MNI ASIA OPEN: ADP, NFP Employ Data Bookend Tariff Risk Event

EXECUTIVE SUAMMRY

- MNI US TARIFFS: Reciprocal Tariffs Will Be "Effective Immediately" - White House

- MNI US TARIFFS: WaPo-WH Draft Proposal Has Tariffs ~20% On 'At Least Most Imports'

- MNI US DATA: ISM Manufacturing: Outlook Deteriorating, Prices Rising On Tariffs

- MNI US DATA: JOLTS Show More Of The Same Broad Labor Normalization

- MNI US OUTLOOK/OPINION: Services Activity Dropped Sharply In March

US

MNI US TARIFFS: Reciprocol Tariffs Will Be "Effective Immediately" - White House

White House Press Secretary Karoline Leavitt has indicated to reporters that President Donald Trump’s reciprocal tariffs will be “effective immediately” following Trump’s White House Rose Garden announcement tomorrow, expected to take place around 16:00 ET 21:00 BST.

- Asked: “Are [the tariffs] all going to take effect this week”, Leavitt says: “My understanding is that the tariff announcement will come tomorrow and they will be effective immediately and the President has been teasing this for quite some time…”

- Leavitt: “Tomorrow will be the day. He’s talking about it for a while and as a result you’ve seen [various companies] make a commitment [to changing manufacturing policy].”

- Asked what kind of market indicators Trump is looking at to gauge the success of his tariff plan, Leavitt notes that Trump has said that the stock market “is a snapshot of time” and says that although Main Street is the focus of tariffs, “Wall Street will be just fine.”

- Asked if Trump is considering extending the pause on Canadian and Mexican tariffs, which expires tomorrow, Leavitt says: “I’ll let the President speak on the specifics tomorrow,” but stresses the dangers of Fentanyl – the justification of the tariffs.

- Leavitt confirms that there have been "quite a few countries" that have called Trump and his team to discuss tariffs. She notes: "There is one country the President cares about and its the United States of America..."

NEWS

MNI US TARIFFS: WaPo-WH Draft Proposal Has Tariffs ~20% On 'At Least Most Imports'

The Washington Post reports that "White House aides have drafted a proposal to impose tariffs of around 20 percent on at least most imports to the United States, three people familiar with the matter said,". While the looming 'reciprocal' tariffs to be imposed from April 2 have been top of the news cycle for some time, there has been very little concrete information about their nature. As such, these comments come as some of the first indications about what level the levies might settle at.

MNI UK: Trade Min-UK 'In Best Possible Position' To Reverse US Tariffs

MNI US-EU: VdL-All Instruments On The Table For Countermeasures To US Tariffs

European Commission President Ursula von der Leyen has been speaking in the European Parliament plenary session in Strasbourg regarding the looming 'reciprocal' tariffs from the United States. Livestream of the session here. Says: "We have the power to push back against US tariffs...Tariffs will just fuel inflation, the opposite of what we want to achieve. [...] We are open to negotiations on trade. [...] All instruments are on the table for countermeasures."

MNI FRANCE: RN's Bardella Leads In 1st Round Poll Following Le Pen's Election Ban

A snap presidential election poll from Harris Interactive shows far-right Rassemblement National (RN, National Rally) leader Jordan Bardella leading in a hypothetical first-round if he becomes the RN candidate. This comes after presumptive RN presidential candidate Marine Le Pen was barred from seeking political office for five years as part of her sentence for misappropriation of funds, a ruling that has sparked outrage from Le Pen's supporters and contemporaries in France and abroad.

MNI US TSYS: Rates Bid/Off Highs Ahead Midweek Tariff Announcement

- Treasury futures are holding decent gains after the bell, off mid-morning highs as accounts square positions ahead of Wednesday afternoon's reciprocal tariff announcement from the White House (1600ET est).

- Washington Post reports that "White House aides have drafted a proposal to impose tariffs of around 20 percent on at least most imports to the United States, three people familiar with the matter said".

- Early FI support after mildly higher than expected S&P Mfg PMI data, lower than expected JOLTS job openings, quits and layoffs higher than expected. ISMs mixed with Mfg, new orders and employment lower than expected while prices paid jumped.

