MNI ASIA MARKETS ANALYSIS: Tariff Management a Challenge

HIGHLIGHTS

- Treasuries look to finish mixed, well off early session highs as hopes of slash China tariffs that spurred strong risk on flows earlier evaporated.

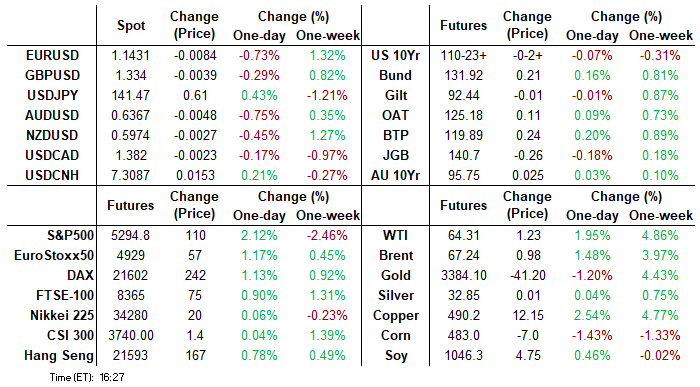

- FX positioning dynamics appear leaned in favour of the greenback across the major pairs, as the likes of USDJPY and USDCHF look set to close the session with gains above 1%.

- Late rebound in stocks as Pres Trump said to exempt certain automakers from US tariffs, Financial Times.

MNI US TSYS: Trade Wars Are Not an Easy Win, Negotiations Take Time

- Treasuries finishing near late session lows, curves continue to unwind Monday's sharp steepening with short end rates weaker vs. Bonds. Busy session for chasing tariff related headline risk.

- Treasuries opened higher as Pres Trump softened his stance on sacking Fed Chair Powell and reducing China tariffs, improved sentiment also lifting S&P eminis with ESM5 futures tapping 5499.75 high.

- Rates gapped higher briefly on a WSJ article that rehashed possible China tariff cuts, but support was short lived as markets assessed potential reductions, non-unilateral negotiations as well as comments from Tsy Sec Bessent's "in need of a rebalancing".

- US Treasury Secretary Bessent further stated that there is no unilateral offer from Trump to cut China tariffs, and that a full China trade deal could take two-to-three years.

- Tsy Jun'25 10Y futures currently -3.5 at 110-22 vs. session high of 111-18.5. Initial technical support at 110-15 (Apr 15 low) followed by 109-08 (bear trigger). Curves holding flatter profiles but off lows, 2s10s -5.713 at 52.252 (46.527 low), 5s30s -6.569 at 81.760 (77.371 low).

- Cross asset: Bbg US$ index near session high currently +6.84 a t 1228.46; stocks firmer but well off highs: SPX eminis +90.50 at 5405.25 (5499.75 high), Gold cratered: down over 103 at 3277.5 earlier trades 3295.5 at the moment, crude retreated as well (WTI -1.36 at 62.31).

REFERENCE RATES (PRIOR SESSION)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.30% (-0.02), volume: $2.527T

- Broad General Collateral Rate (BGCR): 4.29% (-0.03), volume: $1.034T

- Tri-Party General Collateral Rate (TCR): 4.29% (-0.03), volume: $993B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $99B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $287B

FED Reverse Repo Operation

RRP usage rises to $171.780B this afternoon from $137.951B yesterday. Usage had fallen to $54.772B last Wednesday, April 16 -- lowest level since April 2021. Conversely, usage had surged to the highest level since December 31, 2024 on Monday, March 31: $399.167B. The number of counterparties at 45.

US SOFR/TREASURY OPTION SUMMARY

Decent SOFR & Treasury option flow on the day, leaning towards downside rate hedges and curve steepeners fading today's flattening. Underlying futures near late session lows as early sentiment over slashing China tariffs evaporated. Projected rate cuts continue to retreat from this morning's levels (*) as follows: May'25 at -2.1bp (-2.7bp), Jun'25 at -15.1bp (-17.7bp), Jul'25 at -33.6bp (-36.9bp), Sep'25 -51.6bp (-55.2bp).

