MNI ASIA MARKETS ANALYSIS: Risk Sentiment Cools Ahead Tariffs

HIGHLIGHTS

- Treasuries consolidated off early session lows but held to a narrow lower range after this morning's near steady weekly claims & GDP while wholesale & retail inventories were lower than expected.

- General risk-sentiment remained muted after President Trump announced a 25% tariffs on auto imports last night - starting next week.

- Projected rate cuts through mid-2025 gained slightly (but off midday highs) vs. early morning levels (*) as follows: May'25 at -3.9bp, Jun'25 at -17.4bp (-17.2bp), Jul'25 at -29bp (-28bp), Sep'25 -43.2bp (-42.2bp).

MNI US TSYS: Tsy Yields Inch Higher, Focus on Tariffs Continue

- Treasuries look to finish moderately lower for the most part, underlying focus remains on tariffs after President Trump announced a 25% tariffs on auto imports last night - starting next week.

- Tsy futures see-sawed off late overnight lows after weekly claims come out near in-line with expectations, continuing claims lower than expected while the prior was also down-revised. GDP near expectations, Personal Consumption a little lower than expected as are Wholesale/Retail Inventories.

- Pending home sales ticked up to 72.0 in February from 70.6 in January, per the NAR's index. This represents a slightly better-than-expected rebound from January's all-time low, but at still moribund levels (the index's construction implies sales were 28% below the levels of 2001 when the series begins).

- TYM5 currently 110-13 last (-5) - well within the session range after the $44B 7Y note auction (91282CMT5) tailed 0.6bp with 4.233% high yield vs. WI of 4.227%. Initial technical support below at 110-06.5/06 (50-day EMA/Intraday low).

- Curves twisting steeper with the short end outperforming throughout the session (2s10s +4.203 at 37.307, 5s30s +2.302 at 62.685 vs. 63.866 -- the steepest level since early January 2022.).

- Today marked value-date month- and quarter end in FX markets, and despite the signals pointing to US corporate demand for dollars, the USD index sits weaker on the session, declining 0.25% on the session as we approach the APAC crossover.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00227 to 4.32492 (+0.00481/wk)

- 3M -0.00350 to 4.29917 (+0.00134/wk)

- 6M -0.00698 to 4.21660 (+0.01194/wk)

- 12M -0.00614 to 4.05880 (+0.03542/wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.35% (+0.02), volume: $2.472T

- Broad General Collateral Rate (BGCR): 4.34% (+0.03), volume: $950B

- Tri-Party General Collateral Rate (TCR): 4.34% (+0.03), volume: $921B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $104B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $273B

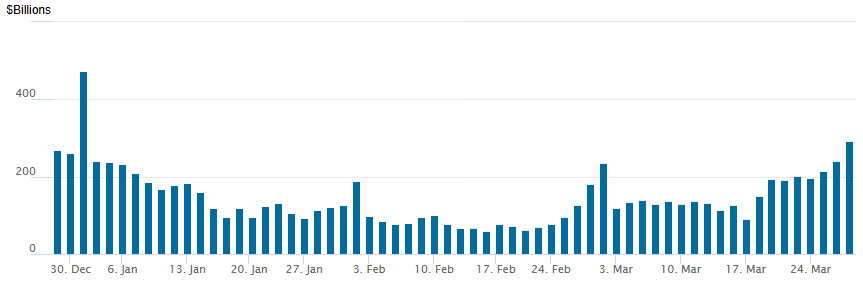

FED Reverse Repo Operation

RRP usage climbs to $291.785B this afternoon from $241.371B Wednesday. Compares to $58.770B (lowest level since mid-April 2021) on February 14. The number of counterparties at 43.

US SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury options continued to revolve around low delta/upside calls Thursday, overall volumes rather muted, however. Projected rate cuts through mid-2025 gained slightly (but off midday highs) vs. early morning levels (*) as follows: May'25 at -3.9bp, Jun'25 at -17.4bp (-17.2bp), Jul'25 at -29bp (-28bp), Sep'25 -43.2bp (-42.2bp).

