MNI ASIA MARKETS ANALYSIS: Tariff Uncertainty Remains

HIGHLIGHTS

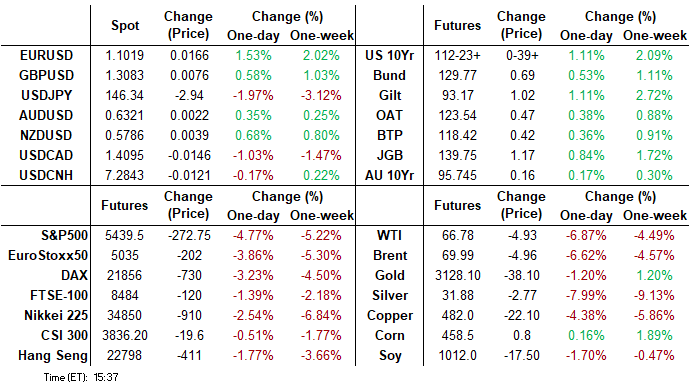

- Treasuries look to finish broadly higher Thursday, heavy risk-off support for rates as stocks cratered in the aftermath of Pres Trump's late Wednesday's reciprocal tariff announcement.

- Markets remain volatile as uncertainty over how tariffs are calculated, the how high they may go and for how long

- US pessimism reverberated into global currency markets, with dollar indices sharply lower on the session, Stocks looked to test session lows in late trade with SPX eminis -4.3%, the tech-heavy Nasdaq -5.5%, the DJIA -3.5%.

MNI US TSYS: US Trade Policy Continues to Weigh Heavily on Sentiment

- Treasuries looked to finish broadly higher Thursday, little off midday highs as markets continue to react negatively to Pres Trump's reciprocal tariff announcement late Wednesday, SPX eminis index fell over 4.25%, the tech-heavy Nasdaq over 5.5%, the DJIA over 3.4%.

- Heavy risk-off support in rates saw June 10Y futures climb to 113-02 midmorning, shy of technical resistance of 113-05 (1.764 proj of the Jan 13 - Feb 7 - Feb 12 price swing), currently trade +1-06.5 at 112-22.5; 10Y yields fall below 4.0 briefly (3.9966% low), currently at 4.0455% after the bell.

- March's ISM Services report showed well below-expected activity measures, alongside a softer-than-expected reading on prices. This wasn't an outright negative report, with an expansionary overall reading and mixed comments about the impact of government policy shifts including tariffs, but it certainly casts a more cautious light on the services sector than February's solid ISM data.

- Despite a rise in projected rate cuts in 2025 rising to three 25bp moves by late October, Fed Governor Jefferson (permanent voter) says there is no need to hurry to make rate adjustments, repeating a stance from Feb 19 when he last spoke on mon pol. "The current policy stance is well positioned to deal with the risks and uncertainties that we face in pursuing both sides of our dual mandate."

- US pessimism reverberated into global currency markets, with dollar indices sharply lower on the session. The ICE dollar index is off its worst levels, but is broadly consolidating a 1.75% decline on Thursday, currently trading around the 102.00 mark.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00184 to 4.32114 (-0.00251/wk)

- 3M +0.00735 to 4.28469 (-0.01292/wk)

- 6M +0.01341 to 4.17789 (-0.03772/wk)

- 12M +0.01995 to 3.97115 (-0.08171/wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.37% (-0.02), volume: $2.555T

- Broad General Collateral Rate (BGCR): 4.34% (-0.01), volume: $983B

- Tri-Party General Collateral Rate (TCR): 4.34% (-0.01), volume: $952B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $104B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $258B

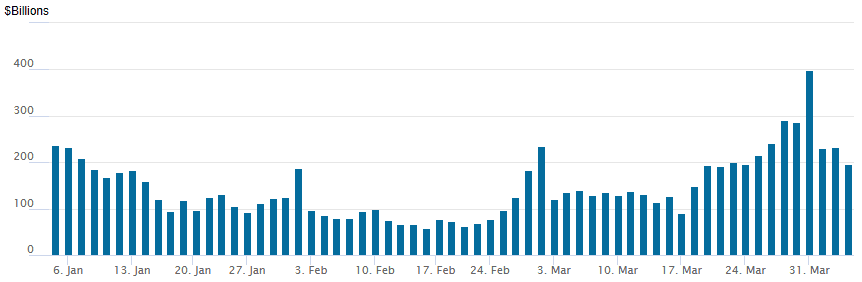

FED Reverse Repo Operation

RRP usage retreats to $196.265B this afternoon from $233.488B on Wednesday. Usage had surged to the highest level since December 31, 2024 this last Monday: $399.167B. Compares to $58.770B (lowest level since mid-April 2021) on February 14. The number of counterparties at 46.

