MNI ASIA MARKETS ANALYSIS: Stocks Up Despite Sentiment Decline

HIGHLIGHTS

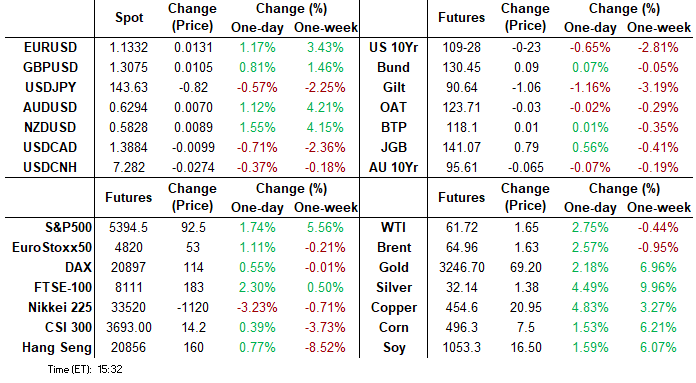

- Treasury yields gained Friday, off highs by the bell, stocks managed to trade higher despite pick up inflation expectations and decline in sentiment via the University of Michigan data.

- Stocks gained off overnight lows after China upped retaliatory tariff on US goods to 125% from 84%, but capped them there. Otherwise, lack of additional tariff bombshells spurred short covering ahead the weekend.

- the greenback continued to come under pressure, culminating in a further 1.7% depreciation for the US dollar index to 99.01 lows, the lowest level since April 2022.

MNI US TSYS: Fed Holds Right Stance, Modestly Restrictive: NY Fed Williams

- Treasuries look to finish weaker Friday, off late morning lows after the bell, curves bear flattening after posting steeper levels on the open.

- Tsy Jun'25 10Y futures currently trade 109-24 (-27) -- after breaching a couple levels of support to mark a session low ofg 109-08, curves flatter/off early highs: 2s10s currently -2.061 at 53.192 (65.521 high), 5s30s -8.343 at 71.171 (86.760 high). 10Y yield at 4.4797% +.0548 vs. 4.5864% high.

- Treasury futures moving off lows after lower than expected PPI (prior up-revised slightly): PPI readthrough for core PCE looked fairly neutral on net vs expectations - core PCE will likely come in slightly higher than core CPI as expected but there won't be a huge margin (0.06% M/M core CPI vs ~0.11% core PCE consensus pre-PPI, either way a pullback from 0.365% M/M core PCE in Feb)

- Treasury futures holding near lows after lower than expected UofM sentiment & higher than anticipated inflation expectations. To put April's UMich consumer sentiment and inflation expectations into long-term perspective: we're back to the early 80s for 5-10Y inflation expectations (6.7%), but overall consumer sentiment is even worse now than it was then (around record lows at 47.2 in April).

- Cross asset: Stocks hold moderate gains (SPX eminis 100.0 at 5401.0), Gold climbed to a new high of 3244.39, Bbg US$ index lower at 1234.71 (-11.55).

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00788 to 4.32880 (+0.00896/wk)

- 3M +0.01206 to 4.24171 (-0.01727/wk)

- 6M +0.01705 to 4.06999 (-0.05553/wk)

- 12M +0.01736 to 3.82210 (-0.04113/Wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.37% (-0.05), volume: $2.657T

- Broad General Collateral Rate (BGCR): 4.36% (-0.04), volume: $1.061T

- Tri-Party General Collateral Rate (TCR): 4.36% (-0.04), volume: $1.020T

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $92B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $241B

FED Reverse Repo Operation

RRP usage retreats below $100B to $98.531B this afternoon from $129.950B on Thursday. Usage had surged to the highest level since December 31, 2024 last Monday, March 31: $399.167B. Compares to $58.770B (lowest level since mid-April 2021) on February 14. The number of counterparties at 30.

US SOFR/TREASURY OPTION SUMMARY

SOFR option volumes outpaced Treasury options Friday, the former saw better put unwinds/taking profits, others fading the reversal in underlying futures to buy cheaper calls, call spreads. Underlying futures are off session lows while projected rate hike pricing has consolidate: current levels vs. this morning (*) as follows: May'25 at -6bp (-8.2bp), Jun'25 at -22.2bp (-27.6bp), Jul'25 at -40.1bp (-48.9bp), Sep'25 -54.8bp (-67bp).