SOFR Options:

-7,000 SFRM5 95.87 calls, 9.5

+10,000 SFRK5 95.68/95.75 put spds, 0.75

Block, -5,000 SFRZ5 96.62/97.12 call spds, 13.0 vs. 96.49/0.18%

+20,000 0QM5/0QN5 97.00/97.25 call spd spd, 1.25 net/July over

-10,000 SFRM5 95.75/95.93/96.18/96.37 call condors, 5.5 ref 95.89

+4,000 0QU5 97.00/97.50 call spds 1.25 over 2QU5 96.87/97.37 call spds

+10,000 SFRU5 95.25/95.75 put spds, 3.25 ref 96.245

-4,000 SFRZ5 96.25/96.50/96.81 broken call flys, 1.0 ref 96.505

10,000 SFRU5 95.75/95.87/96.00 put trees, 0.5 ref 96.24

Blocks, 12,000 0QM5 96.87/97.25 call spds, 10.5 ref 96.76

5,000 SFRM5 95.62 puts & 5,900 USM5 95.75 puts

3,000 SFRZ5 95.37/95.62 put spds ref 96.495

3,000 SFRM5 96.18 calls, 5.0 ref 95.88

3,300 SFRZ5 95.37/95.81 put spds ref 96.49

Blocks, 6,700 SFRU5 95.25/95.75 put spds, 3.75

2,000 SFRK5 95.68/95.75 2x1 put spds ref 95.88

2,000 SFRM5 96.25/96.37 call spds ref 95.855

2,000 SFRK5 96.12/96.25 call spds vs. 95.75 puts ref 95.90

Treasury Options:

6,500 TYM5 111 calls, 59, total volume over 33.5k

5,000 TYK5 110.5 puts, 7 ref 111-00.5

5,000 TYM5 111 puts, 54 ref 111-03 total volume over 26k

+7,500 TYM5 111 straddles, 156

2,000 TYN5 109/114 strangles ref 111-10

1,058 FVM5 108.5/109.5/110.5 call flys ref 108-12

+1,000 FVK5 108.25/108.5 strangles, 18.5 ref 108-11.75

over 19,900 TYK5 111.5 calls

over 14,400 TYM5 112 calls, 36 last

over 10,500 TYM5 115.5 calls, 4 last

over 3,600 USM5 117 calls, 108 last ref 115-10

1,600 TYK5 111/111.5 strangles ref 111-04

1,500 FVN5 107/108 put spds ref 108-09.75

Block, 10,000 TYM5 112/115.5 call spds, 30 vs 111-01/0.28%

1,500 FVM5 109/110/110.5 broken call flys ref 108-06.5

1,500 TYK5 110.5/111.75 call spds ref 110-31.5

9,000 USM5 118/120 call spds, 18 ref 114-14

3,600 TYK5 111.5 calls, 6 ref 110-28.5

MNI BONDS: EGBs-GILTS CASH CLOSE: Curves Flatten On Back-And-Forth US Tariff News

European curves flattened Wednesday, with Bunds underperforming Gilts.

- Bunds were steadily weakening with Gilts a little stronger on the day when an WSJ afternoon sources article pointed toward potential for the US relaxing tariffs on China sent core FI sharply lower. While this was later talked down by US Tsy Sec Bessent, Bunds and Gilts largely held their losses.

- The Eurozone-wide services PMI was on the soft sign of expectations, with weaker-than-expected French and German data appearing to be offset by stronger performances elsewhere in the Eurozone.

- Meanwhile in the UK, public sector net borrowing was higher than expected, though like the Eurozone, Services PMI disappointed. BoE Gov Bailey's speaking appearance was not market-moving.

- While the German and UK curves moved in parallel across the short-end/belly, Gilts outperformed in the segments beyond that with the UK curve twist flattening (vs German bear flattening).

- EGB periphery/semi-core spreads closed tighter amid equity gains and the Bund sell-off, with BTPs and OATs outperforming.

- German IFO leads Thursday's data docket, while we get multiple ECB speakers including Lane.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is up 8.5bps at 1.746%, 5-Yr is up 6.6bps at 2.048%, 10-Yr is up 5.4bps at 2.497%, and 30-Yr is up 5.2bps at 2.911%.

- UK: The 2-Yr yield is up 8.6bps at 3.916%, 5-Yr is up 5.9bps at 4.039%, 10-Yr is up 0.7bps at 4.552%, and 30-Yr is down 5.9bps at 5.309%.

