04/2025 | 1300/0900 | Chicago Fed's Austan Goolsbee | ||

| 23/04/2025 | 1330/0930 | St. Louis Fed's Alberto Musalem | ||

| 23/04/2025 | 1330/0930 | Fed Governor Christopher Waller | ||

| 23/04/2025 | 1345/0945 | *** | S&P Global Manufacturing Index (Flash) | |

| 23/04/2025 | 1345/0945 | *** | S&P Global Services Index (flash) | |

| 23/04/2025 | 1400/1000 | *** | New Home Sales | |

| 23/04/2025 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 23/04/2025 | 1530/1130 | ** | US Treasury Auction Result for 2 Year Floating Rate Note | |

| 23/04/2025 | 1700/1300 | * | US Treasury Auction Result for 5 Year Note | |

| 23/04/2025 | 1715/1815 | BOE's Bailey at Institute of International Finance | ||

| 23/04/2025 | 1800/1400 | Fed Beige Book | ||

| 23/04/2025 | 1800/1900 | BOE's Breeden on Monetary Policy and Financial Stability | ||

| 23/04/2025 | 1915/2115 | ECB's Lane in panel on Central Bankers' Dilemmas Amid Changing Liquidity | ||

| 23/04/2025 | 1945/2145 | ECB's Cipollone in panel on Tokenization and the Financial System | ||

| 23/04/2025 | 2230/1830 | Cleveland Fed's Beth Hammack |