SOFR Options:

+5,000 0QN5 97.25/3QN5 96.87 call spds, 4.5-4.75 steepener

-10,000 SFRU5 95.75/95.93 put spds, 5.75 ref 96.26

+6,000 0QZ 97.50 calls, 17.5 ref 96.59

+30,000 SFRU5 94.62/95.12 put spds, 0.5 ref 96.25

-5,000 SFRM5 96.12 calls, 12.0-11.5 ref 95.95

-10,000 SFRQ5 95.50/95.68/95.87 put flys, 3.25 ref 96.26

-10,000 SFRN5 95.62/95.81/96.00 put flys, 3.75 ref 96.26

+6,000 SFRZ5 96.25/96.37/96.43/96.56 call condors, 1.25 ref 96.495

+10,000 SFRZ5 97.00/97.50 call spds, 9.5 ref 96.485

+20,000 SFRU5 96.37/96.50 call spds, 3.75 ref 96.28

-40,000 0QM5 97.00/97.50 call spds, 9.0-9.5 ref 96.69

+10,000 SFRU5 96.37/96.50 call spds, 3.75 ref 96.32

-6,000 2QU5 96.00/97.00 call over risk reversal, 6.0 vs. 96.50/0.45%

+8,000 0QM5 97.00/97.25 call spds, 5.75 ref 96.705

5,000 SFRK5 96.25/96.50 call spds, 2.75 ref 95.97

5,000 SFRN5 96.50/97.00 call spds

Block, 5,000 SFRK5 96.25/96.50/97.00 broken call flys on 1x1x1 ratio, 6

Block, 27,440 SFRM5 96.18/96.25 call spds, 1.0 ref 95.995 to -.99

47,000 0QU5 97.25/97.68 call spds ref 96.745 to -.76

10,000 0QM5 95.87 puts ref 96.74

Block, 3,000 SFRK5 95.75 puts, 1.25

Block, 22,600 SFRU5 95.50 puts, 1.0-1.25 vs. 96.41/0.04%

Block, 3,000 SFRZ5 97.75/98.50 2x3 call spds, 8.5 ref 96.555

Block, 2,500 2QK5 96.75/96.93/97.06 broken call flys, 3.0 vs. 96.585/0.06%

5,900 0QK5 97.06/97.43/97.56 broken call flys ref 96.73

6,000 SFRZ5 97.50 calls ref 96.56

2,600 0QZ5 98.50/99.25 2x3 call spds ref 96.75

Treasury Options

5,000 TYK5 109.5/111 call spds ref 109-23

11,000 USK5 107/107.5 call spds

Block, 25,000 TYK5 109.25 puts, 33 ref 110-10

over 9,000 USK5 112.5/114 put spds ref 113-18

1,500 TYK5 111/111.5 call spds vs. 109.5/110 put spds ref 110-09.5

3,000 TYK5 112/113 call spds, 7 ref 110-12

2,000 TYK5 113.5 calls, 5 ref 110-08 to -06

MNI BONDS: EGBs-GILTS CASH CLOSE: Bund Outperformance Caps Bull Steepening Week

European yields reversed most of the prior session's moves Friday, with Bunds outperforming.

- Spillover from a renewed rise in US Treasury yields saw Bunds/Gilts soften in early trade, but a flight to quality and a modest recovery in USTs helped yields edge lower.

- Indeed Bunds appeared to be the beneficiary of a global rotation out of US assets as tariff uncertainty lingered, suggested by higher Treasury yields and a weaker dollar.

- A multi-decade high in US consumer inflation expectations helped bring the rally to an end, however.

- Gilts badly underperformed Bunds in a reversal of Thursday's strength: at one point the 10-Year gilt/Bund spread was on track for its first close above 220bp since mid-January.

- For the week, the UK curve bear steepened (2s +11bp, 10Y +30bp), with Germany's bull steepening (2s -4bp, 10s -1bp).

- Periphery/semi-core EGB spreads were mixed but largely wider, with OATs underperforming.

- Next week's schedule includes UK Feb/Mar Labour Market and Mar Inflation Data, and the ECB meeting.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.3bps at 1.789%, 5-Yr is up 1.9bps at 2.132%, 10-Yr is down 1bps at 2.57%, and 30-Yr is down 6.9bps at 2.891%.

- UK: The 2-Yr yield is up 14.5bps at 4.048%, 5-Yr is up 13.2bps at 4.21%, 10-Yr is up 11bps at 4.753%, and 30-Yr is up 8.8bps at 5.516%.

- Italian BTP spread down 0.1bps at 124.2bps / French up 3.6bps at 80bps

MNI EGB OPTIONS: Sonia Structure Highlights Rate Upside Friday

Friday's Europe rates/bond options flow included:

- RXM5 129.00/127.50/126.50p ladder sold at 11 in 6k (Downside unwind).

- ERM5 98.125 call paper paid 2.25 on 6K

- SFIM5 96.30/96.40cs vs 95.75/95.65ps, bought the cs for 0.25 in 17.5k total

MNI FOREX: Higher US Yields Provide Greenback Reprieve

- Friday’s FX session was very volatile on Friday and was a tale of two halves for the US dollar. Initially, the greenback continued to come under pressure, culminating in a further 1.7% depreciation for the US dollar index to 99.01 lows (100.05 after the bell) the lowest level since April 2022. Price action had been exacerbated by China announcing additional tariffs on US goods, reaching 125%.

- The euro was the main beneficiary of this dynamic, and EURUSD narrowed the gap to the 1.15 handle substantially, reaching a 1.1473 high (1.1335 late). However, the low yielding safe haven also made strong advances against the dollar.