US SOFR/TREASURY OPTION SUMMARY

Surge in SOFR & Treasury option trade Thursday, SOFR seeing much better put volumes - some unwinds while bulk of flow looks to be hedging a reversal in the post-tariff annc rally. Treasury options seeing better 5- and 10Y call flow. Very well bid underlying futures are off midmorning highs. Projected rate cuts through mid-2025 continue to gain vs. late Wednesday levels (*) as follows: May'25 at -6.9bp (-3.4bp), Jun'25 at -22.8bp (-17.9bp), Jul'25 at -42.4bp (-33.1bp), Sep'25 -62bp (-49.6bp).

SOFR Options:

Block, 5,000 SFRM5/SFRU5 95.75/95.87 call spd spd, 3.5 net

Block, 15,300 SFRU5 95.25/95.75 put spds 2.5 ref 96.34

Block, 5,000 SFRM5 95.75 puts, 2.75 ref 96.00

Block, 8,000 SFRU5 95.25/95.75 put spds, 2.5 ref 96.335ref 96.335

-20,000 0QM5 97.00 calls, 17.5 vs. 96.825/0.38%

+20,000 SFRZ5 96.25/96.50/96.75/97.00 call condors, 5.5-5.75 ref 96.55

-5,000 SFRZ5 96.50/97.00/97.50 call flys 7.0 ref 96.56

-2,000 SFRZ5 96.56 straddles, 69.5 ref 96.53

+4,000 SFRM5 95.68/95.76/95.87 put trees 5.5 vs. 95.965/0.07%

+6,000 SFRZ5 96.25/96.50/96.75/97.00 call condors 5.5 ref 96.55

-5,000 SFRM5 95.874 puts vs 0QM5 96.06 puts, 6.5 net

Block, 5,000 SFRM5 95.68/95.75/95.81 put flys, 1.0 ref 95.95

Block, 5,000 SFRM5 96.25/96.75 call spds, 3.75 ref 95.955

-20,000 SFRM5 96.43/96.75 call spds, 1.5

4,000 SFRM5 96.25/96.75 call spds, 3.75 ref 95.935 to -.93

5,300 SFRM5 96.06/96.18/96.37 call flys

7,000 SFRU5 95.31/95.50/95.68 put flys

56,000 SFRM5 95.62/95.75 put spds ref 95.91 to -.94

16,000 SFRZ5 97.00 calls vs. SFRH6 97.00/98.00 call spds

Block, 6,000 SFRM5 96.12/96.37 call spds, 2.75

Block, 5,000 SFRM5/SFRU5 95.75/96.00 call spd spd, 6.5 net

Block, 19,500 SFRM5 95.62/95.68/95.75 put trees, 1.5 vs. 95.935/0.07%

Block, 12,500 SFRM5 95.75/95.87 2x1 put spds, 3.5

9,500 SFRK5 95.75/95.81/95.93 2x3x1 put flys

6,800 SFRK5 95.75/95.81 put spds ref 95.935

7,300 SFRK5 95.75 puts ref 95.93

Block, 3,000 SFRU5/SFRZ5 95.75/95.87 put spd spd, 0.75 net

Block, 5,000 SFRK5 96.06/96.12 call spds 1.25 vs. 95.93/0.06%

Block/screen, +20,500 SFRU5 95.25/95.75 put spds, 2.5-2.75 ref 96.235

6,000 0QU5 97.00/98.00 call spds ref 96.765

Block, 10,000 SFRU5 97.50 calls, 4.5 ref 96.24

2,000 0QZ5 96.50/96.75/97.25/97.50 call condors ref 96.73

18,300 SFRU5 95.62/95.75 put spds ref 96.23

2,000 SFRK5 96.00/96.12 call spd svs. 95.62/95.75 put spds ref 95.93

2,000 SFRM5 96.00/96.25/96.37 call flys ref 95.93

1,500 SFRU5 96.00/96.12/96.25/96.37 call condors, ref 96.255

2,200 0QM5 97.12 calls ref 96.71

+9,300 SFRK5 96.12/96.31 call spds, 2.5 ref 95.94/0.11%

8,000 SFRJ5 95.87/95.93 put spds ref 95.94

2,000 SFRK5 96.00/96.12 call spds ref 95.965

5,000 SFRJ5 95.68/95.75/95.81 put flys ref 95.95 to -.94

Treasury Options:

18,000 TYK5 115/116 call spds, 6 ref 112-24.5

10,000 TYM5 113 calls, 106 ref 112-30.5

4,000 TYM5 111.5/113 call spds ref 108-29

5,000 FVM5 106 puts, 2 ref 108-30