- Tsy Jun'25 10Y contract trades 111-23.5 (+16.5), off earlier high of 111-30.5, just shy of technical resistance at 112-01 (High Mar 4 and a bull trigger). Curves bull flattened off early week highs: 2s10s -2.766 at 29.033, 5s30s -1.289 at 60.651.

- Cross asset update, Bbg US$ index -0.88 at 1273.42, Gold retreats to 3117.09 (-6.50) after making new highs around 3148.0, crude retreating (WTI -.23 at 71.25.).

- Aside from tomorrow's tariff announcement, midweek data includes ADP Employment Change at 0815ET, Factory & Durable goods Orders at 1000ET, while Fed Gov Kugler speaks on inflation expectations (text, Q&A) at 1630ET.

OVERNIGHT DATA

MNI US OUTLOOK/OPINION: Services Activity Dropped Sharply In March

However, the pullback in the general activity indices of the 3 regional Fed services surveys points to a below-consensus ISM Services headline reading.

- The average of NY/Philadelphia/Dallas - which fell to the lowest levels since the onset of the Covid pandemic in 2020 - is consistent with an ISM services index of closer to 50.0 than the 52.9 consensus (53.5 February).

- Compared with a less obvious rise in the price indices across the 3 Feds, general activity indices pulled back sharply in March across the three regions: NY by 9 points, Philly by 19 points, and Dallas by 16 points.

- Notably the KC and Richmond Fed surveys also saw their composite indices decline - so this is a national story.

MNI US DATA: ISM Manufacturing: Outlook Deteriorating, Prices Rising On Tariffs

ISM Manufacturing printed the lowest reading in 4 months in March, falling to 49.0 from 50.3 prior (49.5 expected). This was a very weak report that can be partly attributed to volatility in the data, including front-loading activity in prior months ahead of anticipated tariffs, but forward looking indicators look poor. Additionally, price pressures are mounting for manufacturers.

- New Orders (45.2, lowest since May 2023, vs 48.2 expected, 48.6 prior) and Employment (44.7 vs 47.3 expected, 47.6 prior) dropped more than expected.

- Both subindices have fallen for two consecutive months (In January, New Orders was 55.1 and Employment was 50.3).

- Worryingly, new orders minus inventories (53.4) fell to -8.2, the lowest since May 2020. This has historically been a leading indicator, though clearly there are large tariff-related distortions (the report: "panelists’ companies continue to pull forward (advance) deliveries of materials in an attempt to minimize the financial impacts of potential tariffs").

- Export orders slipped to 49.6, a 4-month low, while supplier deliveries dipped 1 point to 53.5.

- The ISM report points out: "Slower supplier deliveries and expanded inventories in March are not considered positives for the economy: Both conditions figure to be temporary and are driven by tariff concerns, either delaying buyer/seller negotiations or advancing material deliveries that will be reversed after tariffs are deployed, leading to a drawdown of manufacturing inventory. "

- Meanwhile, Prices Paid jumped 7 points to a 33-momnth high 69.4 (64.6 expected). The report noted that almost all products (including, in tariff-related news, aluminum and steel) had risen in price, whereas just two had fallen in price (Industrial Alcohols; and Natural Gas).

- MNI had pointed out that regional Fed manufacturing surveys had been pointing to a much more significant jump in ISM Prices Paid than consensus had expected.

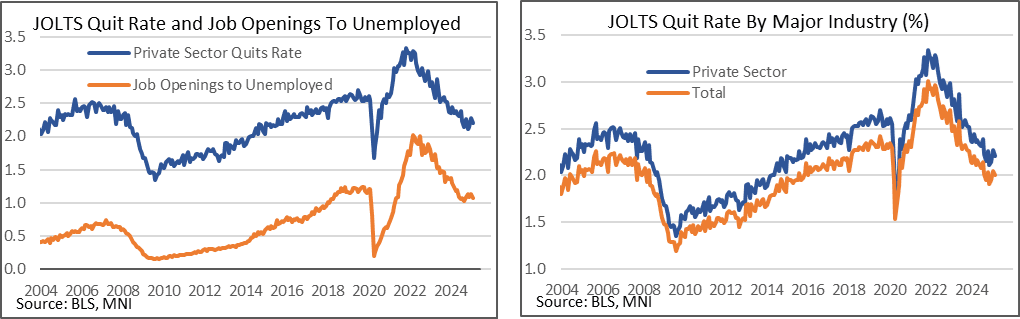

MNI US DATA: JOLTS Show More Of The Same Broad Labor Normalization

The JOLTS report showed lower than expected openings, keeping the vacancy to unemployed ratio within familiar ranges seen since 2H24. Quits rates broadly remain comfortably lower than pre-pandemic levels.