- Italian BTP spread down 3.3bps at 113.3bps / French OAT down 3.7bps at 73.8bps

MNI EGB OPTIONS: Limited Options Flow Includes Large Bobl Put Selling Wednesday

Wednesday's Europe rates/bond options flow included:

- OEM5 118p sold at 14.5 and 14 in 16.25k

- ERH6 98.43/98.12ps 1x2, bought the 1 for 2.25 in 3k

MNI FOREX: Dollar Index Extends Recovery, Advances 0.75%

- Initial overnight price action was dominated by headlines emanating from President Trump, who said it was not his intention to fire the Federal Reserve Chair, Jerome Powell. The news provided a solid boost for the greenback as the market breathed a sigh of relief surrounding the pessimistic narrative attached to the US.

- Despite subsequently trading in a volatile manner, the US dollar index is gaining for a second consecutive session on Wednesday, registering a 0.75% advance as we approach the APAC crossover. This extends the bounce from Monday’s fresh 3-year lows to ~1.7%, with the DXY narrowing the gap back to the psychological 100 mark.

- Positioning dynamics appear to be leaning in favour of the greenback across the major pairs, as the likes of USDJPY and USDCHF look set to close the session with gains above 1%. For USDJPY, spot remains just shy of the overnight highs at 143.22, with initial firm resistance not seen until the 20-day EMA, at 144.90.

- Given the sensitivity of the Swiss Franc to souring sentiment in recent weeks, the recovery in risk appetite has understandably weighed on CHF. This brings USDCHF to 0.8280, a significant 3% recovery from the Monday lows. Resistance is seen at the prior breakdown point of 0.8333, the 2023 low.

- For EURUSD, we appear to be witnessing a technical correction, as even US treasury secretary Bessent remarked on the ‘substantial appreciation’ for the single currency. The softer price action and higher equity markets have weighed on EUR crosses, as the higher beta AUD and NZD relatively outperform.

- Separately, crude front month fell to a fresh low for the week on the potential for another increase in OPEC+ production in June. This in turn weighed on the Norwegian krona, prompting USDNOK to extend session gains to over 1%.

- German IFO data headlines the European calendar on Thursday, before US durable goods, initial jobless claims and existing home sales are scheduled.

MNI FX OPTIONS: Expiries for Apr24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1370(E505mln)

- USD/JPY: Y140.00($1.8bln), Y145.00($1.4bln)

MNI US STOCKS: Late Equities Roundup: Trade Wars Aren't an Easy Win

- Stocks hold decently positive levels in late Wednesday trade - but well off this morning's knee-jerk rally as Treasury Sec Bessent through cold water on trade hopes, clarifying there is no unilateral offer from Trump to cut China tariffs, and that a full China trade deal could take two-to-three years.

- Currently, the DJIA trades up 426.52 points (1.09%) at 39608.04 (40,376 high), S&P E-Minis up 95 points (1.79%) at 5409.5 (5499.75 high), Nasdaq up 465.6 points (2.9%) at 16762.93 (17029.86 high).

- Consumer Discretionary and Information Technology sectors continued to outperform in late trade, leading gainers included Super Micro Computer +10.89%, Amphenol +10.39%, Palantir Technologies +9.00%, Dell Technologies +7.62%, Monolithic Power Systems +7.06% and Advanced Micro Devices +6.82%. Meanwhile, Tesla rallied 8.41% while Amazon gained 4.93%.

- Conversely, a mix of Consumer Staples, Energy and Real Estate sector shares continued to underperform: Enphase Energy -14.62%, Lennox International I-8.10%, American Tower -4.92%, SBA Communications -4.36%, Teledyne Technologies -3.54%, General Dynamics-3.46% and Bristol-Myers Squibb -2.99%.

- Meanwhile, a heavy earnings docket resumes after the close with the following reporting: Whirlpool Corp, Chipotle Mexican Grill, O'Reilly Automotive, Raymond James Financial, Molina Healthcare Alaska Air, Discover Financial Services, Rollins Inc, Newmont Corp, ServiceNow Inc, FirstEnergy Corp, Lam Research Corp, Texas Instruments Inc, Community Health Systems, IBM, United Rentals, Edwards Lifesciences, Viiking Therapeutics and Las Vegas Sands.