- However, as the US session developed, selling of treasuries became the main theme which provided a bottom for the waning dollar. The US 10 year yield rose as high 4.58%, prompting a strong reversal higher for USDJPY specifically. USDJPY rose from 142.07 lows to trade closer to 143.66 ahead of the close. The pair was also supported by a solid recovery for major US equity benchmarks, but does remain down 0.4% on the session.

- The reprieve for the dollar helped EURUSD back below 1.13, also roughly 200 pips off the prior session highs. In tandem USDCHF headed back towards 0.8200, however the earlier 0.8099 low matched perfectly with touted support, the 76.4% retracement of the Jan 15 '15 - Dec 15 '16 recovery. SNB domestic sight deposits data out Monday will give indication on any potential intervention this week.

- Other major currencies such as GBP, AUD and CAD have all strengthened in line with the dollar index adjustment, however, NZD remains an outperformer. Nothing stands out in the newsflow to explain this, however, NZDUSD did reverse the entirety of the post-liberation day selloff which may have triggered some additional short covering above the 0.5800 mark.

- China trade data and FOMC speech highlights Monday’s session, before the focus will turn to central bank decisions in Canada and ECB later in the week.

MNI US STOCKS: Late Equities Roundup: Moderate Risk-On, Banks Kickoff Earnings

- Stocks trade firmer late Friday, off highs - and certainly off Wednesday's post-tariff pause highs. Stocks support earlier in the second half likely had more to do with Boston Fed Collins Fed "tools" comments than Pres Trump's open door policy with CEOs.

- Information Technology and Materials sectors continued to underpin major indexes with, the DJIA trades up 593.89 points (1.5%) at 40170.92, S&P E-Minis up 88.25 points (1.66%) at 5387.5, Nasdaq up 280.8 points (1.7%) at 16659.92.

- Semiconductor and hardware makers continued to buoy the Tech sector: Monolithic Power Systems +8.21%, Applied Materials +4.89%, Advanced Micro Devices +4.84%, Broadcom +3.92%, Dell Technologies +3.88% and QUALCOMM +3.30%.

- The Materials sector well bid as Gold surged to new high of 3244.39 Friday: Newmont +9.13%, Mosaic +6.36%, Freeport-McMoRan +6.22% and Martin Marietta Materials +3.75%.

- On the flipside, Consumer Discretionary and Communication Services sectors underperformed in the second half, Aptiv -3.58%, Norwegian Cruise Line -2.97%, Deckers Outdoor -1.64%, Tesla -1.49% and Tapestry -1.43% weighed on the Discretionary sector.

- Meanwhile, interactive media and entertainment shares weighed on the Communication Service sector: Warner Bros Discovery -2.53%, Paramount Global -2.34%, Fox Corp -1.28% and Charter Communications -1.21%.

- Of note, the latest earning cycle kicked off in earnest this morning with Bank of NY Mellon, Wells Fargo, JP Morgan and Morgan Stanley reporting.

MNI EQUITY TECHS: (M5) Corrective Cycle

- RES 4: 5906.75 High Mar 6

- RES 3: 5837.25 High Mar 25 and the reversal trigger

- RES 2: 5737.71 50-day EMA

- RES 1: 5524.91 20-day EMA

- PRICE: 5395.00 @ 1530 ET Apr 11

- SUP 1: 5098.16 61.8% retracement of the Apr 7 - 10 bounce

- SUP 2: 4832.00 Low Apr 7 and the bear trigger

- SUP 3: 4760.88 1.618 proj of the Feb 19 - Mar 13 - 25 price swing

- SUP 4: 4663.75 1.764 proj of the Feb 19 - Mar 13 - 25 price swing

A short-term reversal in S&P E-Minis on Wednesday highlights the start of what appears to be a corrective cycle. The trend condition has been oversold following recent weakness and the move higher is allowing this set-up to unwind. Initial resistance to watch is 5524.91, the 20-day EMA. Resistance at the 50-day EMA is at 5737.71. On the downside, key support and the bear trigger has been defined at 4832.00, the Apr 7 low.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 14/04/2025 | - | *** | Trade | |

| 14/04/2025 | - | *** | Money Supply | |

| 14/04/2025 | - | *** | New Loans | |

| 14/04/2025 | - | *** | Social Financing | |

| 14/04/2025 | 1230/0830 | ** | Wholesale Trade | |

| 14/04/2025 | 1500/1100 | ** | NY Fed Survey of Consumer Expectations | |

| 14/04/2025 | 1530/1130 | * | US Treasury Auction Result for 26 Week Bill | |

| 14/04/2025 | 1530/1130 | * | US Treasury Auction Result for 13 Week Bill | |

| 14/04/2025 | 1700/1300 | Fed Governor Christopher Waller | ||

| 14/04/2025 | 2200/1800 | Philly Fed's Pat Harker | ||

| 15/04/2025 | 2301/0001 | * | BRC-KPMG Shop Sales Monitor | |

| 14/04/2025 | 2340/1940 | Atlanta Fed's Raphael Bostic | ||

| 15/04/2025 | 0130/1130 | RBA Meeting Minutes |