- Job openings: 7568k (sa, cons 7658k) in February after a marginally upward revised 7762k (initial 7740k) in January.

- Ratio of openings to unemployed: 1.07 after an unrevised 1.13 in Jan. This ratio would have dropped 0.03pps on unchanged openings owing to the already known 203k increase in unemployment back in Feb.

- It’s technically the lowest ratio since the 1.03 in September. Looking at the broad trend, it has averaged 1.1 since June, with a slightly softer patch in Jun-Sept before a stronger period Oct-Jan. For context, it averaged 1.2 in 2019 and 1.0 in 2017-18.

- Quits rates meanwhile gave back some of the increase from January, dipping to 2.01% from 2.047% (revised to just round lower to 2.0% after 2.053% initially) after that 2.05% had been its highest since July.

- Despite having firmed slightly since Q4, these quit rates continue to be notably lower than pre-pandemic levels, having averaged 2.3% in 2019 and 2.2% in 2017-18.

- Private sector quits show a similar trend, most recently dipping from 2.27% in Jan to 2.21% in Feb but no longer trending lower.

- Government quits meanwhile were unchanged at their fourth rounded 0.8% whilst federal quits rates, receiving particular attention in light of DOGE cuts, actually stepped to a fresh low since Dec 2016 at just 0.3%.

MNI US DATA: PMI Mfg Orders Slow, Input Cost Inflation Highest In 2.5 Years

- The manufacturing PMI was revised up slightly in the March final release to 50.2 (cons 49.9, flash 49.8), although still sees a sizeable decline from 52.7 in February (highest since Jun 2022).

- The press releases summarizes the report as: “Production declines in March as order book growth slows on tariff uncertainty”

- It also confirms strong input cost inflation indicated in the flash release, at its highest in “over two-and-a-half years”. The flash release, for both manufacturing and services, had noted that “Input price inflation accelerated sharply, especially in manufacturing, to a near two-year high, often attributed to the impact of tariff policies. However, competition limited the pass-through of higher costs to selling prices.” Here, specifically for manufacturing, output price inflation increased to a 25-month high.

MNI US DATA: Johnson Redbook Retail Sales Slows On Easter Effect, Still Solid

Johnson Redbook Retail Sales were up 5.3% Y/Y in March month-to-date (as of the week ending March 29), after sales in the 4th week of the month slowed to 4.8% Y/Y (5.6% prior).

- The apparent dip in retail activity at the end of the month requires some context: last year saw pre-Easter shopping, which hurts the Y/Y comparisons this year, but "these differences are expected to balance out in April as Easter sales begin, leading to improved growth rates compared to last year's retail performance in April. Most retailers recommend smoothing the Easter distortion by averaging the performance data from March and April."

- Overall we consider this to be solid "hard" retail data, with the Johnson Redbook report covering around 80% of "official" retail sales (March data for which is out on Apr 16).

MARKETS SNAPSHOT

Key market levels of markets in late NY trade:

DJIA down 90.23 points (-0.21%) at 41911.77

S&P E-Mini Future up 8.25 points (0.15%) at 5661.5

Nasdaq up 92.9 points (0.5%) at 17392.03

US 10-Yr yield is down 4 bps at 4.1651%

US Jun 10-Yr futures are up 15/32 at 111-22

EURUSD down 0.003 (-0.28%) at 1.0786

USDJPY down 0.36 (-0.24%) at 149.59

WTI Crude Oil (front-month) down $0.24 (-0.34%) at $71.25

Gold is down $6.66 (-0.21%) at $3117.07

European bourses closing levels:

EuroStoxx 50 up 71.91 points (1.37%) at 5320.3

FTSE 100 up 51.99 points (0.61%) at 8634.8

German DAX up 376.49 points (1.7%) at 22539.98

French CAC 40 up 85.65 points (1.1%) at 7876.36

US TREASURY FUTURES CLOSE

3M10Y -4.063, -13.946 (L: -17.368 / H: -9.147)

2Y10Y -2.781, 29.018 (L: 27.876 / H: 32.373)