1,500 TYK5 111.5/113.5 call spds vs. 110.5/111.5 put spds ref 112-10

1,500 TYK5 112.5/113.5 call spds vs. 109.5/110 put spds ref 112-11

3,000 FVK5 109/109.5 call spds vs. 107/107.5 put spds ref 108-25.5

Block, 4,000 TYK5 110 puts, 4 vs. 112-17.5/0.08%

-7,000 TYK5 112/113.5 call spds, 37 vs. 112-10.5/0.29%

+5,000 FVK5 110 calls, 12 ref 108-29

+3,500 FVK5 111 calls, 4 ref 108-27

5,000 TYK5 113/114 1x2 call spds ref 112-17.5

MNI BONDS: EGBs-GILTS CASH CLOSE: Sizeable Bull Steepening On US Tariffs

Core European FI soared with semi-core/periphery spreads widening Thursday in a flight-to-safety move.

- The dominant force throughout the session was Wednesday evening's US tariff announcement, which proved much harsher on global trading partners than expected overall.

- Equities fell sharply, boosting rate cut pricing globally and driving a bid for core bonds.

- Weak US Services ISM data deepened the risk-off sentiment, and yields would close near the session lows.

- Curves bull steepened. 2Y German yields saw their lowest close since early December, with UK 2s lowest since October.

- Periphery instruments couldn't keep up with the Bund rally, with Iberian paper underperforming (SPGBs/PGBs around 3bp wider of Bund).

- Looking ahead, Friday's data slate includes German factory orders.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is down 9bps at 1.948%, 5-Yr is down 9.5bps at 2.233%, 10-Yr is down 7bps at 2.651%, and 30-Yr is down 3bps at 3.042%.

- UK: The 2-Yr yield is down 15.9bps at 4.01%, 5-Yr is down 16.3bps at 4.094%, 10-Yr is down 12bps at 4.52%, and 30-Yr is down 6.6bps at 5.184%.

- Italian BTP spread up 2.6bps at 112.1bps / Spanish up 2.9bps at 65.3bps

MNI OPTIONS: Rates Rally Brings Mainly Upside Thursday

Thursday's Europe rates/bond options flow included:

- DUK5 106.70p, bought for 3 up to 3.5 in 8k

- ERM5 98.125/98.25cs, bought for 0.75 in 10.5k

- ERZ5 98.37/98.50cs, bought for 2.75 in 10k

- 0RM5 97.875/97.75ps, sold at 2.5 in 10k

MNI FOREX: USD Index Sharply Lower as US Trade Policy Shakes Global Markets

- Analysts continue to cite the most recent US tariff announcements as a pivotal turning point for global trade policy. While risk sentiment has been negatively impacted, US pessimism reverberated into global currency markets, with dollar indices sharply lower on the session.

- The ICE dollar index is off its worst levels, but is broadly consolidating a 1.75% decline on Thursday, currently trading around the 102.00 mark. This is just 2% above the 2024 lows, marking the significance of the pullback across 2025 so far, and the close proximity to significant medium-term objectives.

- Standing out have been the moves for the dollar against the low yielding safe havens. USDJPY remains down 2.1% despite a 100 pip bounce off the 145.20 lows. AS for USDCHF, spot remains 2.5% lower on the day, having breached the US election inspired lows at 0.8615, and extending as low as 0.8547.