SOFR Options:

Block, 3,000 0QJ5 96.62/96.87/97.12 call flys, 2.0 ref 96.42

4,000 SFRZ5 96.50/97.00 call spds vs. SFRH6 97.00/97.50 call spds

4,000 SFRZ5 97.00/97.25 call spds ref 96.235

Block, 5,202 SFRK5 95.75/95.81/95.87 call flys, 1.0 ref 95.86

1,500 SFRM5 95.68/95.81/95.93 put flys ref 95.86

5,000 0QM5 96.75/97.00 call spds ref 96.405 to -.41

2,000 0QM5 96.56/97.06/97.56 call flys ref 96.425

3,000 x3 SFRU5 96.50/97.00 call spds vs. SFRU5 95.25/95.75 3x2 put spds ref 96.09

Treasury Options:

3,000 TYM5 110.5/112/113 broken call flys, 21 ref 110-12 to -12.5

2,000 FVM5 105/106.5/107/107.5 broken put condors ref 107-21.75

2,000 USM5 107 puts, 7 ref 115-19

2,500 TYK5 108.75/113.25

over 26,000 FVK5 108.25/109.25 call spds ref 107-18.5 to -18.75

over 15,900 TYK5 112 calls, mostly 14-16, 15 last

over 5,000 TYK5 109 puts, 16 last

over 5,200 TYK5 110 puts, 39 last

1,700 FVN5 107.75 straddles

8,200 wk4 TY 112.5 calls ref 110-07 (exp Fri)

over 6,700 wk4 TY 111 calls, 3 ref 110-08.5 (exp Fri)

MNI BONDS: EGBs-GILTS CASH CLOSE: Bunds Rally Amid Auto Tariff Concerns

European curves steepened Thursday, with Bunds easily outperforming Gilts.

- The overnight announcement of the US's imposition of 25% tariffs on auto imports saw Bunds rally on the open, and while they would fluctuate through the session they held onto those gains.

- Conversely, Gilts weakened through most of the morning session, as equities regained ground, and the UK seen as relatively less economically vulnerable to the auto tariffs.

- Norges Bank held rates (a slight chance of a cut had been priced), while in data, Eurozone lending and M3 money supply growth picked up.

- Both Bunds and Gilts gained on weaker-leaning US data out in early afternoon. Both the UK and German curves twist steepened, with short-end yields lower. Periphery EGB / semi-core spreads were mixed but little changed overall.

- Friday's data includes UK retail sales and GDP, with the first country-level data of March's flash Eurozone inflation round (France and Spain) - MNI's preview is here - and ECB CPI expectations, plus appearances by Nagel and Muller.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5bps at 2.069%, 5-Yr is down 4.1bps at 2.373%, 10-Yr is down 2.2bps at 2.773%, and 30-Yr is down 0.3bps at 3.134%.

- UK: The 2-Yr yield is down 1.7bps at 4.273%, 5-Yr is up 2.2bps at 4.392%, 10-Yr is up 5.5bps at 4.783%, and 30-Yr is up 5.9bps at 5.368%.

- Italian BTP spread up 0.4bps at 110.6bps / Spanish down 0.2bps at 62.3bps

MNI EGB OPTIONS: Some Rolling, Some Upside In Rates Thursday

Thursday's Europe rates/bond options flow included:

- OEK5 118.50c, bought for 18 and 18.5 in ~10.3k

- RXK5 126.50/125.50/124.00 broken put fly, bought for 5 in 4.4k

- RXM5 133.50 calls paper paid 12.5 on 8K

- ERN5 98.0625/98.25/98.4375 call fly bought for 2.75 on 9k all day

- 0RJ5/0RK5 98.00/98.125 call spread vs. 97.5625 put roll, paper paid 0.00 for the K5 on 20K all day

- 2RJ5 97.75/97.875 call spread vs. 97.3125 put vs. 2RK5 97.75/97.875 call spread vs. 97.1875 put roll, paper paid -0.25 for the K5 on 7K

- 2RZ5 97.25/97.00 put spread vs. ERQ5 97.75 puts, paper pays 2.25 for the put spread on 10K

- SFIM5 96.45/97.75 call spread paper paid 0.25 on 27K

MNI FOREX: USDJPY Pierces Above Key Resistance, GBP Outperforms

- Today marked value-date month- and quarter end in FX markets, and despite the signals pointing to US corporate demand for dollars, the USD index sits weaker on the session, declining 0.25% on the session as we approach the APAC crossover.