2Y30Y -3.339, 65.007 (L: 64.061 / H: 69.209)

5Y30Y -1.446, 60.494 (L: 59.915 / H: 63.061)

Current futures levels:

Jun 2-Yr futures up 2.25/32 at 103-21 (L: 103-19.75 / H: 103-22.875)

Jun 5-Yr futures up 8/32 at 108-13 (L: 108-08 / H: 108-18.75)

Jun 10-Yr futures up 15/32 at 111-22 (L: 111-11.5 / H: 111-30.5)

Jun 30-Yr futures up 1-04/32 t 118-13 (L: 117-21 / H: 118-29)

Jun Ultra futures up 1-24/32 at 124-0 (L: 122-26 / H: 124-18)

MNI US 10YR FUTURE TECHS: (M5) Trend Outlook Remains Bullish

- RES 4: 112-23+ 1.618 proj of the Jan 13 - Feb 7 - Feb 12 price swing

- RES 3: 112-13 1.500 proj of the Jan 13 - Feb 7 - Feb 12 price swing

- RES 2: 112-01 High Mar 4 and a bull trigger

- RES 1: 111-22+ High Mar 31

- PRICE: 111-20 @ 11:05 BST Apr 1

- SUP 1: 110-23 20-day EMA

- SUP 2: 110-09+/06 50-day EMA / Low Mar 27

- SUP 3: 110-00 High Feb 7 and a key support

- SUP 4: 109-20 Trendline support drawn from the Jan 13 low

Treasury futures are holding on to their latest gains following the recovery from last week’s low of 110-06+ (Mar 27). The outlook remains bullish and attention is on key resistance at 112-01, the Mar 4 high. A break of this level would confirm a resumption of the uptrend that started Jan 13, and open 112-13, a Fibonacci projection. Initial support to watch is 110-23, the 20-day EMA.

SOFR FUTURES CLOSE

Jun 25 +0.015 at 95.935

Sep 25 +0.030 at 96.220

Dec 25 +0.040 at 96.415

Mar 26 +0.040 at 96.535

Red Pack (Jun 26-Mar 27) +0.040 to +0.050

Green Pack (Jun 27-Mar 28) +0.050 to +0.065

Blue Pack (Jun 28-Mar 29) +0.075 to +0.080

Gold Pack (Jun 29-Mar 30) +0.085 to +0.090

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00041 to 4.31896 (-0.00469/wk)

- 3M -0.00690 to 4.28098 (-0.01663/wk)

- 6M -0.02567 to 4.16692 (-0.04869/wk)

- 12M -0.05270 to 3.95989 (-0.09297/wk)

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 4.41% (+0.07), volume: $2.636T

- Broad General Collateral Rate (BGCR): 4.36% (+0.03), volume: $945B

- Tri-Party General Collateral Rate (TCR): 4.36% (+0.03), volume: $898B

- (rate, volume levels reflect prior session)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 4.33% (+0.00), volume: $78B

- Daily Overnight Bank Funding Rate: 4.33% (+0.00), volume: $182B

FED Reverse Repo Operation

RRP usage retreats to $230.063B this afternoon after surging to the highest level since December 31, 2024 yesterday: $399.167B. Compares to $58.770B (lowest level since mid-April 2021) on February 14. The number of counterparties retreats to 36 from 66 prior.

MNI PIPELINE: Corporate Bond Update: $1.5B LPL Holdings 3Pt Launched

$6.45B to price Tuesday:

- Date $MM Issuer (Priced *, Launch #)

- 04/01 $1.5B #LPL Holdings $500M each: 3Y +110, 5Y +128, 10Y +165

- 04/01 $1.5B *NRW Bank 5Y SOFR+46

- 04/01 $1B *DBJ 5Y SOFR+59

- 04/01 $850M *Kommunalbanken Norway 4Y SOFR+41 (upsized from $500M)

- 04/01 $600M #Realty Income 10Y +118

- 04/01 $500M #Banco Votorantim 3Y 5.95%

- 04/01 $500M #Nexa WNG 12Y +245

MNI BONDS: EGBs-GILTS CASH CLOSE: Yields Drop Ahead Of US Tariff Announcement

European curves bull flattened Tuesday.

- There was no clear headline driver of a strong overnight rally whose gains were held through most of the session. Attribution was largely placed on anticipation of the April 2 tariff announcement by US President Trump, though equities remained bid through much of the day and periphery EGBs outperformed.