- EURUSD also had a very aggressive move higher in late European trade, with liquidity evaporating on a swift move above 1.11. Spot reached as high as 1.1147 before stabilising, but remains on course for a move to a cluster of highs around the 1.12 mark. At one point, EURUSD was registering its biggest intra-day advance since 2015.

- Weaker sentiment in equity markets have offset the appreciations for the likes of AUD, NZD and GBP, only advancing between 0.75-1.00% today.

- Emphasising the broad dollar weakness, even the Mexican peso has rallied one percent, bolstered by the relatively lenient outcome for the nation of the US liberation day announcements. The Bloomberg dollar index, which includes a broader basket of currencies, notably fell below the US election lows, and is now 5.5% below the February highs.

- The US employment report will be the highlight on Friday’s economic data calendar. Additionally, subsequent comments from Fed Chair Powell will be eagerly awaited given the recent turbulence in markets.

MNI FX OPTIONS: Expiries for Apr04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E2.0bln), $1.0750-60(E2.1bln), $1.0800(E2.4bln), $1.1050(E628mln), $1.1115-25(E548mln)

- USD/JPY: Y147.00($956mln), Y150.00($978mln)

- AUD/USD: $0.6200(A$1.5bln), $0.6350(A$1.3bln)

- USD/CAD: C$1.4050-60($525mln), C$1.4125-35($525mln) C$1.4350($1.2bln), C$1.4400($1.4bln)

MNI US STOCKS: Late Equities Roundup: Looking to Extend Lows, Refiners, Tech Pressed

- Stocks remain sharply lower late Thursday in an apparent vote of no confidence in the Trump administration's reciprocal tariff plans announced late Wednesday, relevant trading halt/circuit breakers (7% initially) for SPX eminis after the index fell over 4.25%, the tech-heavy Nasdaq over 5.5%, the DJIA over 3.4%.

- After a couple rounds of program buying support around midday, indexes were looking to test midmorning lows again in late trade, the DJIA trades down 1427.08 points (-3.38%) at 40798.62, S&P E-Minis down 243.5 points (-4.26%) at 5468, Nasdaq down 965.4 points (-5.5%) at 16634.88.

- Energy and Information Technology sectors continued to underperform in late trade, oil and gas stocks sharply lower with crude falling (WTI -4.9 at 66.81): APA Corp down -14.69%, Valero Energy -13.34%, Phillips 66 -12.96%, Marathon Petroleum -12.18% and Halliburton -12.00%.

- Semiconductor and hardware stocks were under heavy pressure as tariffs seen as major barriers ahead: Dell Technologies falling -17.83%, Microchip Technology -16.55%, Zebra Technologies -15.14%, Western Digital -15.03% and Micron Technology -14.38%.

- On the positive side, Consumer Staples and Utilities continued to outperform: Lamb Weston Holdings +10.34%, Kroger +5.07%, Dollar General +4.29% and Philip Morris International +3.79% led gainers in the Staples sector.

- Meanwhile, independent energy providers buoyed the Utilities sector: Duke Energy +3.30%, Exelon Corp +3.08%, Consolidated Edison +2.98%, NextEra Energy +2.73% and Xcel Energy +2.07%.

MNI EQUITY TECHS: E-MINI S&P: (M5) Bears Remain In The Driver’s Seat

- RES 4: 5837.25 High Mar 25 and a reversal trigger

- RES 3: 5773.25 High Apr 2

- RES 2: 5753.60 20-day EMA

- RES 1: 5651.25 Low Mar 21

- PRICE: 5507.50 @ 14:25 BST Apr 3

- SUP 1: 5481.00 Intraday low

- SUP 2: 5426.13 0.618 proj of the Feb 19 - Mar 13 - 25 price swing

- SUP 3: 5396.00 2.236 proj of the Dec 6 ‘24 - Jan 13 - Feb 19 swing

- SUP 4: 5366.97 76.4% of the Aug 5 ‘24 - Feb 19 bull leg (cont)

S&P E-Minis are trading in a volatile manner. A bearish theme remains intact and today’s fresh cycle low, strengthens current conditions. A resumption of weakness would signal scope for an extension towards 5426.13, a Fibonacci projection. Moving average studies are in a bear-mode position, highlighting a dominant downtrend. Key short-term resistance has been defined at 5837.25, the Mar 25 high.