- GBP has outperformed on Thursday relative to the rest of G10, with the stability off lows for GBPUSD overnight largely responsible. Markets continue to digest the relatively smooth reception of yesterday's Spring Statement.

- Despite the moderate declines for US stock indices, the JPY is weaker, and USDJPY has pierced above a key cluster of resistance around 150.95, trading to a three-week high of 151.15.

- This has allowed GBPJPY to extend its intra-day rally to ~0.85%, comfortably extending above the 195.00 across the session. We noted yesterday Tuesday that on a shorter-term basis, 20-and 50-day moving averages have proven supportive for the cross, culminating in a test of medium-term pivot resistance at the 195.00 mark. On the topside, 198.95 would be a notable target for the move.

- In similar vein, AUDJPY is also breaking above its 50-day EMA, which intersected ~95.20. Importantly, we have not closed above this average since January. Above here, the February highs at 97.33 would be a notable target for a more protracted recovery.

- The single currency also trades well, shrugging off the latest auto-tariff developments, with EURUSD hovering just below 1.08 after recording a fresh pullback low of 1.0735 overnight. Faring less well has been the Mexican peso, depreciating over 1% against the greenback, as President Sheinbaum said her administration is working on a thorough response to auto tariffs. USDMXN trades at 20.33 ahead of what should be a well telegraphed 50bp cut from Banxico late Thursday.

- Eurozone inflation data kicks off Friday, with readings from France and Spain. UK retail sales and activity data is also scheduled before the focus turns to the US PCE report.

MNI FX OPTIONS: Expiries for Mar28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.4bln), $1.0750(E790mln), $1.0800(E2.7bln)

- USD/JPY: Y150.40($863mln), Y151.00($1.3bln)

- EUR/GBP: Gbp0.8450(E604mln)

- USD/CAD: C$1.4145-50($1.2bln), C$1.4330-50($1.2bln), C$1.4400($601mln)

- USD/CNY: Cny7.3800($812mln)

MNI US STOCKS: Late Equities Roundup: Remain Inside Lower Marrow Range

- US equity indexes continue to hold mild to moderately lower levels late Thursday, risk sentiment dampened after President Trump announced a 25% tariffs on auto imports last night - starting next week. Currently, the DJIA trades down 84.77 points (-0.2%) at 42373.58, S&P E-Minis down 2.5 points (-0.04%) at 5758, Nasdaq down 10.6 points (-0.1%) at 17891.31.

- Information Technology and Energy sectors continued to underperform in late trade, chip makers weighing on the Tech sector: Palo Alto Networks -4.92%, Super Micro Computer -4.86%, Broadcom -4.21% and Advanced Micro Devices -3.31%.

- Ironically, Oil and gas shares traded weaker after the Trump administration expressed its preference for lower crude prices to fight inflation: ONEOK -2.16%, EQT Corp -2.15%. EOG Resources -1.87%, Phillips 66 -1.56%, Marathon Petroleum Corp and Diamondback Energy both -1.45%

- The Consumer Discretionary sector held a wide range of auto-share prices in the first half: AutoZone +3.21%, O'Reilly Automotive +2.76%, CarMax +2.44% and Tesla +1.74% off earlier highs). On the flipside General Motors -6.30%, Aptiv -4.36%, Ford Motor -2.72%.

- Broadline retailers buoyed the Consumer Staples sector with Dollar Tree +10.88%, Dollar General +3.15% and Bunge Global +3.09%.

MNI EQUITY TECHS: E-MINI S&P: (M5) MA Studies Highlight A Dominant Downtrend

- RES 4: 5970.87 61.8% retracement of the Feb 19 - Mar 13 bear leg

- RES 3: 5924.59 50-day EMA

- RES 2: 5864.25 Low Jan 13 and a recent breakout level

- RES 1: 5837.25 High Mar 25

- PRICE: 5723.75 @ 13:42 GMT Mar 27

- SUP 1: 5650.75/5559.75 Low Mar 18 / 13 and the bear trigger

- SUP 2: 5483.50 2.00 proj of the Dec 6 ‘24 - Jan 13 - Feb 19 swing

- SUP 3: 5396.00 2.236 proj of the Dec 6 ‘24 - Jan 13 - Feb 19 swing

- SUP 4: 5341.87 2.382 proj of the Dec 6 ‘24 - Jan 13 - Feb 19 swing

S&P E-Minis traded lower yesterday but for now, price remains closer to recent highs. The trend is bearish and gains since Mar 13 are considered corrective. Note that the 20-day EMA has been breached. A continuation higher near-term would open 5864.25, the Jan 13 low. MA studies are in a bear-mode set-up, highlighting a dominant downtrend. A stronger reversal lower would refocus attention on 5559.75, the Mar 13 low and bear trigger.