- Weak-leaning US data toward the cash close (including a contractionary ISM Manufacturing index) saw Bunds and Gilts near session highs again before fading those gains slightly.

- March Eurozone flash inflation and manufacturing PMIs for Italy and Spain came slightly below consensus, though Eurozone labour market readings were solid.

- On the day, Bunds outperformed Gilts, with bull flattening in both curves. Periphery/semi-core EGB spreads tightened.

- Wednesday's calendar highlight is US President Trump's highly anticipated tariff announcement (2100BST, well after the European cash close), while we also get some Spanish labour market data and hear from multiple ECB speakers including Schnabel.

Closing Yields / 10-Yr EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.5bps at 2.022%, 5-Yr is down 3.5bps at 2.304%, 10-Yr is down 5.1bps at 2.687%, and 30-Yr is down 6bps at 3.03%.

- UK: The 2-Yr yield is down 2.2bps at 4.174%, 5-Yr is down 3bps at 4.254%, 10-Yr is down 4.1bps at 4.634%, and 30-Yr is down 3.5bps at 5.247%.

- Italian BTP spread down 2.7bps at 110.2bps / French OAT down 0.9bps at 71.6bps

MNI FOREX: AUD and NZD Recover, DXY Unchanged Ahead of ‘Liberation Day’

- Global currency markets have lacked momentum on Tuesday, as participants remain wary of entering new positions ahead of the reciprocal tariff announcements, due from President Trump on Wednesday. As such, the USD index remains close to unchanged levels as we approach the APAC crossover.

- AUD and NZD have received a moderate boost from more stable equity markets today, recovering a solid portion of the declines seen Monday. For AUD specifically, price action has been assisted by a cautious sounding RBA. Tariff uncertainty ahead of tomorrow’s deadline remains the key risk for higher beta currencies in G10, as AUDUSD continues to consolidate ~6.5% losses from the US election highs.

- Key AUDUSD support remains untested at 0.6187, the Mar 4 low. Importantly, clearance of this level would reinstate a bearish technical theme for the pair. This may coincide with EURAUD testing 1.7419 (Mar 11 high), a breach of which would place EURAUD at levels not seen since the early onset of the pandemic in 2020.

- USDJPY remains volatile, registering a 116-pip range on the session. Spot is around 0.3% lower on the session, reflective of the lower US yields across the curve following the weaker-than expected ISM manufacturing and JOLTS data. As noted, the lack of conviction in either direction keeps the USDJPY well pinned between the short-term technical parameters of 150.86 (50-day EMA), and the first key support at 148.18, the Mar 20 low.

- All eyes will be on the Rose Garden event tomorrow at the adjusted time of 1600ET, for the latest updates regarding the imminent trajectory of the US administration’s trade policy. Elsewhere, US ADP Non-Farm Employment Change is the data highlight.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 02/04/2025 | 0900/1000 | * | Index Linked Gilt Outright Auction Result | |

| 02/04/2025 | 1030/1230 | ECB's Schnabel At SciencesPo Conference | ||

| 02/04/2025 | 1100/0700 | ** | MBA Weekly Applications Index | |

| 02/04/2025 | 1215/0815 | *** | ADP Employment Report | |

| 02/04/2025 | 1400/1000 | ** | Factory New Orders | |

| 02/04/2025 | 1405/1605 | ECB's Lane At AI Conference | ||

| 02/04/2025 | 1430/1030 | ** | DOE Weekly Crude Oil Stocks | |

| 02/04/2025 | 2030/1630 | Fed Governor Adriana Kugler | ||

| 03/04/2025 | 2200/0900 | * | S&P Global Final Australia Services PMI | |

| 03/04/2025 | 2200/0900 | ** | S&P Global Final Australia Composite PMI | |

| 03/04/2025 | 0030/1130 | Job Vacancies | ||

| 03/04/2025 | 0030/1130 | ** | Trade Balance | |

| 03/04/2025 | 0030/0930 | ** | S&P Global Final Japan Services PMI | |

| 03/04/2025 | 0030/0930 | ** | S&P Global Final Japan Composite PMI | |

| 03/04/2025 | 0145/0945 | ** | S&P Global Final China Services PMI | |

| 03/04/2025 | 0145/0945 | ** | S&P Global Final China Composite PMI |