MNI COMMODITIES: Crude Plunges, Precious Metals Fall As US Tariffs Roil Markets

- Crude prices have extended losses today following the surprise OPEC+ announcement to speed up the pace of its voluntary cut unwinding, coupled with concerns for global energy demand in the face of potential retaliatory tariffs and trade wars.

- WTI May 25 is down by 6.8% at $66.8/bbl.

- OPEC+ will raise production for May by more than expected to 41kk b/d.

- In a worst-case scenario, with an escalating trade war and other adverse effects, global oil demand growth could fall by up to 40% to 750,000 b/d in 2025, Platts said.

- The move lower in WTI futures has resulted in a break of both the 20- and 50-day EMAs, undermining the recent bullish theme. A continuation lower would signal scope for a move towards $66.09, the Mar 19 low, and key support at $64.85, the Mar 5 low.

- Meanwhile, given the sharp decline in the USD, US yields and the risk-off backdrop, gold weakness stands out, with spot erasing early gains to trade 1.0% lower at $3,103/oz.

- Trump didn't mention gold or metals tariffs yesterday, meaning the rising US inventories across his term (on speculation that future trade could be tariffed) is now feeding through to prices.

- While gold is softer, silver is weaker still, with the gold/silver ratio surging through 97.00 for the first time since Q3'20, providing further evidence of broad selling in precious metals.

- Copper has also fallen sharply, with the red metal down by 4.2% at $484/lb, taking total losses since the March 26 high to 10%.

- Initial support at $497.22, the 20-day EMA has been pierced, opening $451.15, the Feb 28 low.

FRIDAY DATA CALENDAR

| Date | ET | Impact | Period | Release | Prior | Consensus | |

| 04/04/2025 | 0830 | *** | Mar | Average Hourly Earnings y/y, current month | -- | -- | % |

| 04/04/2025 | 0830 | *** | Mar | Average Hourly Earnings, m/m | 0.3 | 0.3 | % |

| 04/04/2025 | 0830 | *** | Mar | Average Workweek, All Workers | 34.1 | 34.2 | hrs |

| 04/04/2025 | 0830 | *** | Mar | Nonfarm Payrolls | 151 | 135 | (k) |

| 04/04/2025 | 0830 | *** | Mar | Prev Nonfarm Payrolls, Rev | -- | -- | (k) |

| 04/04/2025 | 0830 | *** | Mar | Private Payrolls | 140 | 125 | (k) |

| 04/04/2025 | 0830 | *** | Mar | Unemployment Rate | 4.1 | 4.1 | % |

| 04/04/2025 | 0830 | *** | Mar | Unemployment Rate (3 dp) | -- | -- | % |

| 04/04/2025 | 1300 | ** | 04-Apr | Baker Hughes Canada Gas Rig Count | -- | -- | |

| 04/04/2025 | 1300 | ** | 04-Apr | Baker Hughes Canada Oil Rig Count | -- | -- | |

| 04/04/2025 | 1300 | ** | 04-Apr | Baker Hughes Canada Rig Count | -- | -- | |

| 04/04/2025 | 1300 | ** | 04-Apr | Baker Hughes US Gas Rig Count | -- | -- | |

| 04/04/2025 | 1300 | ** | 04-Apr | Baker Hughes US Oil Rig Count | -- | -- | |

| 04/04/2025 | 1300 | ** | 04-Apr | Baker Hughes US Rig Count | -- | -- | |

| 04/04/2025 | 1300 | ** | 04-Apr | Baker Hughes Canada Gas Rig Count | -- | -- | |

| 04/04/2025 | 1300 | ** | 04-Apr | Baker Hughes Canada Oil Rig Count | -- | -- | |

| 04/04/2025 | 1300 | ** | 04-Apr | Baker Hughes Canada Rig Count | -- | -- | |

| 04/04/2025 | 1300 | ** | 04-Apr | Baker Hughes US Gas Rig Count | -- | -- | |

| 04/04/2025 | 1300 | ** | 04-Apr | Baker Hughes US Oil Rig Count | -- | -- | |

| 04/04/2025 | 1300 | ** | 04-Apr | Baker Hughes US Rig Count | -- | -- |