MNI EQUITY TECHS: E-MINI S&P: (M5) Corrective Cycle

- RES 4: 5773.25 High Apr 2

- RES 3: 5639.32 50-day EMA

- RES 2: 5528.75 High Apr 10 and the bull trigger

- RES 1: 5485.00 High Apr 15

- PRICE: 5453.25 @ 14:23 BST Apr 23

- SUP 1: 5098.16 61.8% retracement of the Apr 7 - 10 bounce

- SUP 2: 4996.43 76.4% retracement of the Apr 7 - 10 bounce

- SUP 3: 4832.00 Low Apr 7 and the bear trigger

- SUP 4: 4760.88 1.618 proj of the Feb 19 - Mar 13 - 25 price swing

A reversal higher in S&P E-Minis on Apr 9 highlighted the start of a correction. The trend condition has been oversold following recent weakness and gains have allowed this to unwind. Price has traded above the 20-day EMA, at 5425.57, today. This exposes 5528.75, the Apr 10 high. For bears, a resumption of weakness would refocus attention on 4832.00, the Apr 7 low and bear trigger.

MNI COMMODITIES: Pullback In Gold Extends Further, WTI Crude Declines

- Spot gold has fallen by a further 3.0% today to $3,280/oz, taking the pullback from yesterday's $3,500.1 all-time high to over 6%.

- The WSJ's latest article on possible Chinese tariff rollbacks provided the latest source of pressure, coming after market fears had already been calmed somewhat as President Trump softened his stance on Fed Chair Powell.

- The pullback in gold has allowed an overbought condition to unwind, with gold piercing initial support at the April 17 low of $3,284.0. Firm support is seen at the 20-day EMA of $3,193.5. Shallower selloffs will be considered corrective at this stage.

- A dominant uptrend remains intact, however, with moving average studies firmly in a bull-mode setup. Initial resistance is at $3,500.1, the Apr 22 high.

- Meanwhile, crude has fallen in a volatile trading session, with the main bearish driver a Reuters report that some OPEC+ members are pushing for another accelerated supply return in June.

- Earlier signs that the US may ease its tariffs on China were briefly supportive.

- WTI Jun 25 is down by 2.1% at $62.4/bbl.

- Recent weakness in WTI futures has resulted in the breach of a number of important support levels, reinforcing a bearish threat. Initial support is seen at $58.29, the Apr 10 low, followed by $54.67, the Apr 9 low and bear trigger.

- Resistance is seen at $64.49, the Mar 5 low.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 24/04/2025 | 0645/0845 | ** | Consumer Sentiment | |

| 24/04/2025 | 0700/0900 | ** | PPI | |

| 24/04/2025 | 0800/1000 | *** | IFO Business Climate Index | |

| 24/04/2025 | 0900/1000 | ** | Gilt Outright Auction Result | |

| 24/04/2025 | 1000/1100 | ** | CBI Industrial Trends | |

| 24/04/2025 | 1230/0830 | *** | Jobless Claims | |

| 24/04/2025 | 1230/0830 | ** | WASDE Weekly Import/Export | |

| 24/04/2025 | 1230/0830 | * | Payroll employment | |

| 24/04/2025 | 1230/0830 | ** | Durable Goods New Orders | |

| 24/04/2025 | 1300/1500 | ** | BNB Business Confidence | |

| 24/04/2025 | 1300/1500 | ECB's Lane, Peterson Ins Webcast on Monetary Policy Strategy | ||

| 24/04/2025 | 1325/1425 | BOE's Lombardelli on Monetary Policy Strategy | ||

| 24/04/2025 | 1400/1000 | *** | NAR existing home sales | |

| 24/04/2025 | 1430/1030 | ** | Natural Gas Stocks | |

| 24/04/2025 | 1500/1100 | ** | Kansas City Fed Manufacturing Index | |

| 24/04/2025 | 1530/1130 | * | US Bill 08 Week Treasury Auction Result | |

| 24/04/2025 | 1530/1130 | ** | US Bill 04 Week Treasury Auction Result | |

| 24/04/2025 | 1700/1300 | ** | US Treasury Auction Result for 7 Year Note | |

| 24/04/2025 | 2100/1700 | Minneapolis Fed's Neel Kashkari | ||

| 25/04/2025 | 2301/0001 | ** | Gfk Monthly Consumer Confidence | |

| 25/04/2025 | 2330/0830 | ** | Tokyo CPI |