MNI COMMODITIES: Gold Hits New Record High, Copper Pulls Back, WTI Edges Up

- Gold reached a fresh all-time high as haven demand remained high following President Trump’s auto tariffs announcement. Spot gold is currently up 1.2% on the day at $3,057/oz, just $3 below the earlier high.

- The trend condition in gold remains bullish, with sights on $3,079.2 next, a Fibonacci projection.

- Yesterday, Goldman Sachs raised their year-end gold forecast to $3,300 from $3,100, putting their forecast range to $3,250-3,520.

- Citing upside surprises in ETF flow and continued strong central bank demand, they see medium-term price risks skewed to the upside.

- In contrast, copper has pulled back from yesterday’s record high, falling by 2.3% today to $512/lb.

- The move likely reflects traders taking profits and reassessing scope to secure new supplies before tariffs take effect. Goldman Sachs still expects copper demand and supply imbalances to favour more bullish price action into Q3.

- A bull cycle in copper futures remains in play. A clear break of major resistance at $519.90, the May 20 ‘24 high, would open $542.70, a Fibonacci projection.

- Meanwhile, WTI is slightly stronger today, driven by US inventory drawdowns and expected reductions in global supply amid tighter restrictions against Iran and Venezuela. Worsening Middle East tensions and ongoing US-Russia-Ukraine negotiations heighten market uncertainty.

- WTI May 25 is up by 0.4% at $69.9/bbl.

- Despite recent gains, a bearish trend condition in WTI futures remains intact, and gains are considered corrective. However, a key resistance at $69.17, the 50-day EMA, has been pierced, opening $70.98, the Feb 25 high.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 28/03/2025 | 0700/0800 | * | GFK Consumer Climate | |

| 28/03/2025 | 0700/0800 | ** | Retail Sales | |

| 28/03/2025 | 0700/0700 | *** | Retail Sales | |

| 28/03/2025 | 0700/0700 | * | Quarterly current account balance | |

| 28/03/2025 | 0700/0700 | *** | GDP Second Estimate | |

| 28/03/2025 | 0700/0700 | ** | Trade Balance | |

| 28/03/2025 | 0745/0845 | ** | PPI | |

| 28/03/2025 | 0745/0845 | ** | Consumer Spending | |

| 28/03/2025 | 0745/0845 | *** | HICP (p) | |

| 28/03/2025 | 0800/0900 | *** | HICP (p) | |

| 28/03/2025 | 0800/0900 | ** | KOF Economic Barometer | |

| 28/03/2025 | 0830/0930 | ECB de Guindos At Fed. of Female Professionals Conf | ||

| 28/03/2025 | 0855/0955 | ** | Unemployment | |

| 28/03/2025 | 0900/1000 | Business and Consumer confidence | ||

| 28/03/2025 | 0900/1000 | ** | ECB Consumer Expectations Survey | |

| 28/03/2025 | 1000/1100 | * | Consumer Confidence, Industrial Sentiment | |

| 28/03/2025 | 1100/1200 | ** | PPI | |

| 28/03/2025 | 1230/0830 | *** | Personal Income and Consumption | |

| 28/03/2025 | 1230/0830 | *** | Gross Domestic Product by Industry | |

| 28/03/2025 | 1400/1000 | *** | U. Mich. Survey of Consumers | |

| 28/03/2025 | 1400/1000 | ** | University of Michigan Surveys of Consumers Inflation Expectation | |

| 28/03/2025 | 1500/1100 | Finance Dept monthly Fiscal Monitor (expected) | ||

| 28/03/2025 | 1615/1215 | Fed Governor Michael Barr | ||

| 28/03/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 28/03/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 28/03/2025 | 1930/1530 | Atlanta Fed's Raphael Bostic |